What Is a Custodial Account?

A custodial account is an investment account opened and maintained by the parent or guardian of a minor child. The assets belong to the child and can be used when they reach adulthood for education, medical expenses, or any other purpose.

This account allows parents to save for their children's future while enjoying tax benefits.

Once the child reaches the age of majority, which is 18 or 21, depending on the state, they take control of the account and can use the assets however they choose.

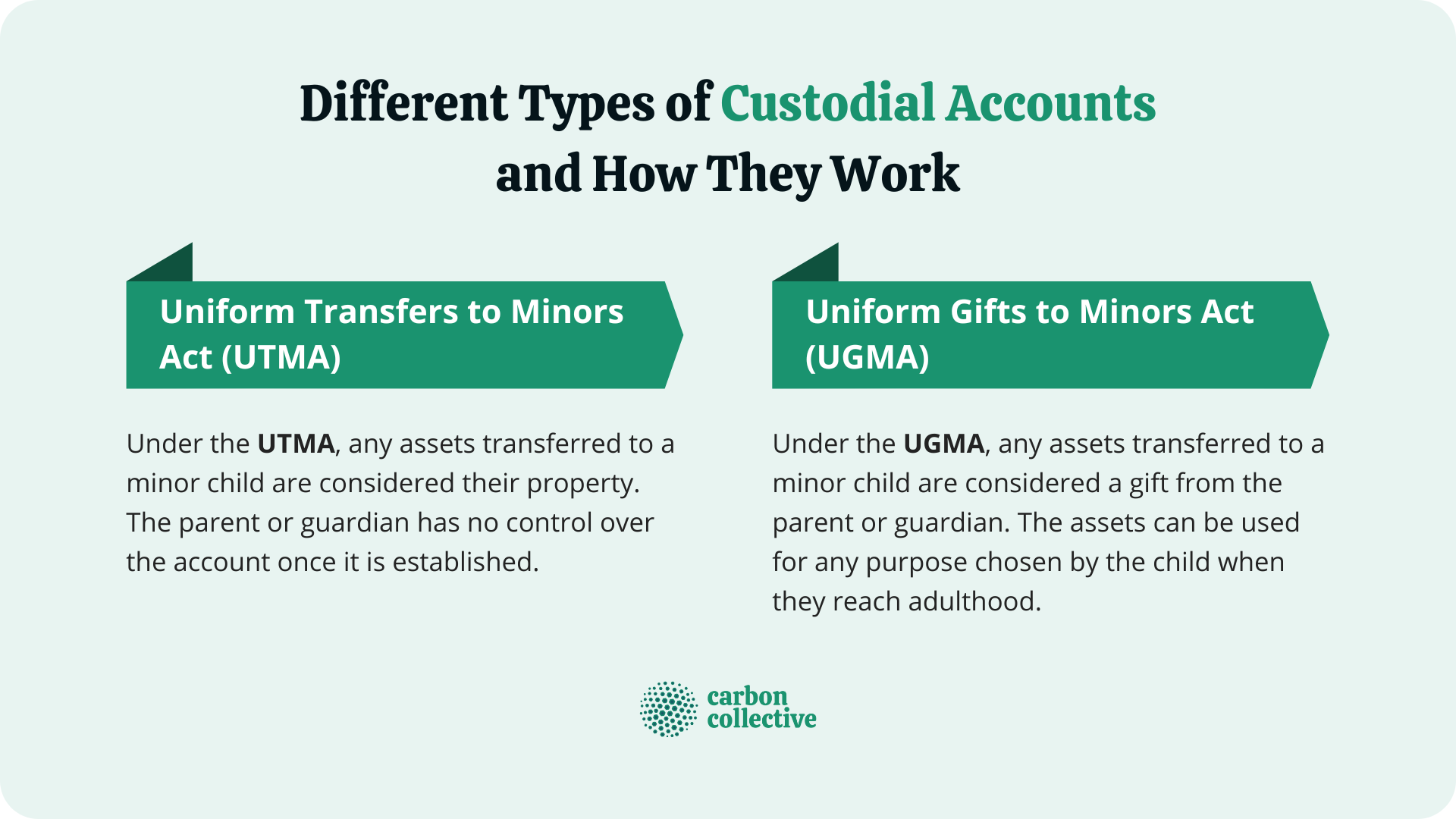

Different Types of Custodial Accounts and How They Work

How a custodial account works depend on the type, of which there are two: Uniform Transfers to Minors Act (UTMA) and the Uniform Gifts to Minors Act (UGMA).

Both account types allow parents to transfer assets to a minor child without going through probate court. And both have their own rules and regulations.

The main difference between the two is that UGMA assets are considered taxable income for the child, while UTMA assets are not.

Uniform Transfers to Minors Act (UTMA)

Under the UTMA, any assets transferred to a minor child are considered their property. The parent or guardian has no control over the account once it is established.

The child can use the assets in the account for any purpose they choose when they reach adulthood. And there is no limit to how much can be transferred into the account.

The assets in a UTMA account are taxed as the child's income, which may or may not be advantageous depending on the child's tax bracket.

Uniform Gifts to Minors Act (UGMA)

Under the UGMA, any assets transferred to a minor child are considered a gift from the parent or guardian. The assets can be used for any purpose chosen by the child when they reach adulthood.

There is no limit to how much can be transferred into a UGMA account, and the assets are not taxed as income for the child.

However, once the child reaches adulthood, they are responsible for any taxes due on the account.

Advantages of Custodial Accounts

There are several advantages of custodial accounts:

- The assets belong to the child, so they can be used for any purpose when they reach adulthood

- It is not tax-deferred, which means the child pays taxes on the assets as income. However, this may be advantageous depending on the child's tax bracket

- The account can be used to save for the child's education, medical expenses, or any other purpose

- Unearned income can be gifted to a minor without gift tax consequences

- The child can use the assets in the account for any purpose when they reach adulthood

- There is no limit to how much can be transferred into a custodial account

- Custodial accounts offer tax benefits

- The assets in a custodial account are protected from creditors

Disadvantages of Custodial Accounts

There are also some disadvantages to custodial accounts:

- The parent or guardian has no control over the assets once they are transferred to the child

- Once the child reaches adulthood, they are responsible for any taxes on the account

- The child can use the assets in the account for any purpose when they reach adulthood, which may not be what the parent or guardian had in mind

- May reduce the child's financial aid eligibility

- There is no limit to how much can be transferred into a custodial account, which, if not managed correctly, could result in a large tax bill for the child

- If the child is under 18, the account must be transferred to them when they turn 18

- The assets in a custodial account are considered taxable income for the child

How Can You Open a Custodial Account?

One good thing about custodial accounts is that they are easy to set up, whether you choose an UGMA or UTMA.

You can open a custodial account at most financial institutions, including banks, credit unions, brokerage firms, and even online. State requirements can vary based on the type of accounts or assets you choose.

The process is similar to opening any other investment account. The parent or guardian will need to fill out some paperwork and designate the child as the beneficiary.

To open an account, you will need the following:

Generally, there is no minimum deposit required to open a custodial account. Once the account is funded, you can start investing the money however you see fit.

Should You Get a Custodial Account?

Now that you know what a custodial account is and how it works, you may be wondering if you should get one.

There are pros and cons to custodial accounts, so it is crucial to consider all the factors before making a decision.

If you decide that a custodial account is suitable for your child, research your options and find an institution that offers good rates and investment options.

The Bottom Line

A custodial account is a great way for parents to save for their children's future.

It offers flexibility and tax benefits, but it is important to understand the drawbacks before opening an account.

Since there are many different custodial accounts, be sure to talk to a financial advisor to see if a custodial account is suitable for you and your family.

Remember, there is no limit to how much can be transferred into a custodial account, so be sure to start saving early. It is also a great way to teach your child about saving and investing for their future.

FAQs

1. What happens if the parents die before the child becomes an adult?

The assets in the account will pass to the child. If the child is not yet 18, the account will transfer to them when they turn 18.

2. What happens if the child dies before the parents?

The assets in the account will pass to the beneficiary named by the parent or guardian. If there is no beneficiary designated, the assets will go to probate.

3. How is a custodial account taxed?

The assets in a custodial account are considered taxable income for the child. This means that the child will owe taxes on any gains made in the account. Children can file as part of their parent's tax returns. In 2022, earnings in the account are untaxed up to $1150 ($1,250 in 2023). Meanwhile, the next $1150 ($1,250 in 2023) is taxed at the child’s rate and anything above this combined amount of $2,300 ( $2,500 in 2023) is taxed at the parent’s rate.

4. Can I take money out of a custodial account?

You can technically withdraw money from a custodial account before your child reaches the age of majority, but only if it is for their direct benefit. That means you have to use this cash on your child's clothes or things like school supplies.

5. Can both parents be on a custodial account?

Yes, both parents can be on a custodial account. This is known as a joint custodial account. The parents will need to decide who will act as the custodian and make investment decisions for the account. If one of the parents dies, the other parent will automatically become the custodian.