A bond can be defined as fixed income security that represents a loan by an investor to a borrower. Bonds are one of the three asset classes that investors are familiar with along with equity and cash equivalents.

A contract is set up detailing what the borrower needs to pay on the bond's face value. It will also contain details about the end date and the terms of the variable or fixed interest payments. Bonds are normally issued in denominations of $500 or $1000.

Bond Categories

There are four categories of bonds sold in the markets:

- Corporate bonds are issued by companies that seek funding, rather than using loaning money from a bank they issue bonds. Bonds offer more favorable terms and lower interest rates for the companies.

- Municipal bonds are issued by the states and municipalities the bonds are offered with a tax-free coupon income to investors.

- Government bonds are issued by the government; the bonds issued by national governments are referred to as sovereign debt.

- Agency bonds are issued by government-affiliated organizations.

Characteristics of Bonds

Most bonds share some basic characteristics including:

Face Value

Face value is the amount that the bond will be worth at maturity. Bond issuers use the face value of the bond to calculate the interest payments.

For example, if a bond has a face value of $1000 a buyer purchases the bond at a premium of $1050. The same bond is bought by a different buyer a few months later at a discounted price of $950. At the maturity of the bond, both investors will receive $1000 which is the face value of the bond.

Coupon Rate

The coupon rate is the interest rate of the bond, this interest is calculated on the face value of the bond. The interest rate is expressed as a percentage.

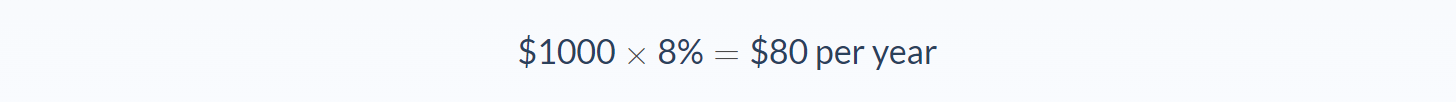

For example, a $1000 face value bond with an 8% coupon rate is issued. What amount of interest will the bondholders receive?

Coupon Date

Coupon dates are the dates on which interest payments will be made. Interest payments can be made at different intervals, but the standard is semi-annual payments.

Maturity Date

The maturity date is the date at which the face value of the bond will be paid out to the bondholder.

Issue Price

The issue price is the price that the bond was originally sold for.

Market Price of a Bond

The market price of a bond depends on numerous factors:

- The credit quality of the issuer – the credit rating of a company’s bond is determined by credit rating agencies. A company can have a high or low credit rating. Very high-quality bonds are issued by stable companies and they are called investment-grade bonds.

If the credit quality of the issuers is poor, then it increases the risk of the bond these bonds are called high yield or junk bonds. The bonds will pay a higher interest rate due to the risk.

- Time until expiration – Bonds with very long expiration dates are considered riskier. Higher interest rates will be paid to the bondholder because the bond is exposed longer to fluctuating interest and inflation rates.

- The coupon rate will be compared to the general interest rate at the time of issuing the bond.

You can use our bond value Excel spreadsheet to calculate your bond pricing, valuation, and yield.

Varieties of Bonds

The bonds available for investors come in different varieties. They are separated by the rate, type of interest, or the coupon payment of the bond. Let’s discuss the varieties of bonds:

- Zero-coupon bonds – are issued at a discounted value, they do not pay any coupon payment. The bondholder gets a return when the bond matures, and the face value is paid out.

- Convertible bonds – allow the bondholders to convert their debt into equity depending on certain conditions.

For example, a company needs $2 million to fund a new expansion project. The company can issue bonds with a 10% coupon rate that matures in 10 years. The alternative is to issue a 6% coupon with the ability to convert the bond into equity if the price of the stock rises above a certain value.

If the company issues the 6% convertible bonds the company will pay lower interest rates at the start of the project which could be beneficial. If the investors convert the bonds to equity the shareholders will be diluted but the company would not have to pay the higher interest rate on the bond principal.

- Callable bonds can be called back by the company before their end date. A callable bond is considered a riskier investment.

For example, a company borrows $2 million by issuing a 12% coupon rate, a callable bond that matures in 10 years. The interest rate declined in year 4 and the company can now borrow at 10%. The company can then call back all the bonds at the face value and reissue new bonds with a 10% coupon rate.

- A Puttable bond – lets the bondholders sell back the bond to the company before maturity. Investors that are worried about the value of their bonds falling or interest rates rising could then get their principal amount back.

Pricing Bonds

A bond can be issued at a discount or premium price depending on the market interest rate. The bondholder will pay the face value of the bond. The bond will then be paid back at maturity with monthly, semi-annual, or annual interest payments.

A bond’s price will change daily a bondholder doesn’t have to keep their bond until maturity, the bonds can be sold on the open market. The price of the bond will change due to a change in the interest rate of the economy.

Way of considering a bond’s price:

- Inverse to Interest Rates – a bond’s price will vary inversely to the interest rate. When interest rates decrease the bond prices will rise to have an equalizing effect on the interest rate of the bond.

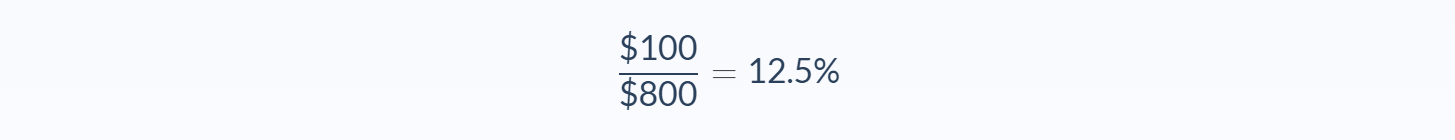

For example – a 10% coupon rate, a $1000 bond is issued, and the price goes down to $800. The yield will go up to 12.5% this is since you are guaranteed $100 on an asset that is now worth $800.

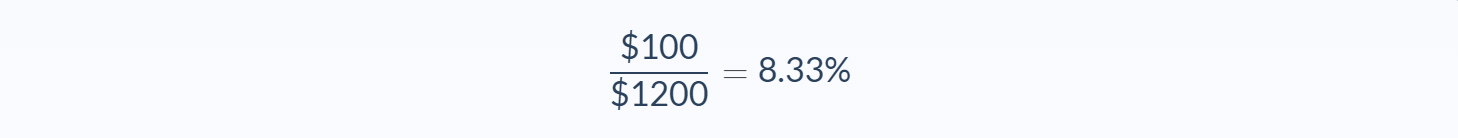

If the price of the bond goes up to $1200 the yield will decrease to 8.33%:

- Yield-to-Maturity (YTM) – is the total return anticipated on a bond that is held until the end of its lifetime. The yield-to-maturity is a complex calculation that is calculated by using a computer. We also have a YTM calculator you can use.

- Duration – measures the anticipated change in a bond price given a change in the interest rate. The duration can be calculated by determining the price sensitivity to the interest rate changes of a bond. Bonds with long maturities and low coupon rates have a great sensitivity to interest rate changes.

Bond Benefits

Bond financing has three benefits:

- Bonds do not affect the ownership of a company whereas equity financing does. Issuing bonds will not dilute company shares.

- Interest expenses on a bond are tax-deductible meaning even though you are incurring interest expenses in financing the bonds you can deduct the money from tax. Equity financing doesn’t provide any tax advantages.

- Financial leverage – when finance a bond and the bond earns you a return on equity it is financial leverage. If a company invests the proceeds from the bond at a higher interest rate than the interest payments on the bond, then the company will make money on issuing the bond.

Bond Example

A bond is issued with a face value of $1000 and a coupon rate of $8. The bondholder will get $80 interest annually if nothing changes the bond will remain at its face value.

The interest rate begins to decrease, and the company issues a similar bond with a face value of $1000 and a coupon rate of $5. The bondholder will get $50 of interest annually, making the initial bond more valuable. The investors would want the higher interest rate bonds, they will have to pay extra to convince a current bond owner to sell their bonds. New investors will pay an amount above the face value to purchase the initial bonds, raising the price of the bond and thus decreasing the yield of the bond

If the interest rate rises from 8% to 10% then 8% coupons are no longer attractive to buyers. This will decrease the bond's price and the bond will be sold at a discounted price.

Bond Conclusion

- A bond can be defined as fixed income security that represents a loan by an investor to a borrower.

- There are four categories of bonds sold in the markets:

- Corporate bonds

- Municipal bonds

- Government bonds

- Agency bonds

- Most bonds share some basic characteristics including:

- Face value

- The coupon rate

- Coupon dates

- The market price of a bond depends on numerous factors:

- The credit quality of the issuer

- Time until expiration

- The coupon rate

- Varieties of bonds

- Zero-coupon bonds

- Convertible bonds

- Callable bonds

- A Puttable bond

- Way of considering a bond’s price:

- Inverse to Interest Rates

- Yield-to-Maturity (YTM)

- Duration

- Bond financing has three benefits:

- Bonds do not affect the ownership of a company

- Interest expenses on a bond are tax-deductible

- Financial leverage

FAQs

1. What is a bond?

A bond is a fixed-income security that represents a loan by an investor to a borrower.

2. Who are the issuers of bonds?

The issuers of bonds can be a company, municipality, or government.

3. What are the characteristics of bonds?

Some of the characteristics of bonds include the face value, coupon rate, and maturity date.

4. What are the types of bonds?

There are four categories of bonds: corporate, municipal, government, and agency.

5. What are the benefits and risks of bonds?

Bonds offer benefits such as tax deductions and financial leverage, but also come with risks such as default.