Compound annual growth rate (CAGR) is the metric that allows an investor to compare the return rates of their investments over a given time period. In simpler terms, the compound annual growth rate removes the volatility a stock might experience.

CAGR tells you the annual growth the stock had as if it had grown steadily over the course of those same years. It’s important to remember that if you are calculating for multiple years, the returns are reinvested throughout the desired period.

Compound annual growth rate can be used to analyze past investments in order to compare the performance of them. You can also use it to try and forecast the expected future returns on prospective investments.

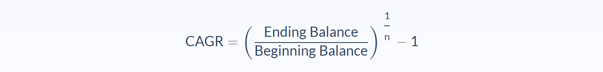

Compound Annual Growth Rate Formula

- n = number of periods

The name of the variables may change slightly, but the meaning behind them stays the same. For this article, we will use investment ending and beginning balance but you might see it referred to as ending (EV) and beginning value (BV) or simply ending (EB) and beginning balance (BB).

When thinking about these variables to evaluate past investments, use the actual numbers from the stock investment. You can plug them into the number of periods. This means that if you originally spent $100 on 3 shares and, as of today, the shares are worth $45 each, the ending balance would be $135. This will allow you to see which of your investments have performed better historically.

If your goal is to try and predict a future return, then you would put the desired theoretical investment ending balance and the actual current stock price into the formula. For the number of periods, you would substitute the desired length of time. You can then compare the compound annual growth rate for that stock’s past performance to the predicted compound annual growth rate to see if the number is a realistic projection.

Compound Annual Growth Rate Example

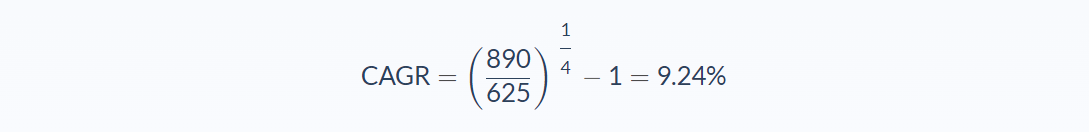

Example 1

Let’s do a few examples to show the versatility of the compound growth rate. The first 2 investments that you want to evaluate are stocks’ that have been in your portfolio for a few years now. You’ve had one investment for 4 years with the starting balance of $625 and the end balance of $890. The other investment you’ve had for 7 years and had a starting balance of $400 and the end balance of $945.

First, we’ll break it down to identify the meaning and value of the different variables in this problem. Then, for each, we can apply the values to our variables and calculate the compound annual growth rate. Now let’s use our formula: compound annual growth rate = ((investment ending balance / investment beginning balance) (1/n)) – 1

Investment A

- Investment ending balance = $890

- Investment beginning balance = $625

- Number of periods = 4

In this case, the compound annual growth rate would be 0.0924 or 9.24%.

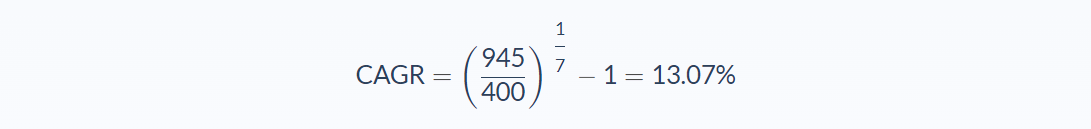

Investment B

- Investment ending balance = $945

- Investment beginning balance = $400

- Number of periods = 7

In this case, the compound annual growth rate would be 0.1307 or 13.07%. In this example of analyzing past performance investment b has a higher rate of return annually.

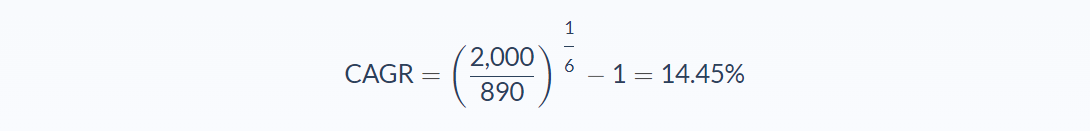

Example 2

Now let’s do an example where we are looking to predict the future growth of these same two investments. To do this we will need to choose the amount that we want the ending balance to be. To keep things simple let’s say that we want both of our investments to have the ending balance of $2000 and we want them to reach that amount in 6 more years.

Let’s break down the new variable values for each investment.

Investment A

- Investment ending balance = $2000

- Investment beginning balance = $890

- Number of periods = 6

In this case, the compound annual growth rate would be 0.1445 or 14.45%.

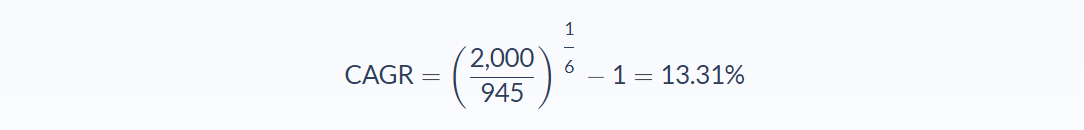

Investment B

- Investment ending balance = $2000

- Investment beginning balance = $945

- Number of periods = 6

In this case, the CAGR would be 0.1331 or 13.31%. Looking at these numbers you can predict that investment B will reach $2000 in six years with a much higher degree of confidence since the compound annual growth rate is fairly close to the historic number.

Remember that since this is just a prediction there is no guarantee that investment won’t have a higher return rate as the market is volatile.

Compound Annual Growth Rate Analysis

The compound annual growth rate formula is a great tool for investors when they want to analyze the return rate of their investments. Because it smooths the performance of the investment over time, it allows for comparison between various investments over the course of time, as well as predicting future investment value.

This can be especially essential when an investor needs to determine which of their investments are performing well and which are not. This means that emotion can be more easily removed from the decision process of buying and selling an investment.

Compound Annual Growth Rate Conclusion

- The compound annual growth rate measures how much cash is generated from a business’s everyday operating activities and processes over a specific length of time.

- It can be used to analyze past investment performance or to try and predict future investment performance.

- The formula for CAGR requires three variable variables: investment ending balance, investment beginning balance, number of compounding periods

Compound Annual Growth Rate Calculator

You can use the compound annual growth rate calculator below to quickly find your investment’s annual return rate by entering the required numbers.

FAQs

1. What is Compound Annual Growth Rate (CAGR)?

Compound annual growth rate (CAGR) is the metric that allows an investor to compare the return rates of their investments over a given time. In simpler terms, the compound annual growth rate removes the volatility a stock might experience.

2. How is the Compound Annual Growth Rate (CAGR)calculated?

CAGR is calculated by taking the investment ending balance and dividing it by the investment beginning balance. The quotient is then raised to the power of the number of compounding periods and minus one.

The formula for the compound annual growth rate is:

CAGR = (Ending Balance / Beginning Balance) 1/n - 1

3. What are the benefits and downsides of using Compound Annual Growth Rate (CAGR)?

The benefits of using the compound annual growth rate are that investors can compare the performance of their investments over a given time period. Additionally, CAGR can be used to predict future investment values.

The few downsides to using CAGR are that it relies on past data and may not be accurate when predicting future investment values.

4. What is Compound Annual Growth Rate (CAGR) used for?

CAGR is most used for two purposes: analyzing past investment performance and trying to predict future investment values.

5. What is the difference between simple growth rate and Compound Annual Growth Rate (CAGR)?

The simple growth rate is the metric used to calculate how much cash was generated from a business’s everyday operating activities and processes in a specific time period.

The compound annual growth rate, on the other hand, calculates how much cash has been generated from these activities and processes over a given length of time.

Additionally, the compound annual growth rate removes the volatility a stock might experience, while the simple growth rate does not.