An annuity is a financial product that pays out a series of cash flows at a specified frequency and over a fixed time period. The payment period of an annuity can be yearly, twice yearly, quarterly and monthly. Once you know the interest rate and the number of time periods, you can calculate both the present and future value of an annuity.

There are generally two types of annuity: ordinary annuities and annuities due. An ordinary annuity requires payment at the end of each period. For example, straight bonds make coupon payments typically at the end of every six months until maturity. Annuity due payments are required at the beginning of each period, for example, your rent payment is considered an annuity due as it is paid when you first move in and then generally at the beginning of each month thereafter.

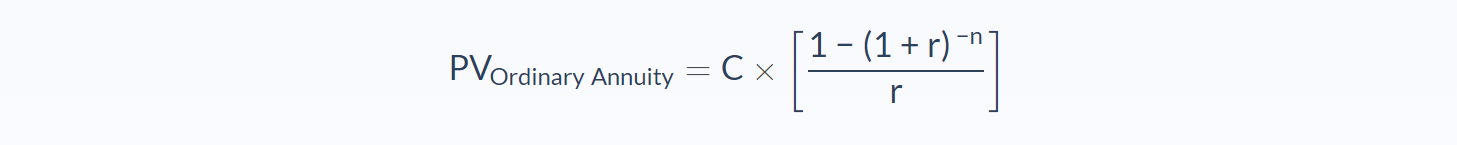

Annuity Payment Formula

- C = cash flow per period

- r = interest rate

- n = number of payments

Put simply, the present value of an annuity is the current value of the income that will be generated by the investment in the future, and it’s the built on the time value of money concept, which states that a dollar today is more valuable than a dollar earned in the future.

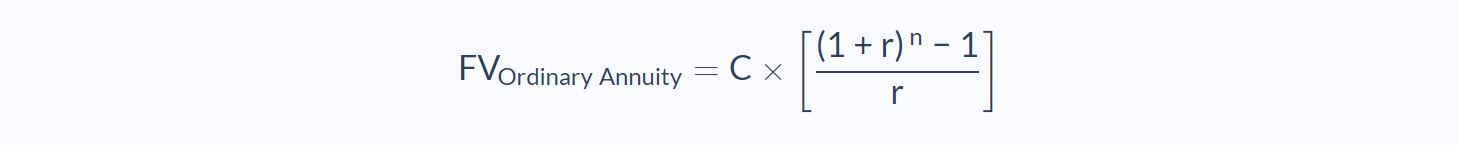

If you know how much you can invest for each payment over a fixed time period, you can also work out the future value (FV) of an annuity to learn how much you would have in the future. For example. if you are making loan repayments, the future value will help you to determine the total cost of the loan.

This formula simplifies the calculation of the future value for a large number of cash flows and acts as a shortcut to find the accumulated value of all cash flows received from the annuity.

Annuity Payment Example

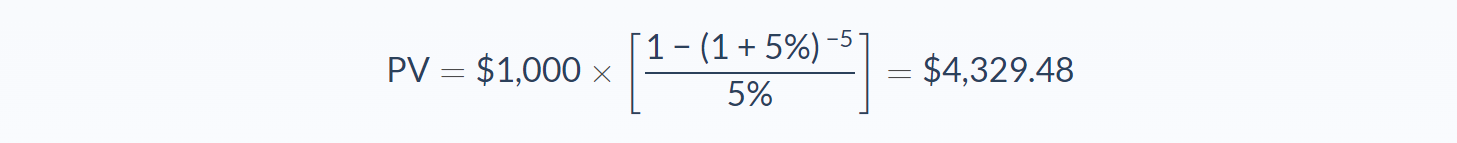

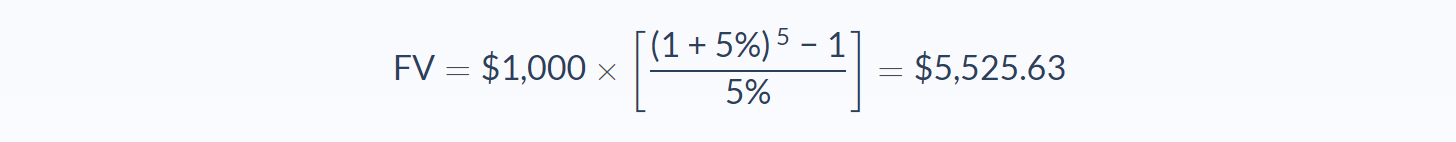

Let’s say you have an annuity which pays out a cash flow of $1,000 every year for the next five years, and you invest each payment at 5% interest rate. We can work out both the present and future value of this annuity.

The present value of this annuity in today’s money is $4,329.48. Let’s take a look at the future value as well.

Here we can see that the future value of this annuity will be $5,525.63 once all of the cash flow payments have been received and invested at 5%.

Annuity Payment Conclusion

When calculating annuity payment conclusion, the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- After an equal interval of time, there is a series of cash flow that will occur and that’s called an annuity.

- Knowing the interest rate and the number of periods is very important.

- How often the payment is made reflects the rate per period and number of periods.

- By rearranging the PV of the annuity formula, you can determine the annuity payment formula.

- To find the annuity payment, you can use the PV of the annuity equation.

Annuity Payment Calculator

You can use the annuity payment calculator below to work both the present and future value of a series of annuity payments.

FAQs

1. What is an annuity payment?

An annuity payment is a fixed sum of money that is paid at fixed intervals over time. This type of payment is often used in financial transactions such as loans and investments, where the regularity and predictability of the payments are important.

2. How do you calculate annuity payments?

The calculation of annuity payments is done by rearranging the PV of the annuity formula. This will give you the annuity payment formula, which can then be used to determine the amount of each payment.

3. Are annuity payments monthly or yearly?

The frequency of annuity payments can be either monthly or yearly, depending on the terms of the agreement. Generally, if the payments are to be made monthly, then the rate per period will be expressed in months, and if the payments are to be made yearly, then the rate per period will be expressed in years.

4. Is an annuity a one time payment?

No, an annuity is not a one-time payment. It refers to a series of regular payments that are made over a fixed period.

5. What are the different types of annuities?

There are three types of annuities: immediate, deferred, and perpetuity. An immediate annuity begins making payments immediately, a deferred annuity does not begin making payments until a future date, and a perpetuity annuity makes payments indefinitely.