If you are planning on pursuing a Certified Public Accountant license, commonly known as a CPA, you will need to pass the Uniformed CPA Exam. You can take the exam and become licensed in every state in the United States, as well as Washington D.C., Puerto Rico, the US Virgin Islands, Guam, and the Northern Mariana Islands.

Looking to pass your CPA exams? Take a look at our guide to the best CPA review courses →

As you begin preparing to sit for the CPA exam, you might be wondering what you will be tested on. Will there be essay questions or is it all multiple choice? How much time do I have to take the exam? What is the passing score? Below we walk you through what to expect when you sit for the CPA exam.

What are the sections of the CPA exam?

There are four sections to the CPA exam.

- Auditing and Attestation

- Business Environment and Concepts

- Financial Accounting and Reporting

- Regulation

You have a total of four hours to take each section. It’s a good idea to plan out when you will take each of the four sections. You have 18 months to pass all four sections and each exam score is good for 18 months.

If you don’t pass all four sections of the exam within the above time period, you will need to retake any section that is more than 18 months old.

What is a CPA exam testing window?

Tests are given in blocks of time throughout the year. These are known as testing windows. The American Institute of Public Accountants lists the following testing windows;

- Q1 – January 1 – March 10

- Q2 – April 1 – June 10

- Q3 – July 1 – September 10

- Q4 – October 1 – December 10

When you schedule each section, it’s helpful to do this as early in the testing window as possible. From time to time, a test may be canceled if there are dangerous weather conditions.

If your test was scheduled early enough, you may be able to reschedule to take it again in the same window in the event that it is canceled. If not, you will need to reschedule in the next testing window.

CPA exam sections in detail

Each section of the exam:

- Auditing and Attestation

- Business Environment and Concepts

- Financial Accounting and Reporting

- Regulation

Auditing and Attestation (AUD)

In this section, you’ll be tested on auditing and assurance topics. These include generally accepted auditing standards, auditing concepts and procedures, and standards that apply to attestation engagements, such as reviews and compilations.

In addition to the above, the AUD section will cover other topics such as ethics, professional responsibilities, and the AICPA code of conduct.

Business Environment and Concepts (BEC)

This section covers topics such as corporate governance, financial and operations management, information technology, and economic concepts and analysis.

Concepts addressed in this section include regulatory framework, globalization, capital structure, market risk, the role of technology in making business decisions, and internal controls.

Financial Accounting and Reporting (FAR)

In this section, you’ll be tested in areas such as financial statements, disclosures, and reporting differences between for-profit and non-profit entities.

This section addresses standards and regulations under the Financial Accounting Standards Board (FASB), International Accounting Standards Board (IASB), Government Accounting Standards Board (GASB), and the U.S. Securities and Exchange Commission (SEC).

Regulation (REG)

The REG section of the exam focuses on the legal and ethical responsibilities of a CPA, federal income taxation topics for individuals and corporations, and business law and corporate structure.

How is the CPA exam set up?

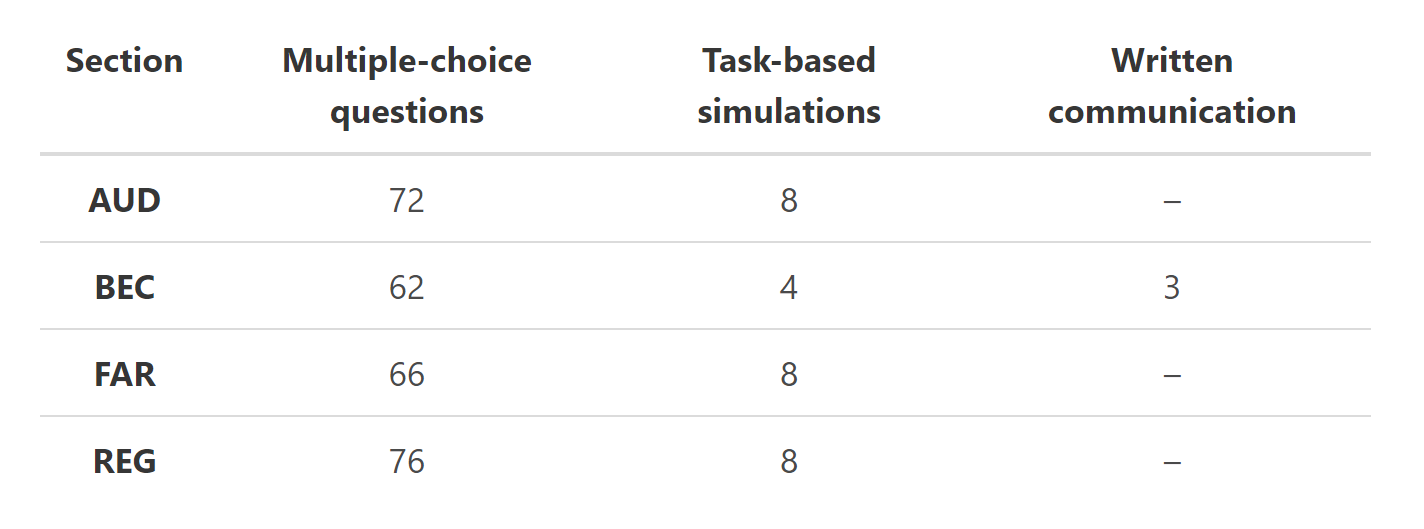

Each section of the CPA exam includes multiple-choice questions (MCQ), which have four answers to choose from, and task-based simulations (TBS). TBS tests your practical knowledge and may require you to complete a form or completing a research question.

The BEC section also has a written communication component. These are typically questions that require an essay response.

The breakdown of each section of the CPA exam is noted below;

What is a passing grade on the CPA exam?

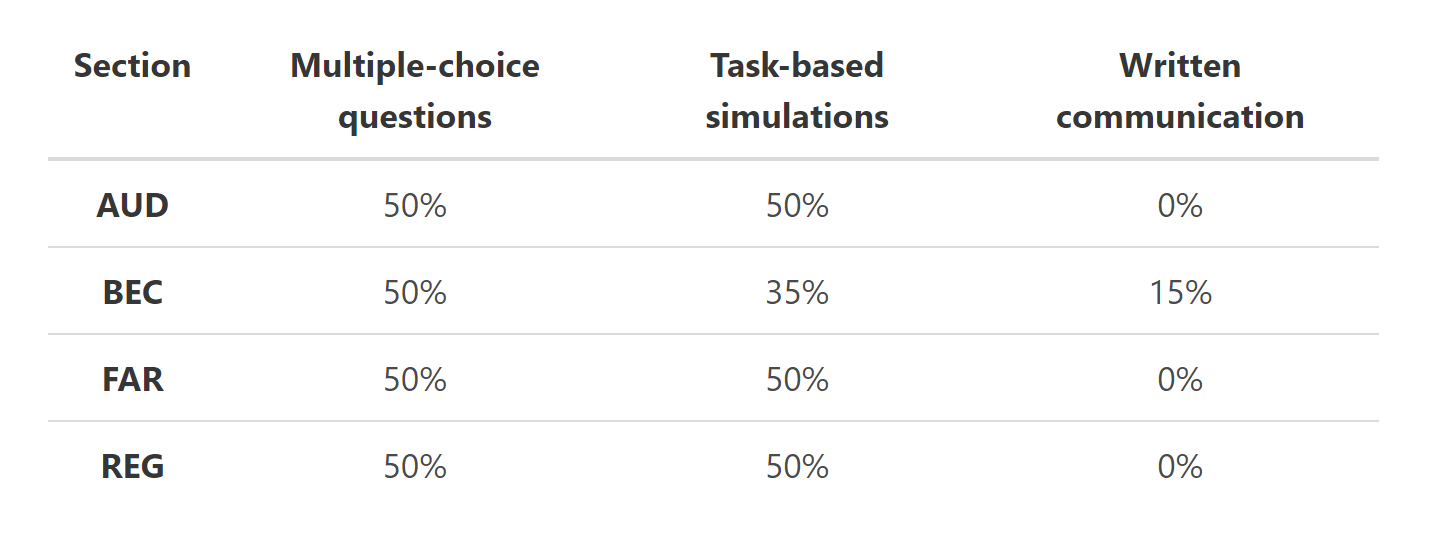

To pass a section, you must score a minimum of 75 or more. The exam is scored based on the parameters below;

You have 18 months to pass all 4 sections of the CPA exam. The 18-month period starts when you take your first section.

It’s a good idea to plan the timeline for taking all 4 sections of the exam so that you can complete this within the required period. You will need to retake any section that exceeds the 18-month period.

What if I don’t pass a section of the CPA exam?

If you don’t pass a section of the CPA exam, don’t lose heart. You can retake that section in the next testing window. You can schedule to retake the section as follows;

- Reapply to take the section with your state’s Board of Accountancy or through the National Association of State Boards of Accountancy (NASBA). Check the NASBA website for guidance on how and where to reapply to take a section of the exam.

- Wait for a new Notice to Schedule (NTS) that applies to this section

- Schedule retaking this section by visiting the Prometric testing website. You will need your new NTS to schedule the exam.

Since this is your second time sitting for this section, try to focus on the areas that you felt you were weakest on when taking the exam. This may help you to get a passing score the next time.

Which CPA exam section should I take first?

Deciding which exam section to take first is a personal choice.

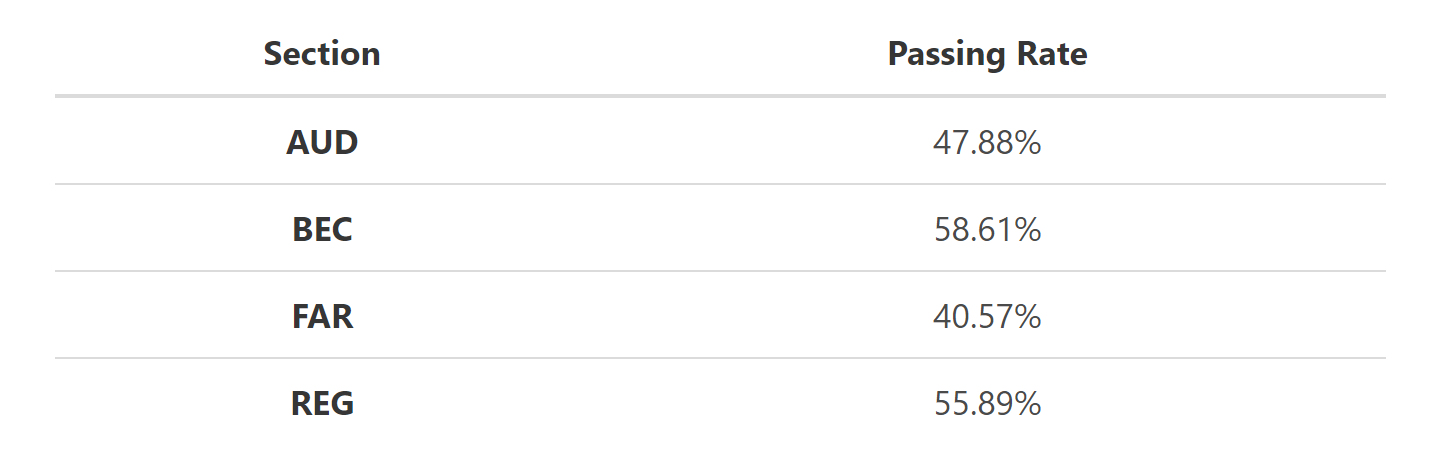

According to the AICPA, the passing rates for the 4th testing window of 2019 were;

Many candidates find that the volume and depth of the concepts tested in the Financial Accounting and Reporting (FAR) section to be the most challenging.

Since this is the first section and you may have more time to prepare for this section, many tackle this exam first. Plus, the 18-month timeframe doesn’t kick in until you pass the first section.

Ultimately, the section that you choose to start with comes down to your comfort level with the topics and personal preference.

FAQs

1. What is the CPA exam?

The CPA Exam is a four-part exam that tests a candidate’s knowledge and skills in auditing and attestation, business environment and concepts, financial accounting and reporting, and regulation.

2. What are the CPA exam testing windows?

The CPA Exam is offered during 4 testing windows per year. The first window is in January, the second is in April, the third is in July, and the fourth is in October.

3. How long do I have to complete all four sections of the CPA exam?

You have a total of four hours to complete each section of the CPA exam and 18 months to complete all four sections.

4. How is the CPA exam set up?

The CPA exam is set up so that each section contains multiple-choice questions, task-based simulations, and written communication tasks. The percentages of each question type vary by section.

5. What is a passing grade on the CPA exam?

To pass a section, you must score a minimum of 75 or more.