Average inventory period refers to a financial ratio used to compute the average number of days a company takes before they sell all their current stock of inventory. In other words, AIP is the duration goods are sitting on the shelves for before they’re sold.

Company management can use average inventory period figures to monitor purchasing patterns and sales trends of the stock inventory so that they can easily minimize carrying and storage costs. It can help management to identify fast-moving goods. Thus, the average inventory period is an essential measure of how efficient a company can convert its inventory into sales.

Average inventory period plays a crucial role in the decision-making process by the financial analysts and investors whose primary interest is more profit generation. They review the AIP ratio as it demonstrates the company’s ability to liquidate its stock. A small AIP indicates an efficient company and vice versa.

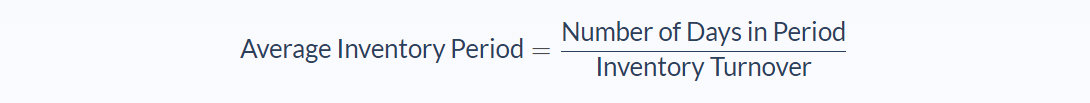

Average Inventory Period Formula

This equation requires two variables. The number of days in the period can be annual or per-quarter, depending on the company’s interest and inventory turnover.

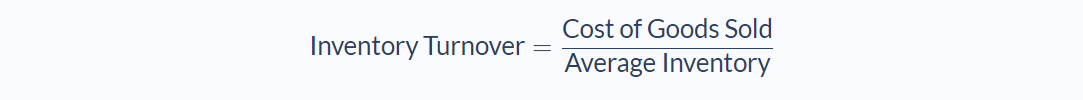

The next step is to determine the inventory turnover rate. If it’s not provided directly, you can solve for it by dividing the cost of goods sold by the average inventory.

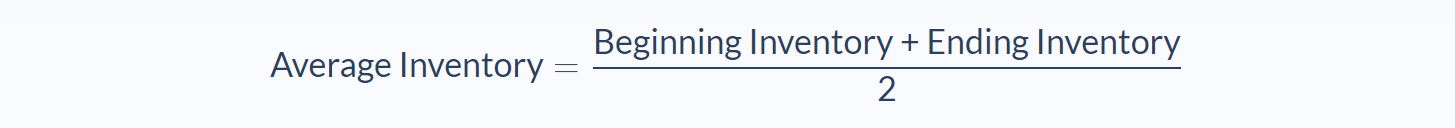

However, you may not always have the average inventory either. You can easily solve for this as well using the following equation.

Average inventory period value shows the efficiency of the company in terms of its operations. For instance, a small average inventory period means that the company is more efficient in its operations because it takes less time to turn its stock into cash hence increasing cash flow. A lower DSI is also preferred because it ensures that the company reduces the storage cost.

By selling the whole stock within a short period for the case of foodstuff, consumers are guaranteed fresh and healthy. An increase in the average inventory period shows that the company is becoming inefficient, and this signals for investigation on what could be the possible causes of slow sales.

Average Inventory Period Example

ABC Limited is a 4-year-old, rapidly growing food and beverage company. In the fiscal year 2017, the company published in their financial statements including $450,000 and $550,000 for beginning and ending inventories, respectively. The average inventory for that year was $500,000.

In the fiscal year 2018, the company published had $350,000 and $450,000 for their beginning and ending inventories, respectively. In both years, their cost of goods sold was $5,000,000. Assuming that 2017 and 2018 ended in 365 days, determine the average inventory period of the company.

Now let’s break it down and identify the values of different variables for 2017.

You can calculate the average inventory by dividing the beginning inventory ($450,000) by 2, then add the closing inventory ($550,000). So the average inventory would be $775,000. We can find the inventory turnover by dividing the cost of goods sold ( $5,000,000) by the average inventory.

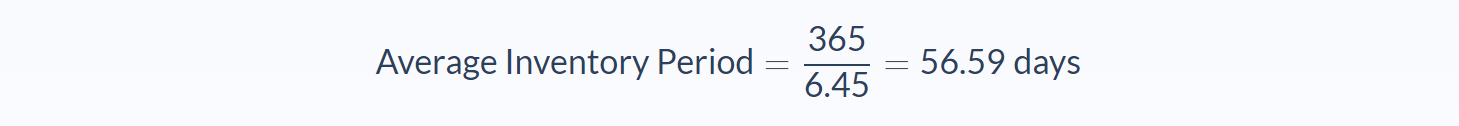

- Number of Days in Period = 365 days

- Inventory Turnover = 6.45

Finally, we can use our formula to calculate the average inventory period:

The company needed 56.59 days to sell all its current stock.

For the 2018 fiscal year, you can use the same methods as above to identify the average inventory as $625,000. And you can use that number to find the inventory turnover rate.

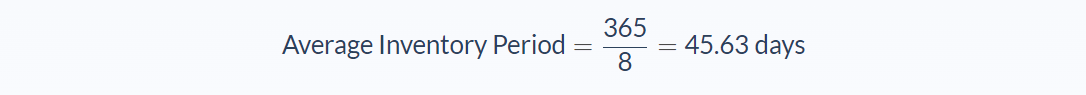

- Number of Days in Period = 365 days

- Inventory turnover = 8

The company needed approximately 45.63 days to sell all its current stock. Company managers can compare past figures with the current ones to find out if the level of efficiency is either going down or up. In 2017, the company was taking about 57 days to sell all its stock. Then, in 2018 the figure reduced to about 46 days. This was an indication that it converted its inventory into cash more efficiently.

Average Inventory Period Analysis

The average inventory period concept is a measure of interest in the management of companies as it informs managers on purchasing happenings and sales trends of various products and ideas. This helps them to know which products are fast-moving and helps in deciding on the volumes of stock to be purchased to reduce associated costs like carrying and storage costs while increasing cash flows.

Average inventory period may not pinpoint exactly the reason why the period the product is staying on the shelves is long. So in such cases, if the AIP was figure was for more than one product, say, five it usually is advisable for the manager to disintegrate the five products and calculate AIP for each product so that he/she can isolate which product is dragging behind the entire company’s sales. From there, management can proceed to investigate the main issue as to why the product is not moving fast and then decide on the way forward.

AIP rate can change throughout the business cycles as a result of seasonality in some industries. For example, retail shops may experience shorter AIP during holidays and longer AIP during the summer period, and this explains why an average inventory period is the best over a certain period as it will factor in both holiday and summer sales trends.

Since we use the same formula to compute AIP across different seasons and products and companies, comparison too should only be made between companies in a similar industry dealing in related products or within the same company so that the truth of the narrative of apples-to-apples comparison be realized.

Average Inventory Period Conclusion

- Average inventory period is the average number of days a company takes before they sell all their current stock of inventory

- Average inventory period is a measure of how efficiently a company can convert its inventory into goods into sales.

- A low AIP indicates a more efficient company.

- AIP is usually calculated within one year periods.

- DSI requires two variables: Number of days in period and Inventory turnover.

- Only compare the average inventory period to companies with like industries.

Average Inventory Period Calculator

You can use the average inventory period calculator below to quickly calculate the average number of days a company takes before they sell all their current stock of inventory by entering the required numbers.

FAQs

1. What is an average inventory period?

The average inventory period is the number of days it takes a company to sell all their current stock.

2. How do you calculate the average inventory period?

To calculate the average inventory period, you divide the number of days in the period by the inventory turnover.

3. What is a good inventory period?

A good inventory period is one that is lower than the average. This indicates that the company is more efficient at converting its inventory into cash.

4. Why is it important to know the average inventory period?

Knowing the average inventory period can help a company to make better decisions about how much stock to purchase and when to make purchases in order to reduce associated costs and increase cash flows.

5. Where is the average inventory on the balance sheet?

The average inventory is found on the balance sheet as an asset.