Average payment period (APP) is a metric that allows a business to see how long it takes on average to pay its vendors.

There are several advantages that come to a company that tracks their average payment period. But the biggest benefit comes from the average payment period being a solvency ratio. A solvency ratio helps a company determine its ability to continue business as usual in the long-term. It does this by measuring the company’s ability to pay back its obligations.

Learn why investing is the only realistic path to solving climate change.

There are many reasons for a company to use the average payment period. At the basic level, it only tells the average length of time it takes for a company to pay back its vendors. This can help a company make decisions on cash flow. Additionally, it can help them look for discounts available when they choose to pay vendors sooner rather than later.

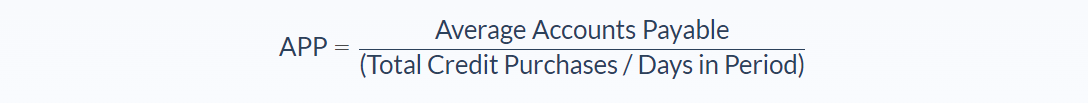

Average Payment Period Formula

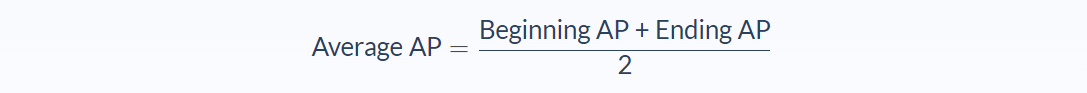

Before you can calculate the average payment period you will have to calculate the average accounts payable. To do so, you will need the following formula:

All of the values for these variables can be found on the company’s financial statements.

In general, the period of time that is used in the formula is for a year so the days with period variable would be 365. Alternately, you can calculate the average payment period on a quarterly, semi-annual or monthly basis. Depending on the period needed you would need to collect the corresponding financial statements for the remaining variables.

Average Payment Period Example

Let’s say that you want to calculate the average payment period for a company that manufactures various styles of Bluetooth headphones, called Blue Ears, Inc.

Most of the parts that are used in the headphones are purchased on credit. The reason that the company wants you to calculate the average payment period is that they want to be as lean as possible in its operations. So they want to see if, on average, they are taking advantage of discounts. These discounts are offered when bills are paid within 30 days since the payment terms are 10/30 net 90. Because you are looking for the yearly average you ask to see the previous years financial statements.

Once you get the statements you look at the years beginning and ending account payable balances. Last year’s beginning accounts payable balance was $110,000 and the ending accounts payable balance was $95,000. Over the course of last year, the company made a total of $1,110,000 purchases on credit.

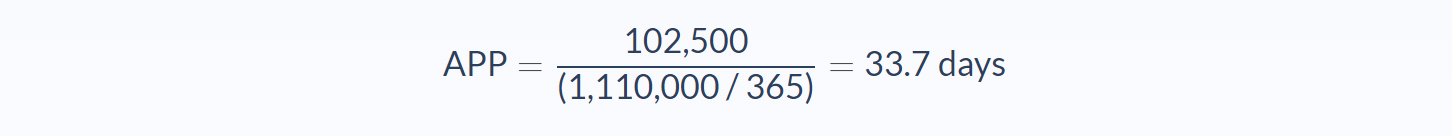

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Beginning Accounts Payable: $110,000

- Ending Accounts Payable: $95,000

- Average Accounts Payable: $102,500 ( (110,000+95,000)/2 )

- Total Credit Purchases: $1,110,000

- Days within Period: 365

We can apply the values to our variables and calculate the average payment period:

In this case, the average payment period would be 33.7 days.

What this means for Blue Ears is that they are running relatively lean. And they are not receiving any late penalties on their purchases. However, if they pay their vendors just 4 days sooner, then they would be eligible for a 10% discount on their parts and materials.

The recommendation made to the company after seeing this should be that Blue Ears should pay the vendors within the first 30 days. Doing this would be a small and “easy” change that would increase profit margins. What company wouldn’t want an additional 10%?

Average Payment Period Analysis

Paying attention to discount opportunities can mean cash-in-pocket for companies. Many vendors offer payment terms such as net 30,60 or 90 days. This means that the full invoiced amount is must be paid to the vendor 30, 60 or 90 days after the invoice date. Anything after that due date would be subject to a late penalty. However, to incentivize companies to pay sooner, a company may also offer a payment option such as 10/30 net 60. This means that the company has 60 days to pay the invoice with no penalty. However, they would receive a 10% discount if the amount is paid in full within the first 30 days after the invoice date.

Another use for the average payment period is to determine how efficiently a company uses its credit in the short term. Also, it examines its ability to pay its vendors in the long-term. If a company generally pays its vendors quickly and on time might result in the company being offered better payment terms from new or existing vendors.

Something that is very important to consider when beginning to calculate the average payment period for a company is the number of days within a period. For instance, if you are viewing the annual financial statements but need to be doing a quarterly report, the numbers may be different from one to the next. In our above example, what if you had been doing a quarterly report but used the same numbers from the annual report. If you plugged in 90 days for the days within the period, it would look like Blue ears pays its vendors within 9 days of invoicing instead of the actual 34 days. This can cause wrong decisions to be made which might have catastrophic consequences for the company in the short term.

Average Payment Period Conclusion

- The average payment period is how long a company takes on average to pay back their vendors.

- The average payment period can be used to compare various companies against each other as well as the industry average.

- It can be used to analyze a company’s ability to use credit over the short term as well as pay vendors in the long term.

- The formula for the average payment period requires 3 variables: average accounts payable, total purchases on credit, and the total number of days within the period.

Average Payment Period Calculator

You can use the average payment period calculator below to quickly discover the average amount of days a company takes to pay its vendors by entering the required numbers.

FAQs

1. What is the average payment period?

The average payment period is how long it takes on average to pay back vendors. It can be used to compare companies against each other or the industry average.

2. How do you calculate the average payment period?

To calculate the average payment period you need to use this formula: Average Accounts Payable * Days in Period / Total Credit Purchases.

3. How long is the average pay period?

The average pay period is calculated by average credit accounts payable and payment days.

4. Is the high average payment period good?

A high average payment period may be bad for a company that is likely to lose customers if they are slow with paying their bills.

5. What does the average payment period show?

The average payment period tells you how efficient a company is in using its credit in the short-term and in supporting its vendors in the long term.