What is a Lump-Sum Payment?

This is a question that many people are asking as they approach retirement. A lump-sum payment is a one-time payment, rather than receiving payments over time.

If you have a large sum of money that needs to be saved and invested, then a lump-sum payment might work best for your situation.

For instance, if an individual plans to retire with IRA accounts in addition to other assets like mutual funds or stocks, they might choose not to make monthly contributions so as not to risk losing some principal due to inflation over time.

The downside is there is not always another option besides saving everything up until 59½ years old (early retirement age).

How Does it Work?

When you receive a lump-sum payment, the money is paid to you all at once. This can be either through an annuity or a lump-sum pension payment.

An annuity is a type of insurance policy that pays you a fixed sum of money each year. This can be helpful if you want regular payments but do not want to worry about the stock market or other investments.

A lump-sum pension payment is just what it sounds like - a one-time payment from your pension plan. This can be a good option if you want to retire early, or if you do not think you will live very long.

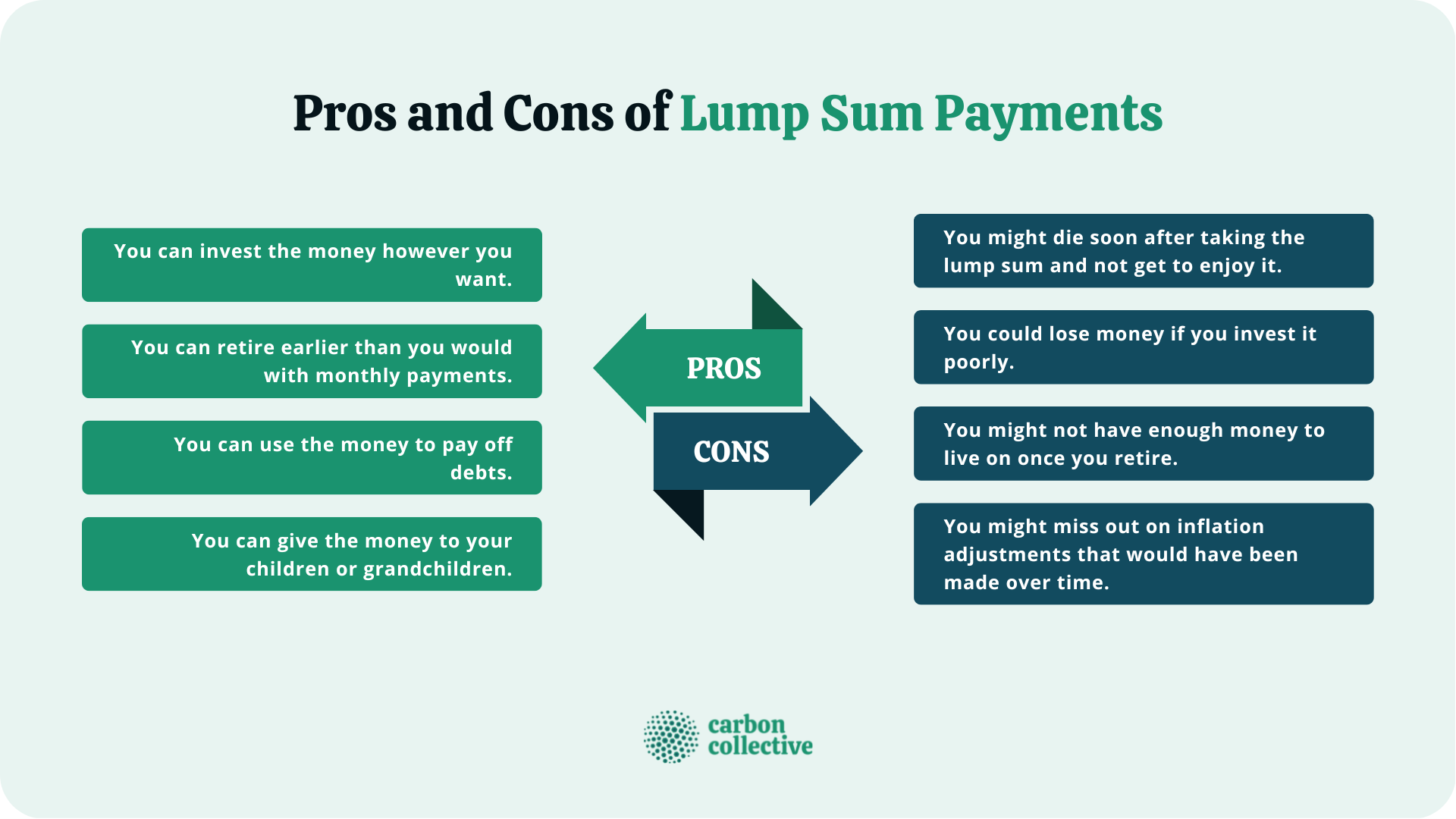

Pros and Cons of Lump-Sum Payments

There are a few pros and cons to consider when deciding whether or not to take a lump-sum payment.

Lump-Sum and Taxes

When it comes to taxes, a lump-sum payment is taxed the same as regular income. You will need to pay taxes on any money you receive from a lump-sum payment.

However, you may be able to claim back some of the taxes you paid on your lump-sum. It depends on the pension plan you have. Some plans allow you to claim back taxes, while others do not.

If you take a lump sum in cash, it is immediately taxable, you will be subject to 20% federal (and possibly state) mandatory tax withholding. However, there are few exceptions, and distributions taken before the age of 59½ are subject to a 10% IRS early withdrawal penalty.

You may also be able to reduce the amount of taxes you owe by having it paid out over a period of time, rather than in a lump-sum - this is called an annuity. Rolling it over into an IRA can also help reduce your taxes.

Be sure to talk to an accountant or financial planner if you have any questions about how the lump-sum will affect your taxes.

Lump-Sum vs. Annuities

Lump-Sum can be a good option if you want to invest the money yourself.

Annuities can be a good option if you want regular payments but do not want to worry about the stock market or other investments.

You will usually get a lower return on your investment than with lump-sums, but you do not have to worry about losing money.

Lump-Sum vs. Regular Pension Payments

Pension payments can be either lump-sum or regular, depending on your plan.

If you choose a lump-sum payment, you will get all of your pension at once. This can be helpful if you want to retire early, or if you do not think you will live very long.

If you choose regular payments, you will get a smaller payment each month. This can be helpful if you want to make sure you have enough money to live on each month.

The Bottom Line

A lump-sum payment is a one-time payment, rather than receiving payments over time. This can be either through an annuity or a lump-sum pension payment.

There are pros and cons to consider when deciding whether or not to take a lump-sum payment. It is important to think about your situation and what would be the best option for you.

The lump-sum needs to be invested, so you also need to consider how you will do that. You should also think about whether you want to retire early or not, and how much money you think you will need each month in retirement.

It is important to weigh all of your options before deciding on a lump-sum payment. Talk to an accountant or financial planner if you have any questions.

FAQs

1. Can you take all of your pension as a lump-sum?

It depends on your pension plan. Some plans allow you to take a lump-sum, while others do not. If you can take a lump-sum, you will get all of your pension at once. This can be helpful if you want to retire earlier, or if you do not think you will live very long. If you cannot take a lump-sum, you will receive smaller payments each month.

2. Are lump-sums taxed differently?

No, lump-sums are taxed the same as regular income. You will need to pay taxes on any money you receive from a lump-sum payment. Be sure to talk to an accountant or financial planner if you have any questions about how the lump-sum will affect your taxes.

3. Can I claim back tax on a pension lump-sum?

It depends on your pension plan. Some plans allow you to claim back tax, while others do not. If you can claim back tax, you will need to fill out a form and send it to the government.

4. How long does it take to receive a lump-sum pension?

It usually takes four to five weeks from the date of your request before your provider releases your pension.

5. Can my beneficiaries inherit my lump-sum?

Yes, your beneficiaries can inherit your lump-sum payment. You will need to name them on the form you send to request your lump-sum.