What Is a Charitable Remainder Unitrust (CRUT)?

A charitable remainder unitrust (CRUT) is a type of trust that pays you or other beneficiaries an income for life or a specified term of years, after which the remainder of the trust's assets goes to charity.

This trust is often used for estate planning and asset management.

How Does a Charitable Remainder Unitrust Work?

A CRUT is typically structured, so the trustee makes periodic payments to the beneficiaries for a set period, after which the remainder of the trust's assets are distributed to charity.

The payments can be made either for the lifetime of the beneficiary (a life income unitrust, or LIFT) or for a specified term of years (a term of years unitrust, or TOY).

The payments can be made in fixed or variable amounts, depending on the trust's investment performance.

The payments can also be made in lump sum or installments.

Taxation of a Charitable Remainder Unitrust

A CRUT is a tax-exempt entity, so any income it generates is not subject to taxation.

However, the trust's beneficiaries are required to pay taxes on the payments they receive from the trust.

The amount of the taxable payment depends on whether the trust is a fixed unitrust or a variable unitrust.

A fixed unitrust pays a fixed percentage of the trust's assets each year, regardless of the trust's investment performance. The entire payment is taxable as income to the beneficiary.

A variable unitrust, on the other hand, pays a variable percentage of the trust's assets each year, depending on the trust's investment performance.

Only the portion of the payment representing the trust's investment income is taxable to the beneficiary. The remainder of the payment is not subject to taxation.

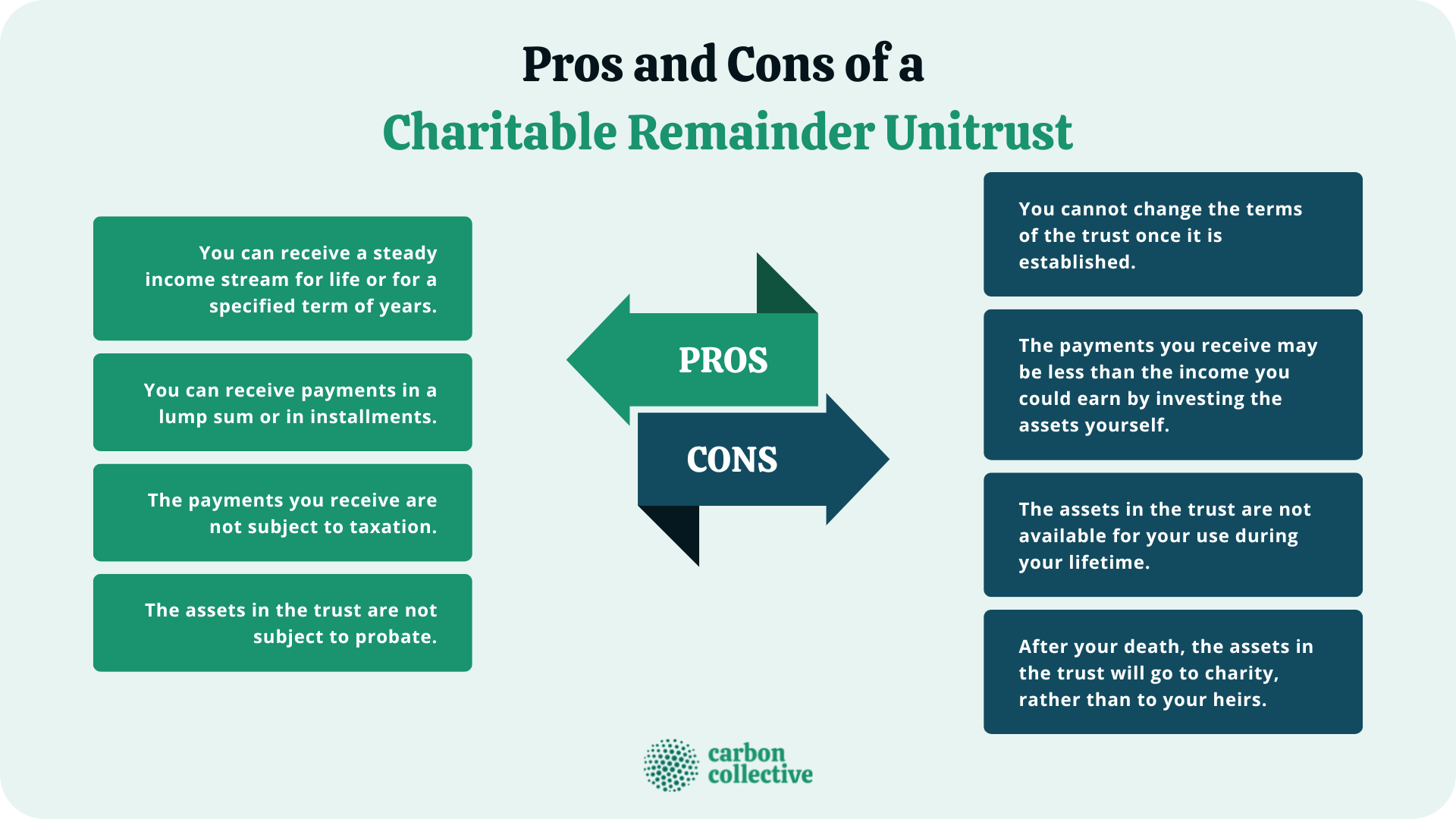

Pros and Cons of a Charitable Remainder Unitrust

There are several advantages and disadvantages to setting up a CRUT.

Advantages

Below are some advantages of a CRUT:

- You can receive a steady income stream for life or a specified term of years.

- You can receive payments in a lump sum or installments.

- The payments you receive are not subject to taxation.

- The assets in the trust are not subject to probate.

Disadvantages

Below are some disadvantages of a CRUT:

- You cannot change the terms of the trust once it is established.

- The payments you receive may be less than the income you could earn by investing the assets yourself.

- The assets in the trust are not available for your use during your lifetime.

- After your death, the assets in the trust will go to charity rather than to your heirs.

CRUT vs CRAT

A charitable remainder annuity trust (CRAT) is similar to a CRUT but with one key difference:

With a CRAT, the payments you receive are fixed rather than variable.

Your payments will stay the same based on the trust's investment performance.

Other than this key difference, a CRAT functions similarly to a CRUT.

Both types of trusts can provide a steady income stream for life or a specified term of years, after which the remainder of the trust's assets will go to charity.

Both types of trusts are tax-exempt entities, and the payments you receive from either type of trust are taxable as income.

The Bottom Line

A CRUT can be a useful tool for estate planning and asset management.

It can provide you with a steady income stream for life or a specified term of years, after which the remainder of the trust's assets will go to charity.

However, there are some drawbacks to setting up a CRUT, such as the fact that you cannot change the terms of the trust once it is established.

The payments you receive may be less than the income you could earn by investing the assets yourself.

Before establishing a CRUT, you should consult a financial advisor to discuss whether this type of trust is right for you.

FAQs

1. What is a charitable remainder unitrust (CRUT)?

A CRUT is a type of trust that pays income to the trust's beneficiaries for life or a specified term of years. After the death of the last beneficiary, the remainder of the trust's assets will go to charity.

2. How does a CRUT work?

A CRUT is a tax-exempt entity, so any income it generates is not subject to taxation. However, the trust's beneficiaries are required to pay taxes on the payments they receive from the trust.

3. What are the benefits of setting up a CRUT?

There are several benefits to setting up a CRUT, such as the fact that it can provide a steady income stream for life or a specified term of years. Additionally, the payments you receive from a CRUT are not subject to taxation.

4. What are the drawbacks of setting up a CRUT?

There are some drawbacks to setting up a CRUT, such as the fact that you cannot change the terms of the trust once it is established and that the payments you receive may be less than the income you could earn by investing the assets yourself.

5. What is the difference between a CRUT and a charitable remainder annuity trust (CRAT)?

The main difference between a CRUT and a CRAT is that the payments you receive are fixed rather than the variable with a CRAT. Your payments will remain stable based on the trust's investment performance.