What is a Financial Coach?

A financial coach works with you to figure out how much money you make and your expenses. They work with you, not for you, to help increase the amount of money coming into your life.

Some coaches may recommend investments or other ways to put more money towards savings or retirement accounts.

A financial coach can help give you a clear idea of how much money is enough for your lifestyle. They also explain the difference between good debt and bad debt and why it is crucial to have an emergency fund available in case anything happens.

In 2017, the Consumer Financial Protection Bureau (CFPB) published a list of skills and knowledge for a Financial Coach. The top three were:

- Coaching and motivational skills.

- Financial content knowledge "with breadth and depth… to address varying consumer needs."

- Cultural responsiveness and systemic understanding.

What Does a Financial Coach Do?

A financial coach can help you in many different ways, depending on your goals. They will ask you questions about your current financial situation, then develop a plan to improve it based on what you want to achieve.

Some coaches work in investments and retirement savings, while others focus on budgeting or debt reduction.

The list of tasks your coach may perform to help you achieve your financial goals is as follows:

- Help identify the differences between good and bad debt.

- Assess where you are financially now and what you want to accomplish in the future.

- Work with you on a plan or goals for reaching those goals.

- Ensure necessary documents are signed and filed with a reputable organization, such as a credit agency or a broker.

- Assist you in understanding the available choices and how those choices affect your overall financial health.

These are just a few of the possible tasks your financial coach could do for you. It all depends on your situation and personal goals.

When Should You Work With a Financial Coach?

You may benefit from the services of a coach if you are currently experiencing any of the following situations.

Possibility 1: You are overwhelmed with your financial situation and do not know where to start.

People usually begin working with a financial coach because they are fed up or overwhelmed with their finances, but do not know how to proceed.

Possibility 2: You cannot quickly answer questions like, "How much do I owe?" or "How much money do I have in savings?"

If you need help and do not know where to start with your finances, a financial coach might be able to give you the tools and knowledge you need to gain control over your money.

Possibility 3: You consistently spend more than you make.

A coach can help you analyze your spending habits and see where you need to make changes. They will also encourage you along the way, helping to keep you on track.

Possibility 4: You are not quite where you want to be financially (financially independent or retired), and you need help getting there.

A financial coach works with people in many different scenarios, even if they are not experiencing any problems. For example, a coach may work with someone who wants to learn more about personal finance to start managing their own money effectively in the future.

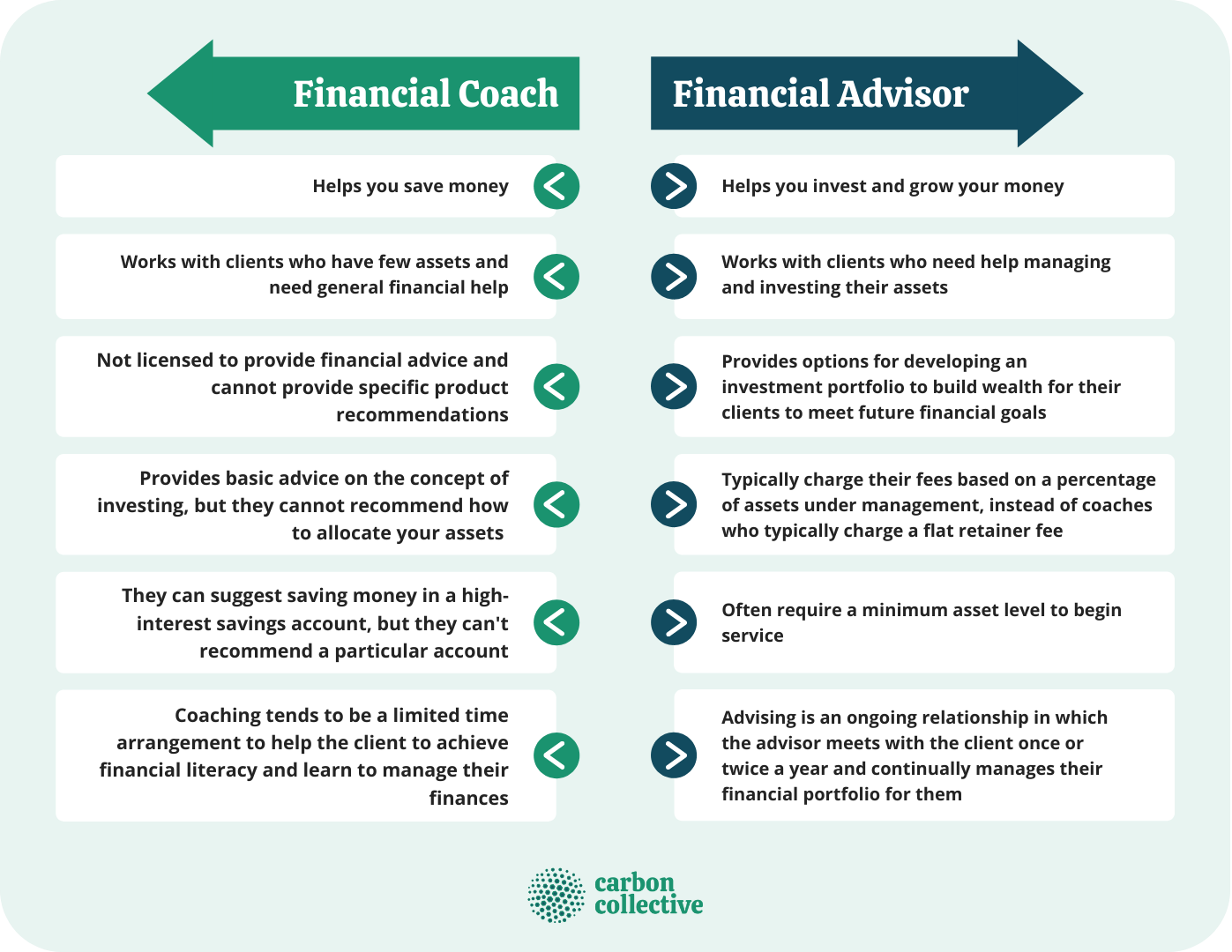

Financial Coach vs. Financial Advisor

Many people think a financial coach and a financial advisor do the same thing, but there are some important differences. Below are a few things to consider when deciding between a financial coach and a financial advisor if you are not quite certain who to turn to for help with your finances.

Financial Coach:

- Helps you save money

- Works with clients who have few assets and need general financial help

- Not licensed to provide financial advice and cannot provide specific product recommendations

- Provides basic advice on the concept of investing, but they cannot recommend how to allocate your assets

- Can suggest saving money in a high-interest savings account, but they cannot recommend a particular account

- Typically charges a flat retainer fee

- Coaching tends to be a limited-time arrangement to help the client achieve financial literacy and learn to manage their finances

Financial Advisor:

- Helps you invest and grow your money

- Works with clients who need help managing and investing their assets

- Provides options for developing an investment portfolio to build wealth for their clients to meet future financial goals

- Typically charges fees based on a percentage of assets under management

- Often requires a minimum asset level to begin service

Advising is an ongoing relationship in which the advisor meets with the client once or twice a year and continually manages their financial portfolio for them

How to Become a Financial Coach

There is no certification or license to become a financial coach, and many venues exist. You can choose to study independently and learn financial concepts and strategies. If you want to be a successful financial coach, certain steps will increase your chances of success.

- Educate Yourself: Many experts recommend at least looking into getting your Financial Industry Regulatory Authority (FINRA) licenses or completing some formal education program. Formal education will help you acquire the knowledge to become a financial coach.

- Find a niche: Find your niche or focus area. For example, if you work at a financial institution, you may focus on coaching clients new to working with the financial industry. Or, perhaps you can help those looking for insights into how they can better manage their money.

- Look for Partnership Opportunities: Consider partnering with other financial industry professionals who have clients that you can help. You can reach out to financial advisors and planners and explain what you do and how you can be of service.

- Be honest in your marketing: If you are marketing yourself as a financial coach, be sure to have information about how you can assist people who require your services.

The Bottom Line

There are many different factors to consider when deciding whether a coach is right for you.

If you need help getting started with your finances or learning the basics of personal finance management, then a financial coach might be able to help you in these areas without providing specific product recommendations.

If you are looking to become a financial coach yourself, know that creating a successful coaching practice takes time and effort. It can be hard to convince people that they need help managing their money or someone else's, especially if you are new to the industry. So be sure to take your time building up your client base to be profitable.

FAQs

1. What is the average cost of working with a financial coach?

The coaching process varies greatly depending on your needs. Some coaches charge by the hour, and others charge a flat rate for their services. When it comes to finding an experienced financial coach, you should always ask about their rates before starting any work with them so that there are no surprises later on.

2. What does a financial coach do?

A coach is a professional who helps people gain control over their finances by setting goals and helping the client to achieve them. A good financial coach will work with you to tackle debt, create a budget and find ways to save money. The process of working with a financial coach can vary greatly depending on the client's situation and where they need help. Some coaches will follow a set plan or formula customized for each individual, while others prefer one-on-one interaction.

3. Who should use a financial coach?

Anyone struggling with their money, in debt, or simply looking to gain more control over their finances can benefit from working with a coach. Financial coaches are beneficial for those who want things done quickly and do not have the time or patience to learn everything about finance on their own.

4. What are the benefits of using a financial coach?

The coach will teach you how to take control of your money and help you avoid costly mistakes that can set back progress. A good financial coach should motivate the client, create a plan for them and answer any questions they may have along the way, so there is less confusion when it comes time to implement new changes.

5. How do I find the right financial coach for me?

There are a few things to look out for when finding the right coach. First of all, you will want someone experienced and knowledgeable about finances so that they can answer any questions you may have along the way. You should also make sure that your potential coaches provide free consultations before starting any work with them so that there is no confusion about what you will be paying for and what you are getting out of it. When choosing a financial coach, you should also consider how flexible or "hands-on" their services are and if any certification has been earned by the person who will help you. Ensure your coach is trustworthy and reliable before taking them up on any offers.