In this section, we cover every step of the accounting cycle to help you understand and follow along with how all of the business transactions of a company are recorded and converted into useful financial statements.

An example of the accounting cycle

The 11 articles below cover the entire accounting cycle process, from journal entries at the beginning of the cycle, right through to the optional reversing entries step before starting a new one.

Click Journal Entries below to get started with the tutorials.

Meet Bob. In this series of articles, we’ll look at the accounting cycle for his delicious startup, Bob’s Donut Shoppe, Inc.

We’ll talk about all of the different transactions and business events that happen throughout the accounting cycle in his first year of business.

What is the accounting cycle?

The accounting cycle (also commonly referred to as a “bookkeeping cycle”) is a multi-step process of recording and processing all business transactions of a company and converting them into useful financial statements. An accounting cycle starts with the recording of individual transactions and ends with the preparation of financial statements and closing entries.

One of the main responsibilities of a bookkeeper is to keep track of the full accounting cycle from start to finish. The term “cycle” indicates that these procedures must be repeated continuously to enable the business to prepare new up-to-date financial statements at reasonable reporting intervals.

Companies can prepare their financial statements on a quarterly or annual basis. Companies doing it quarterly will have an accounting cycle of three months while the annual companies will have a one-year accounting cycle.

Understanding the accounting cycle

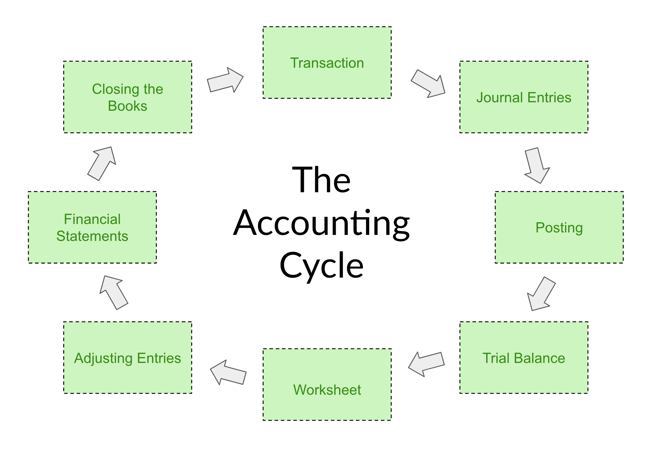

The accounting cycle can be simplified into an eight-step process for completing a company’s bookkeeping tasks. It provides a comprehensive guideline for recording, analyzing and reporting a business’ financial activities.

The sequential process of the accounting cycle ensures that the financial statements a company produces are consistent, accurate and conform to official accounting standards (such as IFRS or GAAP).

It also ensures that all the money passing through the business is properly documented and “accounted” for.

Many companies have these steps automated through accounting software and the use of technology. Depending on the system capabilities, a bookkeeper might be needed to intervene at some stages. Therefore, it is important for them to understand the steps involved in the overall process to better tackle any situation they might be faced with.

The 8-step process

Below are the major steps involved in the accounting cycle:

Step 1: Identifying transactions

An accounting cycle starts when a business transaction takes place. If there are no transactions, there won’t be anything to keep track of. Companies will have many transactions throughout their accounting cycle. The nature of transactions may include sales, purchase of raw materials, debt payoff, acquisition of an asset, payment of any expenses etc.

Recordkeeping of these transactions is essential so that they can be reflected in the final presentation in the form of financial statements. To make record keeping easier, companies will link their books to point of sale systems to collect sales data. Besides revenue, companies will also record expenses which may be of varying nature such as rent, wages, fuel, transportation costs, etc.

Step 2: Record transactions in a journal

The second step in the cycle is to create journal entries for each transaction in chronological order. Point of sale technology can assist in combining steps 1 and 2, but companies might still have to track items like expenses separately.

The bookkeeper will have a choice between cash accounting and accrual accounting depending on his company’s requirements. This choice will determine when the transactions are officially recorded.

In cash accounting, transactions are recorded based on when cash is paid or received.

Accrual accounting, on the other hand, requires that revenues are matched with related expenses so that both are recorded at the time of sale.

The objective behind the matching concept is to prevent misstating the earnings. For example, if company XYZ records a sale of a product in a certain period but fails to record the expenses that related to that sale in the same period, the company will be overstating its profits for that period.

Transactions can also be recorded using single-entry accounting or double-entry accounting. Double-entry bookkeeping requires creating two entries (debit and credit entry) in order to arrive at a fully developed income statement, balance sheet and cash flow statement. A single-entry system is comparable to managing a cheque book as it only reports balances as positive and negative and does not require multiple entries.

Step 3: Posting to the general ledger

Transactions once recorded are then posted to individual accounts in the general ledger. The general ledger gives a breakup of all accounting activities by account. This gives the bookkeeper the ability to monitor balances and positions by account. An example of an account in the general ledger is the cash account which shows the total inflows and outflows relating to that account during an accounting period.

Step 4: Unadjusted trial balance

Preparing an unadjusted trial balance is the next step of the accounting cycle in which a total balance is calculated for all the individual accounts.

Step 5: Worksheets

Evaluating a worksheet and identifying adjusting entries is the fifth step of the process. A worksheet is prepared to ensure that debits and credits are equal to each other. Adjustments can be made to fix any errors.

In addition to fixing errors, adjusting entries might also be needed to incorporate revenue and expense matching principle when using accrual accounting.

Step 6: Adjusting entries

At the end of the accounting period, adjusting entries must be posted to account for accruals and deferrals. Their main objective is to match incomes and expenses to the relevant accounting periods.

Adjusting entries can be one of the following types:

- Accruals: These include revenues that have occurred, but the company has neither received nor recorded them yet. Expenses that relate to those revenues but have not been paid or recorded yet would also fall into this category. For example, interest expense due on a loan for the current period but not yet paid.

- Prepayments: These include revenues that have been collected in advance and will be recorded as liabilities. They also include expenses that have been paid in advance and will be recorded as assets. Examples include prepaid insurance, office supplies, adjustments to unearned revenue, prepaid rent, etc.

- Non-cash: These adjusting entries include recording non-cash items such as depreciation expense, bad debts, etc.

Step 7: Financial statements

After making the adjustment entries, a company will generate its financial statements as the next step. The most common financial statements include an income statement, balance sheet, cash flow statement and statement of shareholder’s equity.

Financial statements can be used to understand what the business is worth and how it got there. It will highlight and narrow down key areas or problems which the decision-makers can then use to make key decisions related to strategy, profitability, leveraging or deleveraging, cost-cutting, expansions etc.

Step 8: Closing temporary accounts via closing entries

A company ends the accounting cycle by closing its books on a specified closing date. Since the revenue and expense accounts are temporary accounts that show position for a certain period, therefore they are closed and zeroed out at the end of the accounting cycle. Balance sheet accounts are not temporary and therefore they are carried forward in the next accounting cycle.

The modern accounting cycle

The accounting cycle was a very important concept when a companies accounting system was manual.

The modern accountant is likely to be using accounting software instead which allows you to enter adjusting entries and see instantly the updated financial statements at the click of a button.

This realtime ability to make adjustments and see them updated means that today, the accounting cycle is happening all at once by automating every step.

The fundamentals are still very important to know and understand but the software makes the whole process a lot less time-consuming.

FAQ

1. What is the accounting cycle?

The accounting cycle is a set of steps practiced by accountants and bookkeepers to keep financial records and prepare financial statements.

2. What are the 5 steps involved in an accounting cycle?

The 5 steps involved in an accounting cycle are the following:

Step 1: Recording the Financial and Non-Financial Transactions

Step 2: Enter the Transactions in Journal

Step 3: Post Journal Entries in Ledger

Step 4: Check for Errors and Trial Balance in the Trial Balance Period

Step 5: Prepare and publish the period's financial reports.

3. Why is the accounting cycle important?

The accounting cycle is the foundation of the entire accounting system and sets up all future entries in a company's financial records.

4. What is the purpose of the accounting cycle?

The purpose of the accounting cycle is to ensure that all financial transactions are accounted for in accordance with strict standards.

5. How is the accounting cycle different from the budget cycle?

The accounting cycle is the process of recording your company's revenue and expenses, while the budget cycle is used to determine how much money a business should have at any given time.