How Much Does a 401(k) Plan Cost Employers?

Cost is (and should be) one of the key considerations when setting up a 401(k) plan. We've helped a lot of companies set up a new 401(k) plan for the first time. Most companies that are ready for a 401(k) plan (5-15 employees) should expect to pay somewhere from $2,000 - $4,500 in total annual fees. But there are some very generous annual tax credits that can knock this down to $800 - $1,400 per year for the first three years.

If you're a company that has a 401(k) and is looking to add an advisor and/or switch recordkeepers, we often find that not only can we offer better, mission-aligned portfolios for your employees, but we often can link you with a recordkeeper that can save you and your team on fees. Learn how much we can save your company every year in fees.

A Breakdown of 401(k) Costs

Pricing varies between 401(k) investment advisors and recordkeepers. The graphic below illustrates the cost of a 401(k) plan with Carbon Collective as your 401(k) investment advisor, and what you can expect to pay in fees to a recordkeeper.

Not sure what the difference between an investment advisor and a recordkeeper is? Let’s break it down.

Investment Advisor: Builds and maintains the plan, manages the portfolios, and helps navigate compliance. As your investment advisor, Carbon Collective can also help you evaluate recordkeepers and select one that will work best with your plan and payroll system. Learn more about how our 401(k) payroll integration works. If you have an existing advisor, we charge 10% less than what you're paying them today. If you don't our fees are generally below industry standard and you can expect a lot more.

Recordkeeper: Their primary role is to keep track of the money in the plan — who is participating in the plan, what each participant owns, and what money is coming in or out. They handle other parts as well, including sending out account statements and they own the portal employees log in to review balances and make adjustments. The recordkeeper will generally charge you three monthly fees:

- Recordkeeping Fee: This is a fee billed to the company for administering the plan. We've seen this fee range from $90 - $360 per month depending on the size of company and complexity of the plan.

- Participant Fee: This is a fee billed per participant in the plan (not every employee may choose to participate). It usually can be billed to the company or deducted from the participant's holdings. We've seen this fee range from $5 - $14 per month.

- Onboarding Fee: All of the recordkeepers we've worked with charge a one-time onboarding fee. We've seen it range from $500 - $1,000.

How Much Are Employees Charged?

In addition to the fees that the company pays, it’s important to be aware of the fees that the employees investing in the plan are paying. Many plans allow the employer to pass the employee—or ‘participant’— fee (cost of managing the plan, typically $5-$14 per month) on to the employees.

The second cost to employees is the expense ratios of the portfolios and funds available to them in their 401(k). Every fund you invest in has some kind of expense ratio. The company offering the fund or portfolio uses this expense for administrative, marketing, and portfolio management costs.

As an investor, the lower the expense ratio, the better! The average expense ratio for most 401(k) plans is still really high – 1% (Investopedia). There is no historical relationship between fees and performance. So if you want a general rule, lower is better. As a fiduciary, we work hard to keep our (Carbon Collective’s) average 401(k) portfolio expense ratio down around 0.15%.

How Tax Credits Can Potentially Save Your Company Thousands

Whenever researching the cost of a 401(k) plan for employers, it’s important to factor in potential savings from tax credits. These savings can add up to thousands of dollars in the first few years of starting a plan.

Most of these tax credits can be applied towards necessary expenses such as educating employees about the plan and costs to set up and administer the plan (for instance, any set up fees charged by the recordkeeper). We are not tax professionals. It is always recommended to refer to the most recent guidance from the IRS on eligibility and details on tax credits. To confirm whether your company is eligible for a tax credit, please contact a tax professional.

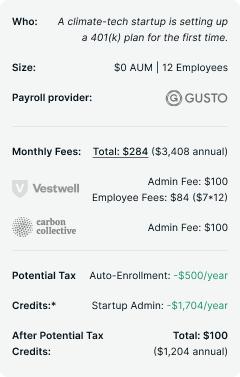

Case Study: Climate Tech Startup Setting Up a Plan for the First Time

Here is an example of a client we helped serve. Note that these prices are subject to change.

In this example, a climate tech startup is setting up a brand new 401(k) plan. They’re looking for a plan that gives their employees the option to invest in sustainable portfolios. You will most likely want to speak to a tax professional to confirm if your company would qualify for the potential tax credits, but this breakdown gives you a sense of what different fees make up the cost of providing a 401(k).

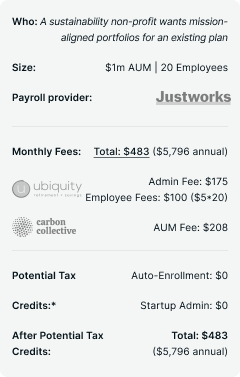

Case Study: Sustainable Company Wants Mission-Aligned Portfolios for an Existing 401(k) Plan

In this example, a small company with 20 employees has $1 million in their plan, and is paying $483 per month or $5,796 per year to offer their employees a 401(k) plan. Again, talk to a tax professional to confirm which potential tax credits your company will qualify for.

This is the short summary on how much a 401(k) plan costs employers. Book a call with us to dig deeper into the numbers.