A budget is a formal statement of estimated revenue and expenses over a specific period in the future, based on their objectives. Budgets can be compiled for an individual, a business, the government, or a group of people.

Budgets are an essential part of running a business efficiently and drawn up for each financial year. It helps to understand if the business can continue to operate within the projected income and expenses.

Types of Budget

Budgets play an important role in the present competitive world in managing costs and maximizing profits. Different budgets can be created depending on the aspect of a business requires focus. Let us look at some of the most popular budgets:

- Sales Budget:

- A sales budget is a financial plan with a focus on how resources of the company can be allocated to achieve forecasted sales.

- The priority of the budget is to achieve maximum utilization of resources and forecast sales.

- The management carefully analyses market competition, economic conditions, and production capacity for this purpose.

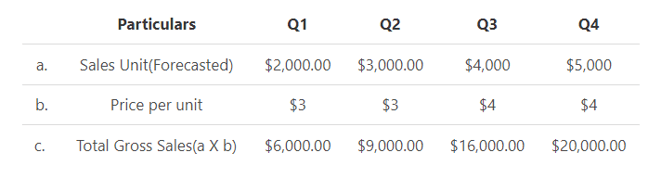

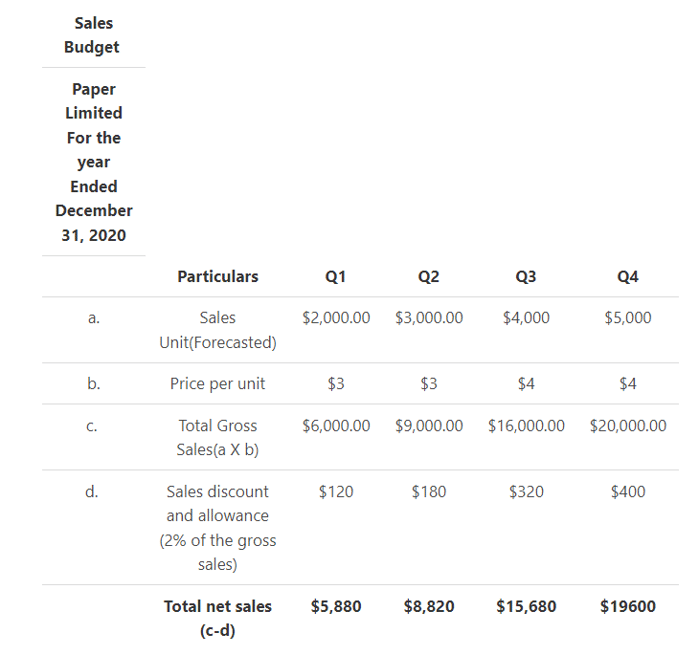

Example: Paper Limited plans to produce pack of assorted color papers in the upcoming year ending in 2020. They forecast the sales to be $2,000 in quarter 1, $3,000 in quarter 2, $4,000 in quarter 3 and $5,000 in quarter 4. They estimate the selling price for the first two quarters to be $3 which is expected to be increased to $4 in quarter 3 and quarter 4 by the sales team.

On analysis of the competition and market conditions, the sales discount and allowance percentage of the company is kept at 2% of the gross sales in the budgeted period. Following will be the updated sales budget of Paper Limited for the year ended on December 31, 2020

- Production Budget:

- A production budget calculates the number of units of products that must be manufactured by the organization and is derived from a combination of the sales forecast and the planned amount of finished goods inventory on hand.

- The production budget is usually presented in either a monthly or quarterly format.

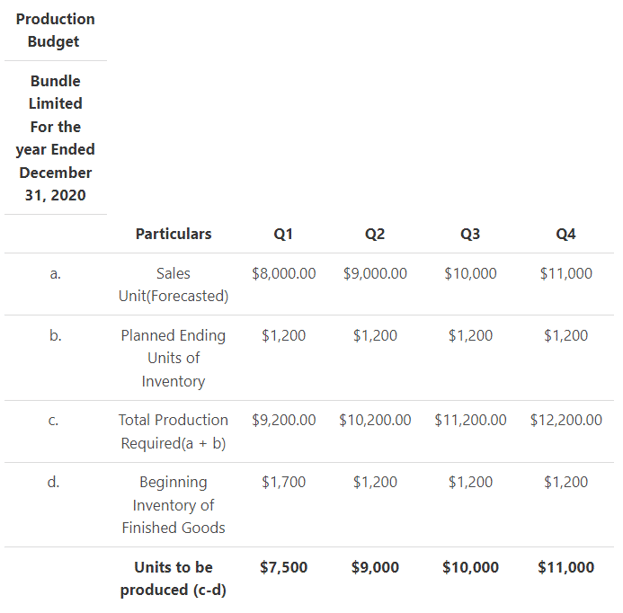

Example: Bundle Ltd plans to produce packs of dry gel pens in the upcoming year ending in 2020. It estimates the sales to be $8000 in quarter 1, $9,000 in quarter 2, $10,000 in quarter 3 and $11,000 in quarter 4. The planned ending inventory is forecasted to be $1200 at the end of each quarter, which in the beginning was $1700.

- Incremental Budget:

- An incremental budget is prepared by using previous period’s budget or actual performance as a basis with incremental amounts then added for the new budget.

- The objective is to develop the best budget by making only some marginal changes to the current budget.

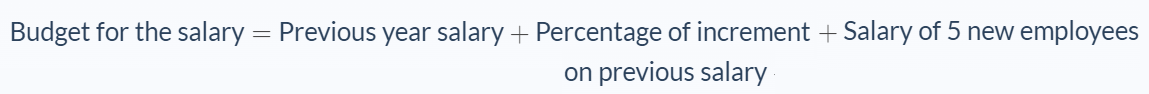

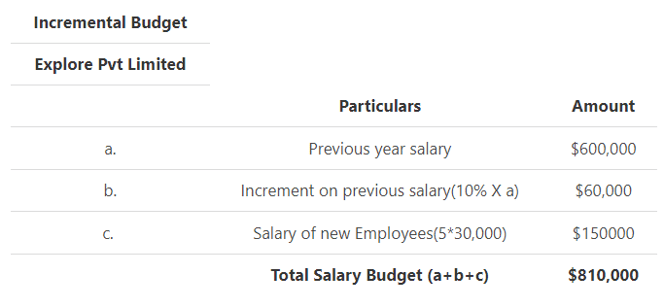

Example: Explore Pvt Limited must develop the budget for the 2020-21 for the salary of its employees. They plan to hire 5 new employees and pay each $30,000 during the next year. They also decide to give an increment to the existing employees of 10% as the company has been able to generate quality business deals.

In the year 2019-20, the company paid a total salary of $600,000 to its employees. Using incremental budgeting:

- Cash Flow Budget:

- An important financial tool in business, a cash flow budget helps in forecasting how and when cash flows in and out of a business in a specific period.

- It is useful in assessing whether a company has enough cash on hand to continue its operations and if there is a possibility of enough cash flowing into the business in the future.

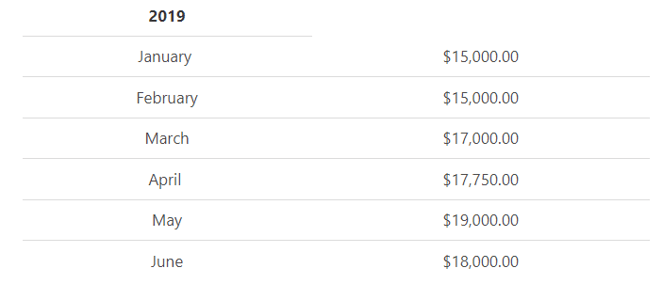

Example: ABS Pvt Limited owns a gym and has decided to use its previous year’s sale amount to prepare a cash flow budget for the next six months. The sales information from the first six months from the previous year is as follows:

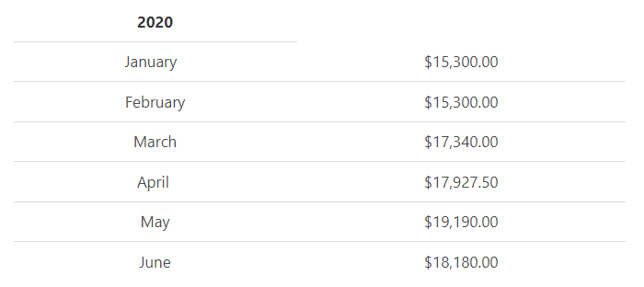

ABS Pvt Limited expects the sales to be up 2 per cent higher in the first three months due to the new year and 1% higher in for the rest of the months due to a new routine. The forecast for sales for the first six months in this year is as follows:

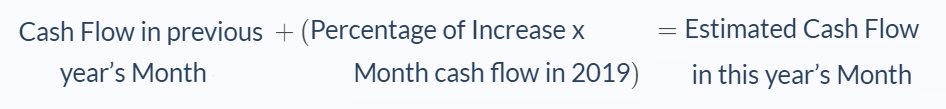

Formula:

For January 2020, with a forecast of 2% hike we use the formula

15000 + (2/100 X15000) = 15300

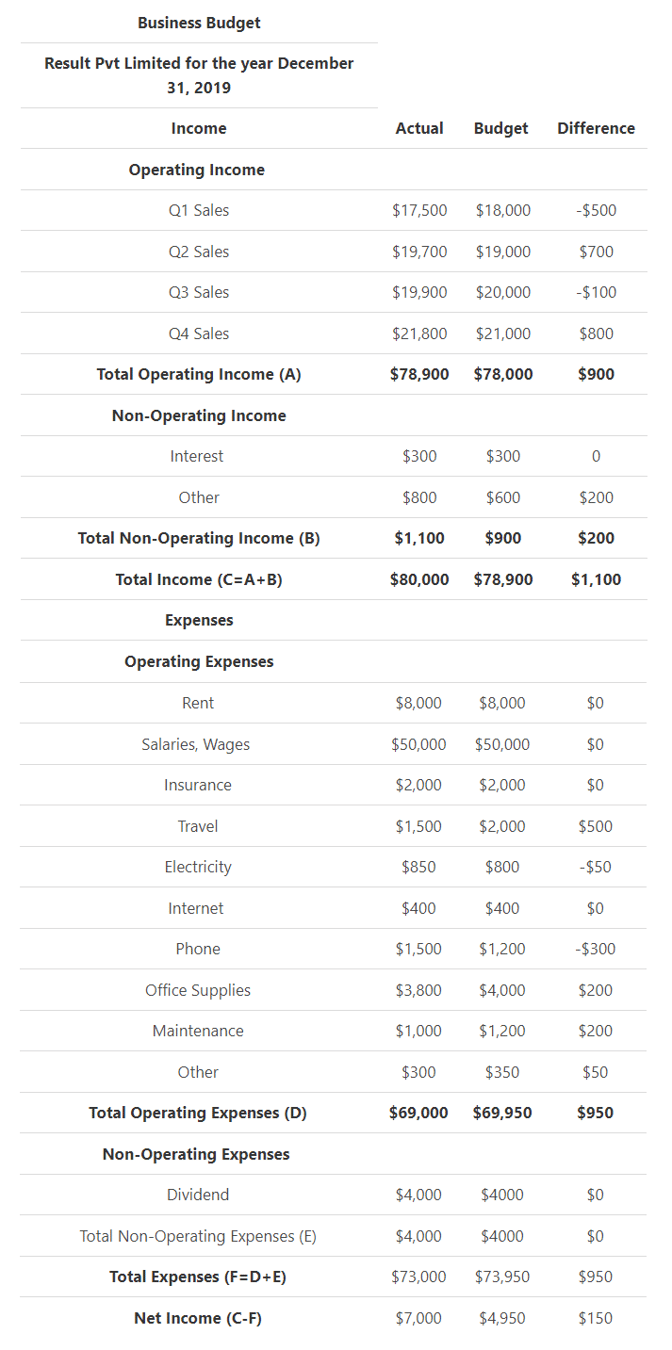

- Business Budget:

- A business budget estimates a company’s revenue and expenses over a specific period. Its probably one of the most important financial tools available to business owners.

Example: The income and expense details of Result Pvt Limited for the year ended in December 2019 is given below

Levels of Involvement in Budgeting process:

There are different levels of involvement in the process which helps to shape the budget. Below at the level of involvement from people in the budget:

- Negotiated Budgeting:

- Combination of both top-down and bottom-up budgeting method

- The executives outline the objectives or targets for the year

- There is a shared responsibility between managers and employees

- Employees might feel a sense of responsibility for the targets

- Participative Budgeting:

- Employees work from the bottom-up to recommend targets to the management

- There is a higher sense of freedom to set up the budget

- Executives may provide some input depending on their analysis, but they usually accept the recommendations given

- Imposed Budgeting:

- A top-down approach where executives decide the targets and managers must follow the goals to set the budget

How to make a budget for a small business:

- Review the cost and revenue from the previous year:

- Use these numbers to create forecasts for this year’s budget. If it is a brand-new business, you might have to research similar businesses to obtain approximate estimates

- Review the revenue for every month and analyze if the revenue has dipped or risen. This is an important step to manage cash flow for a business

- For example, there might be certain months when the revenue earned is low while for few months’ revenue would grow multi-folds. This is a consistent trend observed in many industries and learning from them is important. A gym company usually records a strong uptrend in business in the first three months of the year, as people take up new year resolutions to lose weight and many gyms take the opportunity to sell yearly memberships

- Examine the fixed expenses:

- These are regular monthly expenses such as rent, insurance, salaries, utilities, maintenance and are crucial for operation of the business

- Factor all these expenses to ensure that all the expenses are accounted for in the budget

- Include the variable expenses:

- It is an expense that changes in proportion to the production output.

- Variable cost increases if production goes up and decreases when the volume goes down. They are generally different between industries

- You can calculate variable costs by multiplying the quantity of output by the variable cost per unit of output

- Include one-time and unexpected costs:

- These are unexpected costs which might occur or are hard to notice and could affect the operations of the company

- These can be expenses related to permits or licenses which businesses need to operate in their states. They might also need a permit to run in its locality

- Another example is that businesses might need to consult a professional to stay up to date with tax rates and deadline. Or there can payment delays by customers which can lead the business to lose money or fall back on their own loan payments. Thus, its important to budget for an extra cash cushion to manage delays

- Compile all the information into a budget format:

- A business can utilize accounting software available in the market or use Microsoft Excel or a similar spreadsheet to prepare a budget

- This allows the business to see how accurate their budget is and gives them enough room for timely adjustments

Summary:

- A budget is a formal statement of estimated revenue and expenses over a specific period in the future

- Budgets are an essential part of running a business efficiently and drawn up for each financial year

- A sales budget is a financial plan with a focus on how resources of the company can be allocated to achieve forecasted sales

- A production budget calculates the number of units of products that must be manufactured by the organization

- An incremental budget is prepared by using a previous period’s budget or actual performance as a basis with incremental amounts then added for the new budget

- A cash flow budget helps in forecasting how and when cash flows in and out of a business in a specific period

- A business budget estimates a company’s revenue and expenses over a specific period

- Negotiated budgeting process is a combination of both top-down and bottom-up budgeting method

- Participative Budgeting process involves employees work from the bottom-up to recommend targets to the management

- Imposed Budgeting process involves a top-down approach where executives decide the targets and managers must follow the goals to set the budget

FAQs

1. What is a budget?

A budget is a formal statement of estimated revenue and expenses over a specific period in the future. Budgets are an essential part of running a business efficiently. It helps in forecasting how and when cash flows in and out of a business.2. What is the use of a budget?

A budget can be used for different purposes such as tax planning, financial forecasting, performance measurement, and financial reporting. For instance, a budget can be used to measure a company’s performance against its goals.

3. How do I create a budget?

There are many ways to create a budget. A business can utilize accounting software available in the market or use Microsoft Excel or a similar spreadsheet to prepare a budget. This allows the business to see how accurate their budget is and gives them enough room for timely adjustments.4. What should I do if my budget falls short?

If your budget falls short, you may need to adjust your spending or find ways to increase your revenue. For instance, you may need to increase the prices of your products or services.You can also try to reduce your expenses by renegotiating contracts with suppliers or finding cheaper alternatives.

5. What is the process of preparing a budget?

The process of preparing a budget can be divided into two parts: the top-down approach and the bottom-up approach. The top-down approach starts with executives who decide the targets for the budget. Managers then use these targets to set the budget for their department.The bottom-up approach starts with employees who recommend targets to the management. This approach is often used in participatory budgeting processes.