Introduction

We've spent the last four Chapters of the Ultimate Guide to Sustainable Investing talking about investment's role in solving climate change, how your retirement account is valuable, why it may be a smart investing strategy, and even reviewed several portfolios available online. This is valuable, and we also want to set aside time to look at the personal finances that underpin your investment strategy.

There are plenty of things that we all wish were taught in school. How to manage our personal finances and investing typically make the top of that long list, and for good reason. Our ability to maintain good credit, build wealth, contribute to causes we care about, and have a safe and comfortable retirement all tie back to financial literacy.

According to the TIAA Institute-GFLEC Personal Finance Index, 31% of US adults are unable to address retirement savings and other key areas of their finances due to their debt payments. And 40% don’t have emergency savings that could cover one month of living expenses if needed. It is no secret that financial health is an area of concern for most people.

In this chapter, we’re going to cover:

- Financial freedom and why you should invest your money in the first place

- What to have in place before you start investing

- How to set personal finance and investing goals

- Basic principles for being a successful steward of your investments

- Retirement vs. non-retirement accounts and how to choose the right account

- How to select a portfolio and understand risk

Before we can dive into how to tackle your finances and investment plan, it’s crucial to discuss why you should invest your money.

Why Invest? Money As a Tool for Creating Your Dream Life

Most people understand the basics behind the importance of investing: so you can grow your money and have the ability to take care of yourself in retirement. But I’d like to challenge you to think beyond the traditional idea of working for 45+ years to retire in your 60s or 70s. Not only because you might discover an option for your life that you didn’t think was possible, but also because it will make investing and the concepts we will review in this chapter much more exciting!

Of course, the ability to save for a comfortable, secure retirement in your 60s and beyond is vital. But something else happens when we prioritize our financial health and intentionally save and invest — we create more freedom and flexibility in our lives.

Money is a tool you can use to build the life you desire. I’m so passionate about this concept that I titled my TEDx Talk "Money As a Tool For Creating the Life of Your Dreams."

This can be a tricky concept to embrace at first because most of us are accustomed to money being a limiting factor in our lives. Growing up, many of us overheard stressful conversations between parents and other adults about not having enough. Not to mention being in debt is often considered the norm rather than the exception.

Whether you experience money stress or not, the best way forward to accomplish your goals and gain confidence is to have a plan to get you on the path to financial freedom.

The Path to Financial Freedom

A common recommendation you’ll find across personal finance consultants and resources is to set aside a sum of money in a savings account that you can use to cover costs in case of unexpected events or situations. The idea of setting aside money in case of emergencies is logical. As you can imagine, this one action also relieves a significant amount of financial stress.

Take this a step further and imagine if you had six to 12 months of living expenses in a separate savings account. And let’s say you’ve been investing a percentage of every paycheck and built up a solid nest egg in your investment account. In this case, you might feel more confident in making a career change to a field you love. Or quitting a job that no longer serves you to test a business idea or freelance. Or perhaps you plan on taking a three- or six-month break from work to travel. Or transitioning from full- to part-time work for two years to spend as much time as possible caring for your new baby. The scenarios are limitless.

These examples illustrate how educating yourself about investing, taking action, and being intentional with your finances can create more freedom and flexibility in your life.

Defining Financial Freedom

Most people agree that financial freedom means having the financial resources to not only afford your living expenses but also to live a comfortable, enjoyable life. Financial resources can be defined as assets like real estate that create cash flow, investments where you live off of the interest from your investments, or a mix of the two.

I define financial freedom as the ability to do what I love every day without the constraints of a full-time job. Your definition of financial freedom might differ from mine. And as we enter different stages of our lives, our idea of financial freedom will change and adapt.

Investing 101: Overview of What Investing Is and How It Works

What exactly does it mean to invest? By investing, we mean using your money to purchase investments. Investments include stocks, bonds, or any alternative investments such as real estate, precious metals, cryptocurrencies, commodities, and so on.

Stocks, also called equities, are the most well-known type of investment. When you own stock in a publicly-traded company, you own a very small piece of that company. This piece is called a share.

Companies issue shares to raise money that can then be invested back into the business. They might also use the influx of capital to pay off debt or expand into new markets or products.

Investors purchase stocks and other investments because they believe they will increase in value. Some companies also distribute earnings, or dividends, to their shareholders. By owning shares, investors can also vote on company decisions, from climate change and sustainability action to how much the C-suite earns. This is important because investor votes can influence a company’s direction.

The price of a stock is determined by its supply and demand. When more people want to sell a stock (supply) than buy it (demand), you can expect the price of a stock to decrease. In this simple example, the price of a stock would increase if more people wanted to purchase the stock than sell it.

If you’re interested in learning more about supply and demand and how the economy works, watch the 30-minute video by Ray Dalio on How The Economic Machine Works.

Why Saving Isn’t Enough

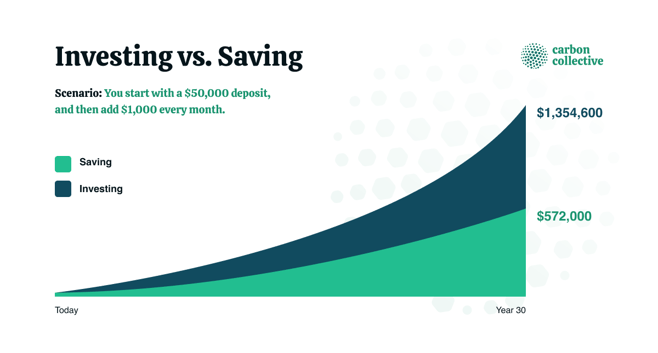

Saving your money, especially for specific short-term savings goals, is important, but it’s not enough when it comes to reaching financial freedom and retirement. The average annual interest rate for savings accounts is 0.06%. Compare this to the average annual stock market return of 10% over the last 30 years if we use the Standard and Poor's 500 index (S&P 500) as the benchmark.

Then, let’s add in inflation. Inflation causes your money to lose approximately 2-3% every year. No savings account interest rate will keep up with inflation. Even the very highest interest savings accounts will get you just 2%. This is why it’s so critical to invest instead of leaving your money in cash or a savings account.

Do I Need to Have a Lot of Money to Start Investing?

While it’s true that you need some amount of money in order to invest, you don’t need much at all to get started. Even if you have $50 to open and invest into an account, starting small is much better than waiting or never starting.

Tip: Choose a percentage of your income that you feel comfortable investing every paycheck or every month. Even if you start at 1%, it’s better to start small than not at all. As your income increases, you can increase the percentage of your income that you contribute to investments.

Before You Invest: Quick Financial Health Checklist

There are no hard rules on when to get started with investing, other than the fact that the sooner you can start, the more time your money will have to grow! I will share some recommended action items to get your finances in order as you start investing. By ensuring your financial health is in check, you can capitalize on all the benefits of putting your dollars to work.

1. Build an Emergency Fund

An emergency fund is money you set aside for "just in case" scenarios. For example, you might use your emergency fund to pay off a big bill from the mechanic after the car you use to get to and from work breaks down. Or in the worst-case scenario where you lose your job and need to live off of your savings while looking for a new job.

An emergency fund is designed to take a situation that would otherwise induce financial stress and possibly put you into debt and make the situation manageable. Ideally, you would keep your emergency fund in a separate savings account that you can easily pull from if needed.

This is a great use case for a high-yield savings account because you will consistently be keeping a good chunk of change in the account. A high-yield savings account can offer you more than the measly 0.06% national savings account average rate.

One way to determine how much to keep in your emergency fund account is to ask yourself how many months of living expenses you would like to have set aside in savings if you were to lose your income.

Take into account how long it might take you to replace that income (i.e., find a new job or replace a big contract) and how much you spend on average on basic living expenses each month. You might determine that $2,000 feels right, or maybe keeping six or 12 months of living expenses set aside is best — it’s what you feel comfortable and secure with.

2. Pay Off High-Interest Debt

It doesn’t make much sense to earn 7% annually in an investment account when your credit card debt drags you down with 18%+ interest rates. High-interest debt is typically considered any debt with an interest rate higher than 6%. Most mortgage rates and student loan rates are lower than this, though there are exceptions.

Credit card debt, sometimes called consumer debt, tends to carry the highest interest rates. The interest rate is written as an annual rate, or APR (annual percentage rate). If you carry a balance on a credit card with a 22% APR, the interest charged over 12 months equals about 22% of the balance. For instance, if you were to carry a $10,000 balance ("carry" as in not making any payments and carrying that amount over into each billing period) for a year, at the end of the year you would owe approximately $2,200 just in interest.

The ideal credit card strategy is to always pay off your cards in full so that you never carry a balance. If you never carry a balance on your cards, you won’t have to worry about those crazy-high APRs! Also, creditors will deem you as more credit-worthy because you pay back the amount you owe on time every time. This is crucial when making larger purchases, such as getting a mortgage on a property, since your credit score is vital in determining the loan terms and interest rates for which you qualify.

Debt Payoff Plan

It makes mathematical sense to pay off your debt by starting with the debt with the highest interest rate. In the personal finance world, this is known as a debt avalanche payoff plan. In a debt avalanche, you pay the monthly minimum on each of your debts, and any money left over goes to the debt with the highest interest rate.

Tip: Input your debt numbers on a free tool like Undebt.It and crunch your payoff plan and timeline.

3. Review Your Monthly Expenses and Budget

To accelerate wealth building, it’s crucial to understand how much money you can allocate to investments every month (especially if your investments are going into climate solutions!).

The best way to do this is to calculate your average monthly expenses and income. Add up your total spend for the last three months and then divide that total by three to give you the average monthly spend. You can use a spreadsheet and break out your spending by category to get a closer look at where your money goes each month. Feel free to steal the simple budget template shared with this free training video.

It can help to reflect on your average monthly expenses, and you will often discover subscriptions or other expenses that you no longer use or enjoy and want to cut from your budget.

Once you have your average expenses and income, you can subtract expenses from your income to get the net income. Your net income is the money you have left over after expenses that you can allocate towards your saving and investment goals. In the next section, we’ll discuss how to set goals as an investor.

4. Invest Early and Often

Even if you continue to add to your emergency fund and pay off student loans, you still need to invest for your future. We will cover this in detail later, but for now, understand that the sooner you can put your money to work by investing, the sooner you can build wealth.

Important Note

Likely, you will simultaneously be tackling multiple items on this checklist. For example, you might be adding to your emergency fund while paying off a private student loan and investing in your company’s 401(k) to get the employer match.

How to Set Goals As An Investor

Setting personal finance goals will keep you motivated, encourage healthy money habits, and help you achieve the vision you have for your life. Most financial targets are categorizable as either short- or long-term. Let’s review the differences between short- and long-term financial goals so you can set your own.

Short-Term Goals

While there is no set timeline for what makes a goal short- or long-term, short-term goals are often savings goals that you’d like to achieve within the next few months or years.

Examples:

- Saving up an emergency fund

- Travel and upcoming trips

- Home repairs and improvements

- Wedding

- Saving to purchase a house

- Buying a car

- Setting aside savings for a maternity or paternity leave

Any time you set aside money to use in less than five years, a savings account is typically best. If you invest this money in the stock market, you could experience a drop in the market that decreases the value of your investment. This situation is more likely when you have a short time frame instead of decades. There are even banks now that use your savings accounts to lend to climate-positive companies like Atmos, Ando, and Climate First Bank.

Just because the general rule of thumb says to put the money in a savings account if you plan to use it in the next few years, it does not mean you have to follow that. You might not mind taking on more risk with your money and may feel comfortable investing savings you set aside to purchase property in five years into a conservative investment portfolio. Be aware of your risk tolerance, and know that yours may vary from your spouse, friends, and other investors.

Tip: Make sure that your savings account is FDIC-insured. The FDIC (Federal Deposit Insurance Corporation) serves banks to protect their members’ savings in the event of theft or bank failure. Typically, $250,000 is the maximum amount insured per user, per bank. Not every bank is FDIC-insured! Double-check to ensure that your savings are protected.

Long-Term Goals

In general, long-term goals typically relate to investing for retirement and are often many years or even decades away.

Examples:

- Retirement and reaching financial freedom

- College tuition for your child

- Paying off a home mortgage

You may find that you have a mid-term goals category for investing and financial goals that have a timeline between short- and long-term. Mid-term goals might include, for example, paying off student loans to become debt-free or saving up for a down payment on a property.

As a next step, reflect on your own short- and long-term goals. Write them down to keep track of them on your journey to financial freedom.

How Much Should I Invest Every Month?

The answer to how much you need to invest will depend on your unique situation, such as your age, annual expenses, expected expenses, and income in retirement. What we can calculate to help inform this question is your savings rate. Your savings rate is a great indicator of how well you are doing at paying yourself first (in other words, saving and investing) each month.

The general rule of thumb is to strive for 10% of your income going to your retirement investments and an additional 10% to your savings. Of course, this is a very generalized rule of thumb, and it depends on your short- and long-term goals and some of the factors mentioned above.

For instance, you might already have an emergency fund and no major upcoming events to save for and can allocate 17% of your paychecks to investments. It is also crucial to note that these percentages are not realistic for everyone but can act as a guideline to work up to.

How to Calculate Your Savings Rate

Your savings rate is simply the amount of money you save or invest divided by your earnings.

Here’s a simple example: You earn $4,000 per month. In a typical month, you spend $3,500 and set aside the rest ($500) to put towards your savings and retirement investments. Your savings rate is $500 / $4,000 = 12.5%.

Five Basic Principles for Being a Smart Investor

Investing does not have to be so complicated. There are five basic principles to keep in mind and practice when it comes to investing:

- Diversify your investments

- Start investing as early as possible

- Consistently contribute to your investment accounts

- Stick to your investment strategy and ignore the noise

- Minimize fees and taxes

Let’s explore each one of these principles in a bit more detail.

#1 Diversify

It is nearly impossible to predict which asset class, let alone which individual stock, will perform best in any given year. The 2018 Mid-Year SPIVA US Scorecard found that most active managers failed to beat the market over a long-term 10- or 15-year investment time horizon. In fact, 95% of financial professionals can’t outperform the market. And these active managers are paid experts in their field who solely focus on accomplishing this!

Even if you were able to beat the market by selecting individual stocks, you have a few forces working against you — taxes, fees, and human emotion. Not to mention that there is always risk involved with investing.

So what does this all mean?

The best way to mitigate these factors while decreasing your risk is to diversify your investments and hold a well-diversified portfolio of long-term investments. There are funds and portfolios made up of hundreds of different types of stocks and bonds that make it extremely easy to diversify. We’ll describe those in more detail later on in this chapter.

#2 Start Early

The sooner you start investing, the more time your money has to grow! When you start investing in your 20s and 30s, your investments have decades to ride out the inevitable dips in the market and take advantage of compound interest. Compound interest is your best friend when it comes to investing.

Basically, compound interest means that your money makes you more money. Compound interest is the interest earned on your interest.

To back up a bit, the money you put into your investment account is called the principal. If you start with $1,000 (the principal) and it earns 5% interest each year, you'll have $1,052 at the end of the first year (principal plus interest). At the end of the second year, you'll have $1,105.

You earned $50 on the initial $1,000 deposit, and then you earned $2 on the $50 in interest. That $2 adds up over time. Even if you never contribute another dollar to that account, in 15 years, you'll have over $2,100, thanks to the magic of compound interest.

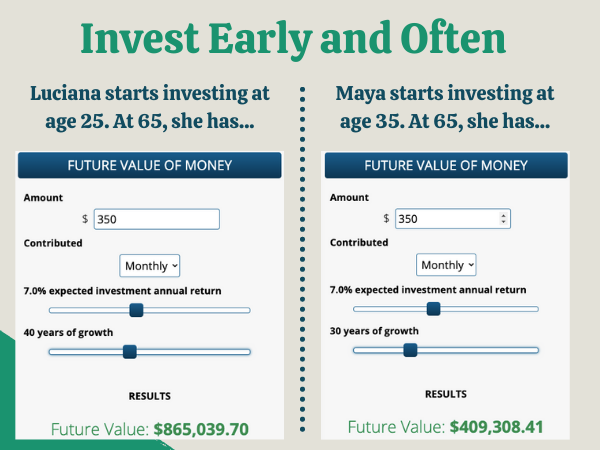

As you can see, the earlier you invest your money, the more time your interest has to compound and earn even more interest. Let’s look at a more exciting example:

(Calculator screenshots from financialfreedombook.com)

Luciana started investing ten years sooner than Maya. This extra time in the market was key. At age 65, she has more than double the amount of Maya when she hits age 65. It’s possible to make up for lost time, but Maya would need to more than double her monthly contributions to $700 to hit the same end value as Luciana at age 65.

Even if you have just $25 or $50 to get started, do it now! You can always increase the amount you contribute to the account as your income increases. Your future self will thank you.

#3 Consistency and Dollar-Cost Averaging

Dollar-cost averaging (DCA) is when an investor contributes to their investments on a regular basis. For example, you might automate investing into your account every payday or on the first of every month. Not only does this avoid the impossible task of needing to correctly time the market with every lump sum you invest, but it’s really, really easy. Set it and forget it, and watch your investments grow over the years and decades.

The above graphic comparing Luciana and Maya’s monthly retirement fund contributions highlights the effectiveness of dollar-cost averaging, especially over decades of compound interest.

#4 Don’t Panic! Ignore the Noise and Stop Trying to Time the Market

The media and press make money by selling advertising, and they don’t sell ads unless they find ways to keep eyeballs glued to the screens. The markets will fluctuate, that is for sure. By sticking to your plan and investing regardless of the news and noise, you can watch your investments grow over the years.

If the market and the news start to stress you out, look at your investments from a different perspective. When you zoom out to look at the stock market and your portfolio, you notice that even with the big dips, historically, the market recovers and grows.

Timing the Market: The Stats

The only thing we can be sure of is that the market will go up and down. No one can predict the market. The good news is that you don’t need to. In fact, it’s better for your wealth if you avoid trying to time the market.

Let’s look at stats from studies on timing the market:

- Most day traders do not profit. In fact, 80% quit within the first two years.

- Data from 1991 to 1996 determined that the average household’s investments had an annual return of 16.4%. Those investors who traded most earned an annual return of 11.4%. The researchers’ takeaway was that "trading is hazardous to your wealth."

- A 2017 study from the Center for Retirement Research at Boston College looked at target-date funds (TDFs). These funds are on a set path, called a glide path, to slowly become more conservative (invest more into bonds than stocks) as the retirement date becomes closer. The study found that when fund managers deviated from the planned glide path, performance did not improve, and in many cases, decreased.

- Putnam Investments looked at investment data between 2000 and 2014 and learned that if an investor left their money out of the market for the ten best days, their overall gains were cut in half (HBK).

Also, most of the best days to invest in terms of market gains have occurred during bear markets or prolonged market downturns. In general, investors lose money when they panic and sell off their investments during bear markets. The bottom line is that it is historically best to keep your money invested during the highs and lows.

Studies have shown that attempting to time the market is not a profitable strategy. Even the world’s greatest, brightest investors are likely to fail at timing when to sell and buy back in. What does work is staying the course and consistently adding to your portfolio.

When in Doubt, Zoom Out

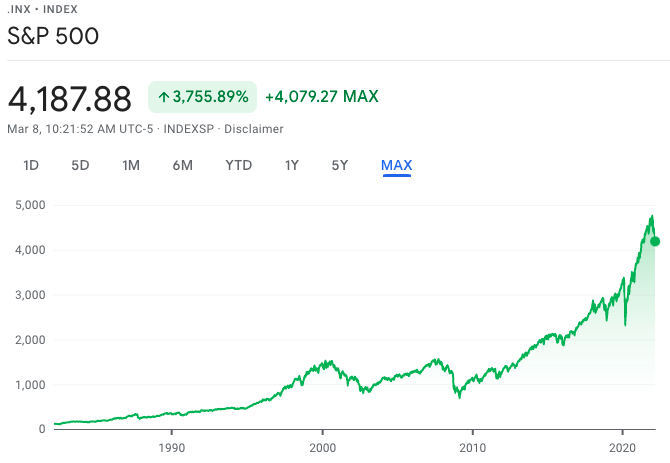

Let’s look at two charts tracking the Standard and Poor's 500 (S&P 500) to underscore the importance of DCA, starting as early as possible, and avoiding panic-selling your stocks when the market dips.

The S&P 500 is one of the most well-known and tracked stock market indices. It tracks the performance of the 500 largest publicly-traded corporations. Because it tracks 500 of the largest companies, it is a solid indicator of what is happening in the American corporate economy and is commonly used as a benchmark.

There are many funds that "track" indices such as the S&P 500. This means that the fund manager invests in the same companies included in that index and works to ensure that the fund has the same returns as the index it tracks.

The first chart shows the S&P 500 during a random six-month period (Sept 8th to March 8th, 2022).

(S&P 500 chart from Google Finance)

Looks like a wild ride! But let’s see what happens when we zoom out and look at the S&P 500 chart over the last few decades.

(S&P 500 chart from Google Finance)

When we broaden our investment time horizon, those market drops that look enormous on a one-month or six-month chart are small drops in the bucket. Even market events that were devastating at the time, such as the 2008 financial crisis, recovered over the years.

The takeaway, then: Historically, the successful strategy for long-term investors has been to keep calm, don’t touch your investments, and ignore the noise.

#5 Minimize Fees and Taxes

There will always be fees and taxes — no escaping that. What you can do is minimize the money that comes out of your investments for fees and taxes.

Firstly, make sure you understand what fees you’re paying on your investments. Let’s look at some of the most important and most common fees for long-term investors.

Understanding Expense Ratios

Every fund you invest in has some kind of expense ratio. The company offering the fund or portfolio uses this expense for administrative, marketing, and portfolio management costs. As an investor, you want low expense ratios to prevent these fees from eating into your investments.

What is a "Good" Expense Ratio?

Active management is typically more expensive because of the research, analysis, and expertise involved in making the decisions to buy, sell, and hold stocks within a fund. For actively-managed funds, the average expense ratio is between 0.5% and 1.0% (Investopedia). Any expense ratios over 1.5% are typically considered high.

Index funds tend to have lower expense ratios because they simply mirror the stocks represented in a specific index, such as the S&P 500. Because there is very little hands-on management required, these more passive funds usually have lower expense ratios.

Expense ratios and management fees are not necessarily bad, but you need to be aware of what you are paying and comfortable with the balance of fees and the value you receive.

Investment Management Fees

Whether you invest with a robo-advisor (and we’ll get to exactly what a robo-advisor is in a bit) or a traditional in-person investment advisor, you will pay a management fee. When you work with a human investment advisor or wealth manager, you pay more for this hands-on service and expertise.

Traditional Human Advisors

Many traditional in-person advisors charge by the number of assets you have under management with them, or AUM. The average AUM fee is 1% (Personal Capital). This means that if you have $1 million invested with the firm, you pay $10,000 per year in fees.

Some advisors charge a flat annual fee or retainer fee that can range from $2,000 to $7,500 (Personal Capital). And other advisors allow clients to work with them on an hourly basis.

Most advisors also earn a commission when they sell you securities and insurance products, which creates a conflict of interest. When you work with an advisor, ensure that they are a fiduciary financial advisor. This legally obliges them to make decisions in your best interest.

Robo-Advisors

A robo-advisor is an online investment platform that helps you set up investment goals (like retirement) and then automatically manages your investment portfolio(s) to help you meet them. Relying on software rather than people, robo-advisors generally cost far less than traditional advisors. Carbon Collective is an example of a robo-advisor.

The average robo-advisor charges 0.25% to 0.50% of your portfolio amount (assets under management or AUM) per year. If your account averaged at $10,000 and your robo-advisor charges a 0.25% annual management fee, you would deduct $25/year (~$2.08/month).

Carbon Collective is the first robo-advisor to offer a climate-forward investment management service, and it costs the same price as a generic one.

Regardless of the type of advisor you use, it is important to understand all of the fees involved.

Taking Advantage of Retirement Accounts When it Comes to Taxes

Asset location is the term used by financial professionals to refer to how an individual investor might take advantage of different tax-advantaged retirement accounts, non-retirement accounts, insurance policies, and so on to create an optimal tax strategy.

We won’t go deep into tax optimization strategies here, but one common way to minimize taxes is to invest in retirement accounts. Retirement accounts exist to help you save for retirement in a tax-advantaged way. Examples include employer-sponsored retirement plans such as a 401(k), 403(b), and others, as well as individual retirement accounts (IRAs).

These types of investments allow you to defer paying taxes on the money you have invested until you withdraw that money in retirement or to allow for your post-tax money to grow without capital gains as long as you stay invested past 59.5 years of age. This is a huge benefit because it allows your money — and the money you would have paid in taxes each year — to compound and grow.

To summarize, the goal of seeking low fees and optimizing for taxes is to keep as much of the wealth that you’re working so hard to build as possible.

Now that you’ve got the five basic principles for being a smart investor, we’re going to learn more about the different types of investment accounts and how to approach selecting the funds to invest in your accounts.

Retirement vs. Non-Retirement Accounts

Roth IRA, Traditional IRA, SEP IRA, 401(k), 403(b)… The list of account types and acronyms can feel overwhelming. This section breaks down the most common types of investment accounts so that you can determine the ones you are eligible for and align with your goals.

First, let’s set some things straight. When we talk about types of accounts, picture these as baskets. The funds (mutual funds, ETFs, stocks, bonds) are the "fruits" that go inside each basket. For example, you might open a Roth IRA and purchase an index fund within that account. The Roth IRA is the "basket", and the index fund is the “fruit”.

The only difference between non-retirement accounts (taxable brokerage accounts) and retirement accounts is how the IRS taxes them. Retirement accounts have more tax benefits compared to regular non-retirement investment accounts. Basically, these accounts exist to make it easier for you to save for retirement.

Types of Retirement Accounts

Depending on the type of account, retirement accounts are either offered by your employer or opened up on your own with a brokerage. There are many different types of accounts within these two categories, and we’ll cover the most common types to get you started.

Employer-Sponsored Retirement Plans - Traditional and Roth 401(k)

Many employers offer retirement plans to give employees a way to invest for retirement. The two main employer-sponsored plan types are defined benefit plans (pensions) and defined contribution plans.

Pension plans, or defined benefit plans, are less common nowadays, especially for employees working in the private sector. This type of plan typically offers a set monthly dollar amount to the employee after retirement based on their salary and how many years they were with the organization.

Nowadays, defined contribution plans where the employee contributes to their individual account and takes on the investment risk are more common. Examples of this type of plan include 401(k) plans and 403(b) plans, specifically designed for employees of tax-exempt organizations such as public schools. State and municipal employers and some non-profit companies sometimes offer a 457 plan. And the Thrift Savings Plan (TSP) was created for federal government employees.

Retirement accounts each have annual contribution limits, meaning the amount you can contribute to the account. And there are specific rules around what age you can withdraw from the account. For example, you can withdraw from a 401(k) without penalties and tax consequences after age 59.5. It’s important to look up the specifics of your plan so that you understand what to expect.

Free Money, AKA the Employer Match

Some employers offer to "match" your retirement plan contribution up to a certain percentage. For example, an employer might invest an additional 50 cents on the dollar up to 6% of the employee's pay. In this case, if you invest 6% of your paychecks into your 401(k), which is equal to $150 every paycheck, then your employer would contribute an additional $75. It’s almost always recommended to invest at least the maximum amount that your employer will match. This is "free" money going towards your retirement!

Individual Retirement Accounts (IRAs)

Whether or not your employer offers a retirement plan, you can open and invest in an Individual Retirement Account, or IRA. Money contributed to an IRA has already been taxed. There are two different types of IRAs with different qualifications and tax benefits.

Roth IRA

You can contribute to a Roth IRA if your modified adjusted gross income (MAGI) falls below a certain amount determined by the IRS each tax year. The IRS also determines how much an individual is allowed to contribute. For the 2022 tax year, the maximum contribution is $6,000, or $7,000 if you are 50 or older.

With a Roth IRA, your contributions are not deductible, meaning that you pay taxes on the money you place into the account and do not have the option to qualify for a tax deduction.

If you are making a ‘qualified withdrawal,’ meaning your first contribution to the account is over five years old and you’ve reached the age of 59.5, the money is tax- and penalty-free.

Traditional IRA

Unlike the Roth IRA, the Traditional IRA does not have any income limitations. The contribution limits per tax year are the same as the Roth IRA ($6,000 for 2022, or $7,000 if you are 50 or older).

Pay Taxes Now or Later?

Depending on several factors, such as whether or not your employer offers a retirement plan, your income, whether or not you receive social security benefits, and so on, you may be able to deduct all or a portion of your Traditional IRA contributions.

You will pay taxes when you withdraw from a Traditional IRA and will also face penalties if you withdraw money before the age of 59.5.

This is a quick summary to help you understand the difference between a Roth and Traditional IRA. The IRS website has up-to-date information on eligibility, contribution limits, and other factors based on your age and situation.

Non-Retirement Accounts

Does your employer not offer a retirement plan, and you’re already maxing out your IRA? Or maybe you are already investing in the tax-advantaged accounts you’re eligible for, but you want to invest more.

Great news — you can invest as much as you’d like in a non-retirement account! You won’t get the tax benefits that come with your retirement accounts, but a non-retirement account (also called a standard brokerage account or taxable brokerage account) is perfect for investing more of your dollars for long-term growth. Also, unlike retirement accounts, there are no rules on when you can or can’t withdraw the money. This gives some people peace of mind knowing that they could use the money sooner than the traditional retirement age.

Joint Accounts

Joint accounts are owned by more than one individual. The most common example is when married partners open a joint account. Typically, two people working towards the same financial goals use joint accounts.

Understanding Risk and How to Pick Your Portfolio

Any time you save or invest money, you take some sort of risk. Risk happens when there is uncertainty. And there is almost always uncertainty in anything we do, whether choosing a career, picking a spouse, traveling somewhere new, or deciding what to do with our investments.

Part of this uncertainty with investing is the stock market’s volatility, meaning the prices of stocks increase and decrease. This is why you may have heard the phrase "past performance does not guarantee future results." No investment firm, fund, portfolio, or individual stock can guarantee that the last 20 years or 20 months or 20 days will reflect the next 20 years or 20 months or 20 days.

Of course, you can use historical data to gain insight into what you might expect from a stock, a fund, or a portfolio’s performance. And as you invest and build your portfolio, you can assess and reassess your comfort levels when taking risks. Your risk profile evaluates your willingness to take risks.

Assessing Your Risk Tolerance

How much volatility and variability with your investments are you willing to handle? This is the primary question when it comes to assessing your risk tolerance.

Your risk tolerance is crucial because how aggressive or conservative you’d like to be helps determine the mix of assets you should consider investing in. A simple way to mitigate risk and maximize the potential return on investment is to follow the basic principles we covered earlier in this chapter.

How Basic Principles to Smart Investing Help Decrease Risk and Increase Returns

The goal is to achieve the highest returns for the least amount of risk.

Diversification of Your investments

This is the first and most important principle when it comes to mitigating your investment risk. If you invest 100% of your portfolio in Tesla (TSLA), you take on far more risk than if you invested in an index fund or portfolio comprising 100+ different stocks across various market sectors. The more diversified your investments, the less exposure you have to a single industry, company, or type of investment.

Also, different types of investments react (go up or down in price) differently to market events. For example, bonds react differently to market events than stocks or real estate. Diversification between asset classes is generally good because it’s less likely that a single market event will tank your entire portfolio and all your different assets at the same time.

In general, the closer you are to retirement, you want to decrease the volatility of your investment portfolio. In most cases, this means investing a higher percentage of your money in less volatile assets like bonds.

Start Investing Early

The sooner you start, the more time your investments have to compound and ride out the ups and downs of the market. And the more time you have before you plan to retire and withdraw from your investments, the more risk you can take.

Do Your Own Research

Investing does not have to be complicated. As you learned in a previous section, there are index funds and portfolios that make it easy to invest in all types of industries and bonds without the need to research every stock and bond. That said, it is important to educate yourself on what you are investing in and the fees and tax implications involved.

Once you have a plan in place, it’s more a matter of sticking to the plan. Don’t panic and sell your investments, and consistently invest. Which brings us to the next point.

Dollar-Cost Averaging (DCA)

No one can predict the market (without maybe getting extremely lucky once or twice). Instead of guessing when the market will drop, set up automatic investments into your accounts every month or payday.

With this dollar-cost averaging (DCA) strategy, you’ll buy during market highs and market lows. This decreases the volatility of your investments, and most importantly, removes emotion from the decision-making process. Emotions are what cause investors to buy and sell investments at the wrong time.

Don’t Forget About Your Emergency Fund

We discussed setting aside savings in case of emergencies such as a job loss. This is crucial when determining your risk tolerance because if you know you have eight months of living expenses set aside in a high-yield savings account, you’re in a much better place for taking on more risk with your investments compared to someone living paycheck to paycheck with no savings.

Choosing Your Portfolio: So What Should I Invest In?

If you read through the first chapters of this guide, you have likely concluded that you have the option to invest in a portfolio of stocks and bonds that align with your personal values and provide a good return on investment.

A diversified portfolio is likely to generate the highest return with the least risk. As you age, you typically care more about preserving your wealth than growing your investments. This is why most advisors recommend allocating more of your portfolio to bonds and less risky investments as you near retirement age.

On the opposite spectrum, when you’re in your 20s, 30s, and 40s, most people are in the accumulation stage because you are in your peak earning years, and the goal is to contribute to and grow your portfolio. You can take on more risk and allocate more money to stocks than someone nearing retirement because you still have years and decades in the market.

We’ll Use Carbon Collective’s Portfolios as an Example of How This Works

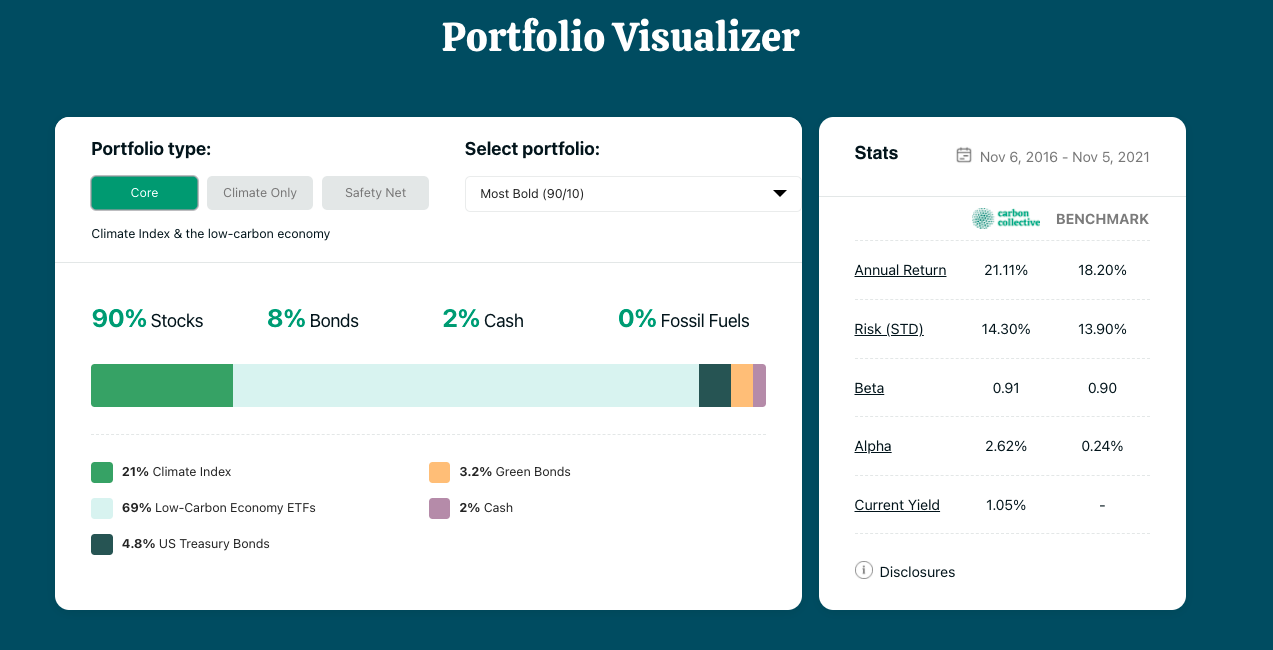

The "Most Bold (90/10)" portfolio is the most aggressive portfolio in that it comprises 90% stocks, 8% bonds, and just 2% cash. This could be a great option, for instance, for a 28-year-old planning to retire at age 65.

Compare this to the least aggressive: "Most Cautious (40/60)." This portfolio has only 40% in stocks, 58% in bonds, and 2% in cash. Notice as you toggle between the portfolios that the more cautious and least aggressive portfolios allocate an increasing percentage of the portfolio to bonds.

Why Are Bonds Considered Less Risky Than Stocks

Investors typically consider bonds low-risk because they have a fixed rate of interest. When you purchase a bond, you know how much interest you will earn, and this amount is paid out regardless of how the value of the bond increases or decreases.

When you are issued a bond, the issuer promises to pay back the principal (the original amount you invested) at the bond’s maturity date. This is very different from stocks where your principal is not protected, and if the value of the stock decreases, you could lose your original investment.

Never Investing or Not Investing Enough is the Greatest Risk of All

The alternative to investing for retirement is much riskier than investing. We have all heard horror stories of never being able to retire. Or outliving the investments set aside and running out of money in retirement. Even if you love your job or your business and want to work or be involved in some way for your entire life, the option to retire by choice or as a result of your health is vital.

Sometimes unfortunate events happen that are out of our control. But we owe it to ourselves and our families (or future family members) to focus on what we can control now. And in order to gain a return on your hard-earned dollars and beat back the ugly monster of inflation, you must invest.

Finding the Right Balance

Everything is about balance. You want to live an amazing, fulfilling life now while still investing as much as possible and setting yourself up for a successful retirement.

One way to navigate this is to visualize your ideal life. What do you want to accomplish over the next five, ten years? What truly brings you fulfillment and joy? How do you envision your retirement?

It’s tricky to put together an optimal plan if you don’t know where you want to go. Set aside some time to reflect on these kinds of questions. Self-awareness will help you identify what decisions to make when it comes to your expenses, income, savings, and investments.

As you apply the basic concepts from this chapter and continue building your investing knowledge, you will find your footing and learn what works best for you.

Reaching Financial Freedom

In this chapter, we covered how you can use money as a tool to create the life of your dreams. This includes setting intentional short- and long-term financial goals and the basic principles of being a smart investor. The final step is to keep learning! Financial education is an ongoing practice.

You now have all the basics down to continue along your path to financial freedom in a way that aligns with your values and the kind of world you actually want to retire into.

Previous Chapter 04

Chapter 4: The Current Sustainable Investing LandscapeNext Chapter 06

Chapter 6: Summary and Conclusion