Expenditure refers to payments made or liabilities incurred in exchange for goods or services. The term expenditure usually refers to capital expenditure, which is usually a one-time cost and is incurred to receive a long-term benefit, such as the purchase of a fixed asset.

In accounting terms, expenditure increases the value of assets or reduces a liability.

Expenditure Types

In accounting terminology, there are three types of expenditure that a business can incur:

-

Capital Expenditure

-

Revenue Expenditure and

-

Deferred Revenue Expenditure

Capital Expenditure

A business is set to have incurred capital expenditure when the payment is made to acquire an asset, the benefit of which would be spread over several years. Businesses invest in capital expenditure (CapEx) to acquire new assets or to improve the performance of existing assets and is usually a one-time expenditure. The hope is that investing in new assets or new technologies would increase revenue and bring substantial benefits to the business in the long run.

Revenue Expenditure

Revenue expenditure refers to payments made or incurred during the normal course of the business, the benefits of which are usually received within the same accounting year. Revenue expenditures are mostly recurring expenses that are incurred by the business to generate revenues for the accounting period. A company can incur revenue expenditure in one of the following two ways:

-

Cost of sales or Direct expenses – All expenses incurred by the business directly related to the manufacture and sale of its goods or services. E.g., Raw material costs, direct labor costs, etc.,

-

Operating expense or Indirect expenses – All expenses incurred by the business to ensure the smooth running of its operations. E.g., Advertising expenses, office rent, utility bills, etc.,

-

Deferred Revenue Expenditure

Deferred revenue expenditure is less common compared to the first two but also contributes to the increase in the value of assets on the balance sheet. Simply put, deferred revenue expenditure refers to an advance payment for goods or services, the benefit of which is to be received only in the future, either during the current accounting period or over the subsequent accounting periods.

It is very similar to a prepaid expense except that, while benefits from prepaid expenses are incurred in the same accounting period, benefits from deferred revenue expenses might be spread over several accounting periods. Until the benefit is received, the expense is treated as an asset on the balance sheet. As and when the benefit is received by the company, the asset value gets reduced by the amount of benefit received and that amount is charged off in the income statement of that accounting period.

Expenditure Example

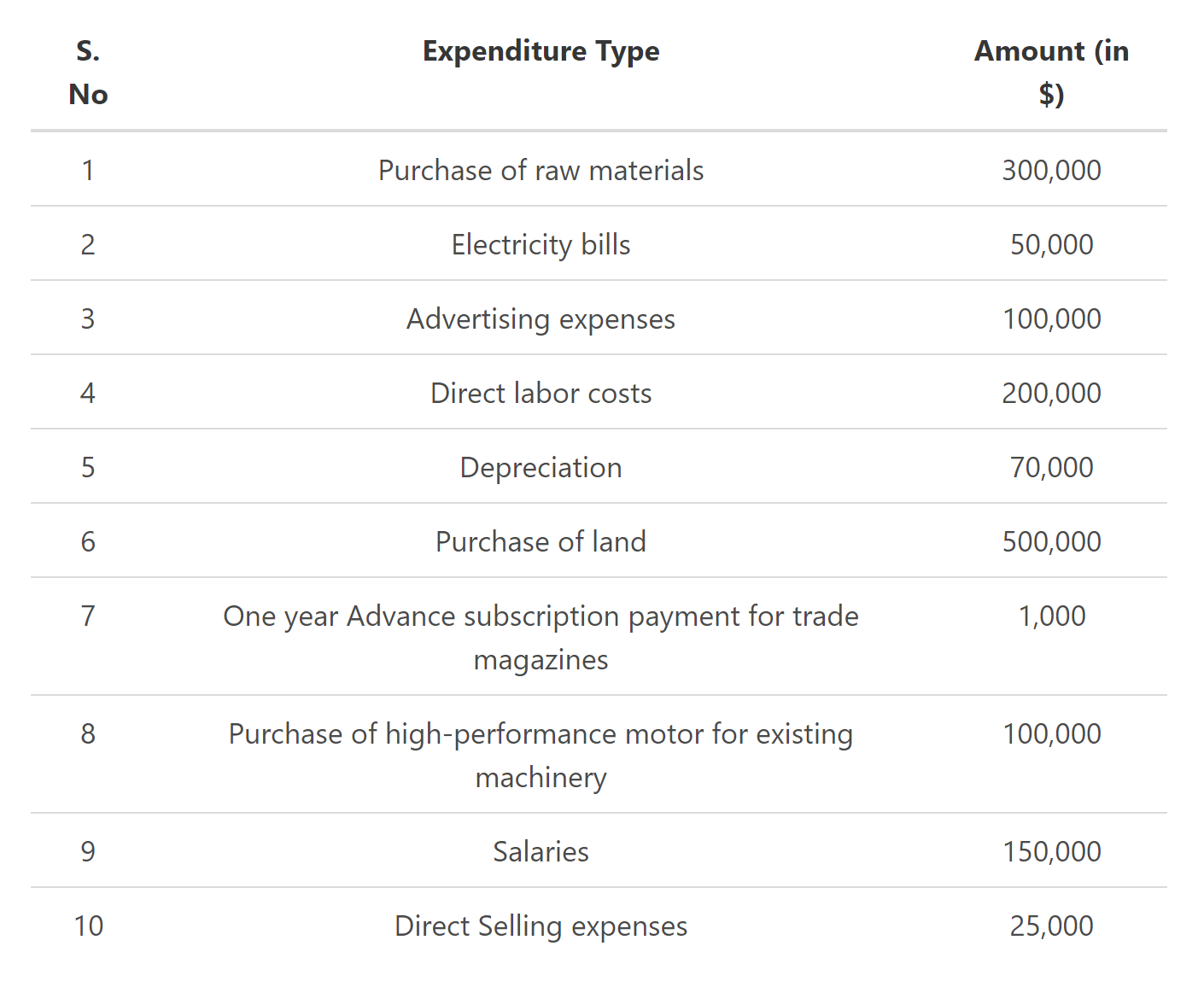

Company S has a list of expenditures that need to be classified into their appropriate category. As the bookkeeper of the company, can you classify them into either capital, revenue, or deferred revenue expenditure?

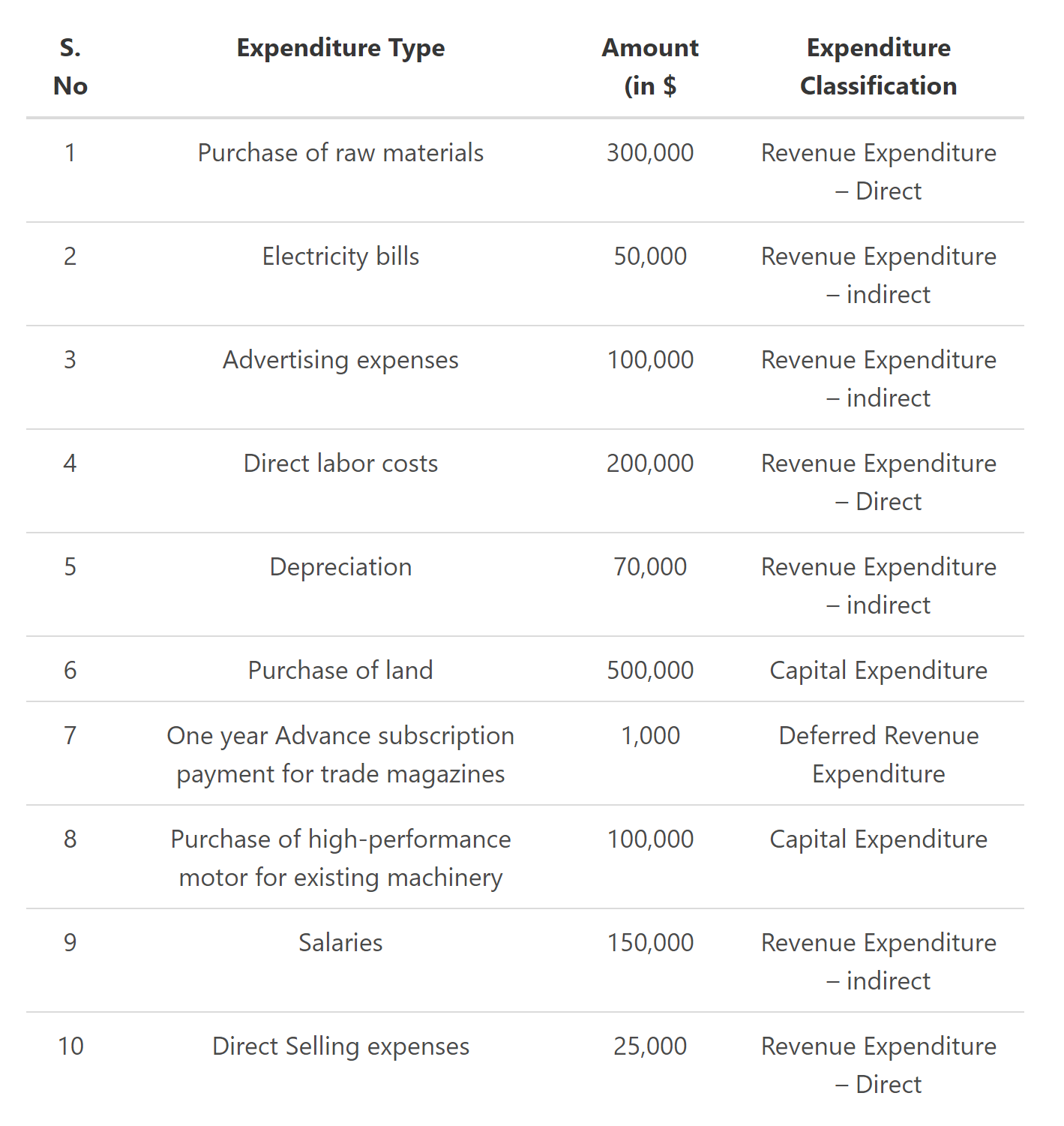

We know that capital expenditure is a one-time cost, the benefit of which is expected to be spread over multiple years. The only two expenses that satisfy these criteria are the purchase of land and the purchase of high-performance motor for existing machinery.

The latter also falls in this category since it enhances the value of an existing asset. By purchasing a high-performance motor, the business is hoping to increase both the life and performance of the existing machinery.

As per the definition, revenue expenditures are usually recurring expenses, the benefits of which are received during the accounting year.

The expenses that qualify as direct expenses include the purchase of raw materials, direct labor costs, direct selling expenses and

The expenses that qualify as indirect expenses include electricity bills, advertising expenses, depreciation, and salaries

We know that deferred revenue expenditure refers to an advance payment for goods or services, the benefit of which is to be received only in the future. Since the subscription for trade magazines is being paid one year in advance, it will be classified as deferred revenue expenditure.

Therefore, we can rewrite the entire table as follows:

Expenditure Analysis

If you follow the accrual basis of accounting, you will have to remember that this method calls for recording an expenditure on an accrual basis and not a cash basis. This means that you will have to record the expenditure as soon as it is incurred, irrespective of whether the payment for it has been made or not. For instance, in our above example, even if you have not paid for the land purchase during the current accounting year, if the name and possession of the land have been passed to the business in the current accounting year, then the capital expenditure needs to be recorded in the current accounting year only and not the year in which the actual payment is made.

Expenditure Conclusion

To sum up:

-

Expenditure refers to payments made or liabilities incurred in exchange for goods or services.

-

Expenditure increases the value of assets or reduces a liability

-

The three types of expenditure that a business can incur include capital expenditure, revenue expenditure, and deferred revenue expenditure

-

Capital expenditure is a one-time cost, the benefit of which is expected to be spread over multiple years.

-

Revenue expenditures are usually recurring expenses, the benefits of which are received during the accounting year. They can be either direct or indirect expenses.

-

Deferred revenue expenditure refers to an advance payment for goods or services, the benefit of which is to be received only in the future

FAQs

1. What is expenditure?

The term expenditure refers to the charge that a business incurs when it pays for goods or services in exchange for the value received.

2. What are the major types of expenditure?

There are three main types of expenditures: revenue, capital & deferred revenue.

Revenue expenditures are usually recurring expenses received during the accounting year, while capital expenditures are one-time costs that the business expects to spread over multiple years. Deferred revenue expenditure refers to an advance payment for goods or services, the benefit of which is to be received only in the future.

3. How do you record expenditure in the books?

You will have to record an expenditure on an accrual basis only, which means that you will have to record the expenditure as soon as it is incurred, irrespective of whether the payment for it has been made or not.

4. What are examples of expenses?

Following are the examples of expenses: paycheck to employees, taxes payable, office rent, interest on loans or bonds, supplies used up in production, etc.

5. Is expenditure the same as an expense?

The two terms are similar, but not identical.

The term "expenditure" refers to the payouts that a company incurs when it buys or receives an economic benefit. On the other hand, "expense" is one of three components of the accounting equation (the other two being assets and liabilities), which represents the cost of goods sold, services rendered, or any other item that decreases an asset or increases a liability.