What Is SEP IRA

A Simplified Employee Pension (SEP) IRA is a retirement plan that is intended for self-employed business owners, freelancers, or small businesses with less than 100 part-time employees.

It is an employer-sponsored retirement account that you can set up through your company. The money that goes into this IRA cannot be withdrawn until you retire, and when you do take it out it will be taxed as income (unlike 401(k)s, which are taxed while the funds are in the account).

The contributions can be made as a percentage of income or as a flat amount – whichever the employer decides upon. It is important for you as an employee to understand how much you will be contributing as a part of your total compensation package.

An employer can contribute up to 25% of the employee’s compensation. For 2022, contributions of up to $61,000 can be paid into the employee's account.

The employer must contribute an equal percentage for all employees, though this may exclude some who have retirement plans through a union agreement.

A SEP IRA functions like a traditional IRA, in which money withdrawn from the account before age 59½ will be subject to a tax penalty of 10%. The account holder should start taking the required minimum distribution by the age of 73, as laid out by the Internal Revenue Service (IRS).

What Is a SIMPLE IRA

A SIMPLE IRA is a type of IRA plan that certain employers can use to select their employees and sponsor contributions for retirement.

SIMPLE stands for Savings Incentive Match Plan for Employees. It is a defined contribution plan with special tax benefits available to all types of businesses.

Business owners can use these plans to save for retirement or other needs, minimize paperwork and recordkeeping requirements, and to offer their employees an opportunity to save for the future.

This type of IRA allows you to contribute up to $15,500 in 2023. If you are 50 years of age or older, you can make an additional $3,500 catch-up contribution.

Setting Up Both Plans

SEP IRA

With a SEP IRA, you will need to contact a financial advisor or tax professional in order to set up the plan.

The representative will help you decide how much your employees can contribute and what percentage of your revenue this amount should be.

Administrators must also make contributions according to this contribution formula for all eligible employees.

SIMPLE IRA

A SIMPLE IRA may be set up by an employer to allow employees to contribute. Self-employed business owners can also establish these accounts for themselves, as well as their employees. However, they cannot make contributions on behalf of themselves.

To set up a SIMPLE IRA, you will need to contact a financial advisor or tax professional and ask for Form 5305-SIMPLE, which is to be signed by both the employer and the employee. The account also requires Form 5304 to be filed by the employer with the IRS.

This form will help you draft the agreement that determines how much both the employee and employer will contribute to their respective accounts each year.

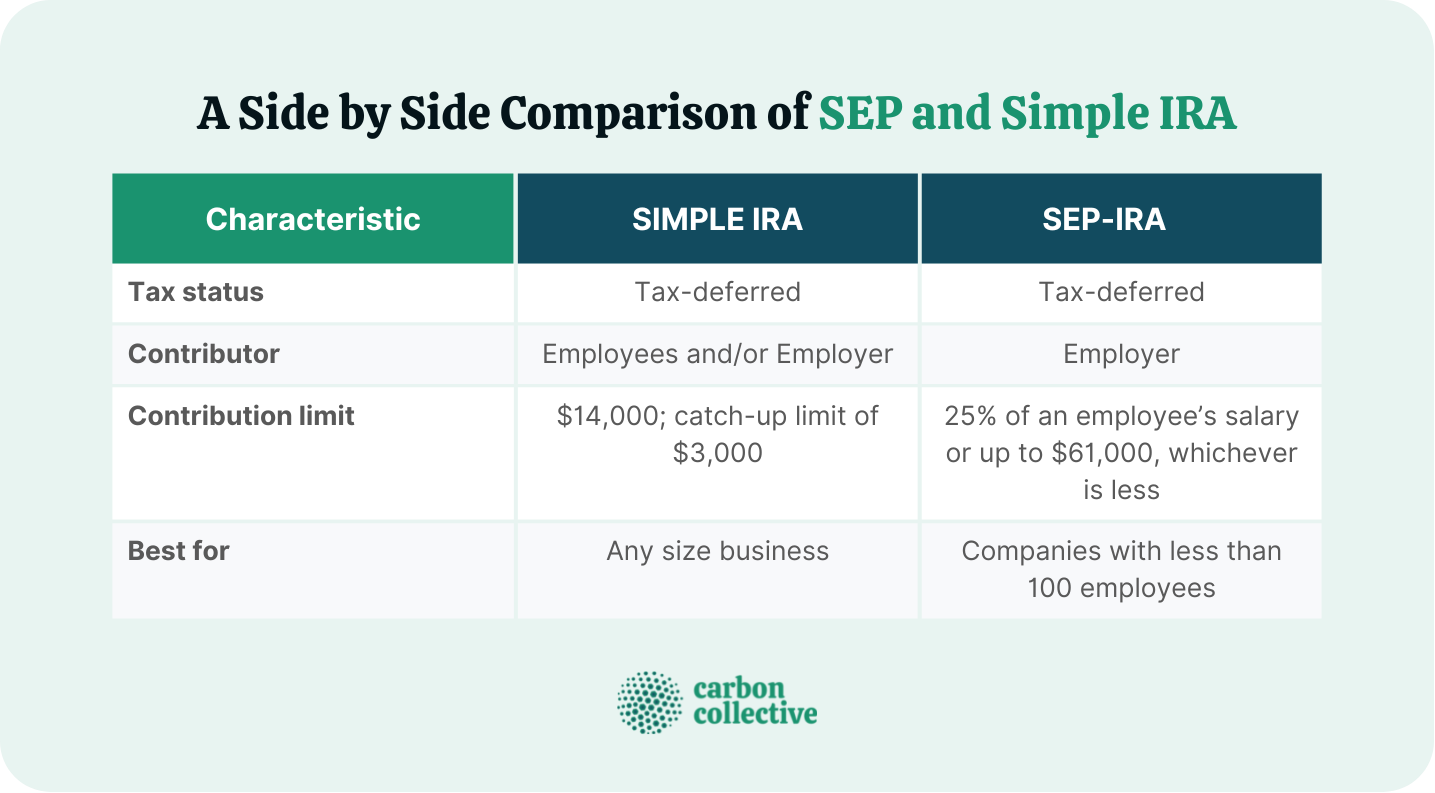

Key Differences Between a SEP and SIMPLE IRA

There are key differences between SEP and SIMPLE IRAs:

Eligibility

SEP and SIMPLE IRAs both have eligibility requirements, but these vary depending on the type of plan.

SEP eligibility is based on employee deferrals and employer contributions. For example, employers must have less than 100 employees contributing if they are to have this type of account.

A SIMPLE IRA, on the other hand, is available to any employer with an average of one employee per year over a two-year period prior to opening the account.

Tax Status

A SEP is a tax-deferred plan, meaning that contributions are not taxed until you withdraw them from the account.

In contrast, SIMPLE IRA accounts are exempt from tax as long as the funds remain in the account. However, any income earned on those funds would be taxable.

Contribution Limits

The contribution limit for a SEP is higher than that of a SIMPLE IRA.

For example, the maximum amount you can contribute to a SEP is 25% of compensation or $66,000 per year in 2023.

In contrast, a SIMPLE IRA has a lower contribution limit of $15,500, which increases to $19,000 for those over 50 years old.

Contributor

Both SEP and SIMPLE IRAs offer employer-only contributions to employees.

For SEPs, the employer is responsible for all contribution decisions, while SIMPLE IRAs allow both the employer and the employee to contribute a percentage of their income.

Penalty for Withdrawal

Withdrawing money from a SEP before you reach 59½ can result in a 10% penalty on the withdrawn amount.

In contrast, a SIMPLE IRA does not have a penalty for early withdrawal as long as contributions remain in an individual's account for at least five years from the date of their first contribution.

Benefits of SEP and SIMPLE IRA

Both SEP IRAs and SIMPLE IRAs have their own benefits.

SEP IRA

There are many benefits to a SEP compared to a SIMPLE IRA:

- Plan to prepare for retirement.

- Contributions are made with pre-tax dollars.

- Easy to set up with the help of a broker.

- Immediate vesting.

- Contribution limits are higher than 401(k)s, as well as traditional and Roth IRAs.

- Flexible

SIMPLE IRA

A SIMPLE IRA account is beneficial to both employers and employees because the account offers the following benefits:

- Retirement Savings.

- Contributions can grow tax-deferred until they’re withdrawn.

- Contributions are directly deducted from your salary.

- Two ways to contribute to plans.

- Immediate vesting.

- Contributions not reported as income.

- Contribution limits are higher than traditional and Roth IRAs, though not more than for a 401(k) or SEP IRA. You might also explore sustainable 401(k) plans.

- Catch-up contributions are available.

Drawbacks of SEP and SIMPLE IRA

Both SEP and SIMPLE IRAs come with their own respective downsides.

SEP IRA

- No catch-up contributions available.

- No options for Roth Plan.

- Employer-only contribution

- 10% penalty when withdrawn before age 59½.

- Starting at the age of 73, you should start withdrawing money from the account.

SIMPLE IRA

- Offered for companies with no more than 100 employees.

- Each year, employees are obliged to fund the accounts of their employees.

- This plan does not offer a Roth version.

- 10% penalty when withdrawn before age 59½.

- Starting at the age of 73, you should start withdrawing money from the account.

Final Thoughts

While SEP and SIMPLE IRAs seem similar, there are enough differences to make each plan more beneficial for some people than others.

Whether you choose a SEP IRA or a SIMPLE IRA, the most important thing is that you start saving for retirement as soon as possible, regardless of whether or not your employer offers matching contributions.

Instead of putting it off, take advantage of these plans now so that you can enjoy the rewards later.

Before you sign up for any retirement plans, it is best to speak with a financial advisor for additional insight.

FAQs

1. What is a Simplified Employee Pension Plan?

A Simplified Employee Pension Plan (SEP) is a self-employed retirement plan available to small businesses that have no more than 100 employees.

2. What is a SIMPLE IRA Plan?

A SIMPLE IRA plan is an alternative to a SEP. In this plan, employees may be able to contribute a portion of their income into their account and enjoy the benefits of tax-deferred growth.

3. What are SEP contributions?

Under a SEP, an employer can contribute up to 25% of earned income, or $66,000 in 2023 per employee. This amount will increase every year in line with inflation.

4. What are SIMPLE IRA contributions?

In a SIMPLE IRA plan, both employees and employers can contribute to the account. The maximum amount that an employee can contribute in 2023 is $15,000, which goes up to $19,000 for those age 50 or older.

5. Which plan should I choose?

A SEP is more employer-oriented, while SIMPLE IRAs give employees the opportunity to contribute as well. A SEP also allows you to use a cash balance plan on top, offering a higher contribution limit compared to a SIMPLE IRA.