What Is a SEP-IRA?

SEP-IRA stands for Simplified Employee Pension Individual Retirement Account. This type of account is especially tailored for small businesses and self-employed individuals.

SEP-IRAs are tax-deferred retirement accounts.

This means that the money inside a SEP-IRA is not taxed until it is withdrawn from the account during retirement.

SEP-IRAs can hold virtually any type of investment: cash, stocks, bonds, mutual funds, and other types of securities.

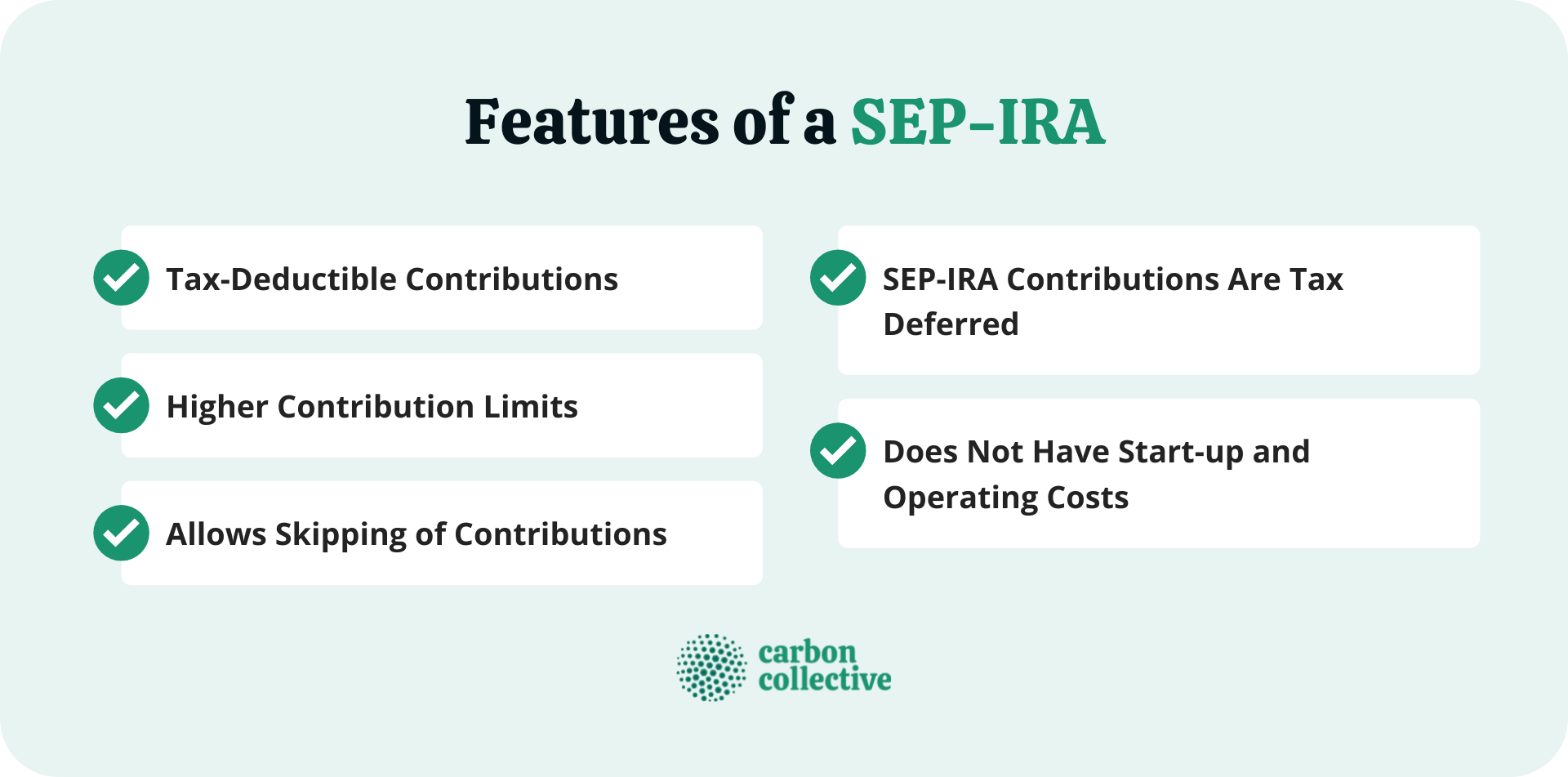

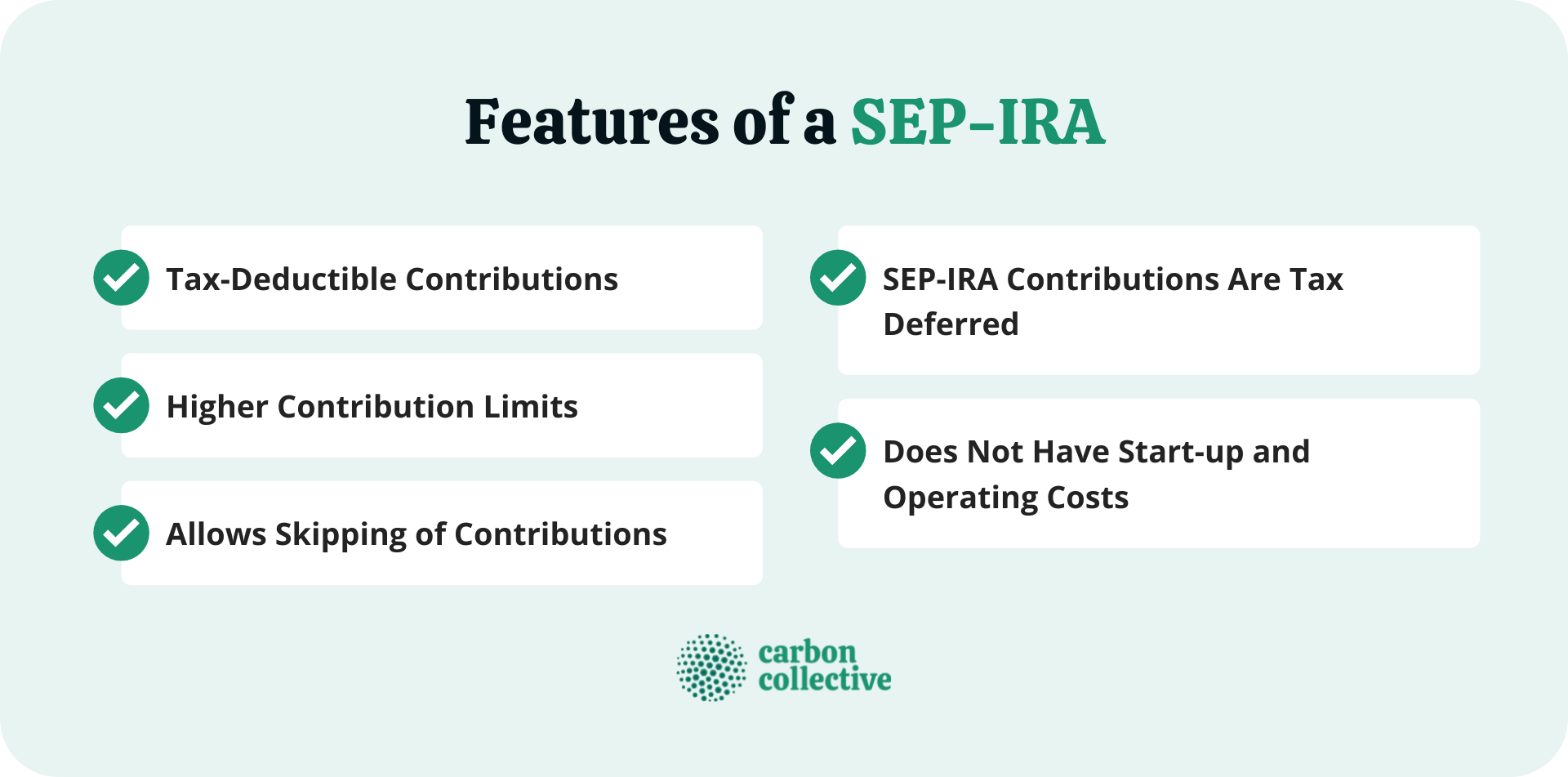

Features of a SEP-IRA

Below are some of the features of a SEP-IRA:

Tax-Deductible Contributions

Contributions made during the year to a SEP-IRA are tax deductible.

This means that if you contribute $5,000 during the tax year to your SEP-IRA, it lowers the amount of taxes that you owe.

SEP-IRA Contributions Are Tax Deferred

Contributions made during the year to a SEP-IRA are not taxed until they are withdrawn from the account during retirement.

This means that when you withdraw money from your SEP-IRA in retirement, it is treated as income and subject to taxation at ordinary income rates.

Does Not Have Start-up and Operating Costs

The absence of start-up and operating costs is what makes SEP-IRAs a favorable option for small businesses.

This is because it does not impose additional costs in the operation of the business.

Higher Contribution Limits

Compared to standard IRAs, SEP-IRAs have a higher contribution limit. This makes it an advantage for business owners who want to save more for their retirement.

Allows Skipping of Contributions

SEP-IRA plan holders are given the option to skip their contributions for a year. This is especially useful when the business is down and income is minimal.

2023 Contribution Limits of SEP-IRA

In 2023, employers who contribute to an employee's SEP-IRA should not exceed the lesser of the following:

- $66,000

- 25% of an employee's compensation

For owners of a sole proprietorship business, the limit is set at 25% of wages or profits minus the SEP contribution.

Contribution Rules of SEP-IRA

Although SEP-IRAs are designed for most businesses that do not set up employer-sponsored plans, not everyone is eligible to have the account.

Sole proprietorship businesses, partnerships, and corporations are eligible to have a SEP-IRA.

There are also limitations for participants in terms of income. The eligible compensation limit is set at $330,000 in 2023, up from $305,000 in 2022.

Also, employers can exclude certain types of employees from enrolling in a SEP-IRA.

Employees who are members of a union with a collective bargaining agreement may be excluded, as well as those who are non-resident aliens who do not receive U.S. service compensation from employers.

The rules that apply for traditional IRAs – in terms of withdrawals of contributions and earnings – are the same for SEP-IRAs. A withdrawal is taxable in the year it is made.

Any withdrawal performed before the age of 59.5 years will generally owe a 10% additional tax.

Conclusion

A SEP-IRA is a popular form of savings account for small business owners. This is because it allows them to contribute with tax benefits and high contribution limits.

Also, the absence of start-up and operating costs is what makes SEP-IRAs an effective option for small businesses.

It is essential to keep up with the rules and regulations that apply to a SEP-IRA. This ensures full compliance and helps to avoid heavy penalties.