Earnings before interest, taxes and amortization (EBITA) is an efficiency measurement of company profitability commonly used by investors. EBITA measures the profitability of a business before it has deducted interest, taxes, and amortization expenses from its profits.

This is a very helpful financial ratio because an investor can get a more accurate view of the performance of a company by excluding financial costs.

Accountants, creditors, investors and business analysts can use EBITA to calculate a company’s operational profitability and compare it with similar companies in the industry.

EBITA is a derivative of EBIT (excludes amortization) and EBITDA (includes depreciation and amortization) and you can use one, two, or all three of these ratios to better understand the earnings of a company.

EBITA Formula

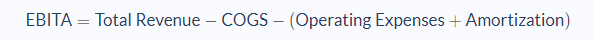

When you need to determine a company’s EBITA value, you can use two methods to do it. The first method is referred to as the direct method of calculation as it adds the operating expenses of a company to its amortization rate, subtracting the result from the cost of goods sold (COGS) by a company as well as its total revenue.

However, sometimes the financial statements of a company may not break down either the cost of goods sold, operating expenses, or amortization expenses. If that is the case, you can use the indirect method to calculate the EBITA of a company.

With the indirect method, you take the net income of the company and add back interest, taxes, and amortization.

This is a very simple and straightforward way to calculate EBITA because all the required numbers are listed on a company’s income statement.

The formula you use to calculate EBITA will depend on the financial records you have available. Some income statements have less detail and don’t break out the cost of goods sold or operating expenses so, for those companies, you would use the indirect method to add back the interest, taxes and amortization because they will all be included in the income statement.

EBITA Analysis

EBITA is an important measure used by investors because it is considered to be a more accurate way to represent the true earnings of a company.

When a company is able to remove the effect that comes with taxes, amortization, and interest, it can determine the true performance of its operations.

Lenders can also use the EBITA profitability measure to determine credit worthiness of companies because it accurately describes the company earnings which could be used to pay off any debts.

When calculating the EBITA, just as with any other financial ratio, you can get a positive or a negative value. A negative value is obviously not favorable as it indicates that a company could be having troubles operating at a profit or managing its cash flows.

A positive EBITA is an indication of efficiency in the company's operations because it clearly shows how much cash flow the company has to pay dividends, reinvest in growth, or pay any outstanding debts.

One of the main limitations of EBITA (and both EBITA and EBITDA) is that it doesn’t take into account changes in working capital, which is the money used to run daily operations. This plays a big part in maintaining a well-running business and this expense is not included in EBITA calculations.

EBITA Example

For over 10 years, Brandon’s Bread Company has been in the confectionery business, and they have been performing well. In 2018, their total revenues were $1,700,000 with net profit of $800,000. Brandon wants to continue the growth and has a goal to double revenue over the next few years.

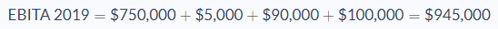

The company took out a loan to purchase new inventory and, as a result, they reported an increase in sales to $ 2,500,000 on their income statement for the year that ended in 2019. However, its net profit dropped to $750,000.

We can explain the company’s increase in sales from $ 1,700,000 to $ 2,500,000 and the decrease in net profit using EBITA as the company sales increased, however, when interest, taxes and amortization expensed were deducted from the sales, the company registered a net loss.

The company income statement for 2018 shows the following:

- Amortization expenses = $5,000

- Taxes= $40,000

- Interest = $0

The company income statement for 2019 shows the following:

- Amortization expenses = $5,000

- Taxes = $90,000

- Interest = $100,000

This calculation clearly shows that the company earnings before interest, taxes and amortization increased by $100,000, even though the net income was $50,000 less in 2019.

EBITA Conclusion

EBITA is considered an important measure of the true profitability of a company. The below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- EBIT is a measure of the profitability of a business before it has deducted interest, taxes, and amortization expenses from its profits

- You can calculate EBIT using a direct method or indirect method, depending on the financial numbers available

- The direct method adds the operating expenses of a company to its amortization rate, subtracting the result from the cost of goods sold (COGS) and its total revenue.

- The indirect method takes the company’s net income and adds back interest, taxes, and amortization expenses.

- Investors use EBITA as a profitability measure to determine whether to invest in the company

- A negative EBITA is not favorable because it indicates that a company could be having trouble operating at a profit or managing their cash flows

- A positive EBITA indicates that the business is efficient in its operations and has the cash flow for dividends, reinvestment, and debts

EBITA Calculator

You can use this calculator to calculate the EBITA for a company by entering total revenue, COGS, operating expenses and amortization expenses.

FAQs

1. What is Earnings Before Interest, Taxes and Amortization (EBITA)?

EBITA (earnings before interest, taxes, and amortization) is a calculation of a company's profits that removes the impact of interest, taxes, and amortization expenses. This makes it a good measure of the true profitability of a company.

2. Why is the Earnings Before Interest, Taxes and Amortization (EBITA) important?

EBITA is considered an important measure of the true profitability of a company as it removes the impact of certain expenses that can distort profits. It is particularly useful for investors who want to determine whether a company is making money or not.

3. How is the Earnings Before Interest, Taxes and Amortization (EBITA) calculated?

There are two ways to calculate EBITA - the direct method and the indirect method. The direct method adds the operating expenses of a company to its amortization rate, subtracting the result from the cost of goods sold (COGS) and its total revenue. The indirect method takes the company's net income and adds back interest, taxes, and amortization expenses.

4. Who uses Earnings Before Interest, Taxes and Amortization (EBITA)?

EBITA is used by investors as a measure of profitability, as well as companies to assess their performance and make comparisons with other businesses.

5. What is the difference between Earnings Before Interest, Taxes and Amortization (EBITA) and EBITDA?

EBITA and EBITDA (earnings before interest, taxes, depreciation and amortization) are similar calculations, but EBITDA includes depreciation and amortization expenses. This makes it a more comprehensive measure of a company's profits.