Defining Microcap Stock

Microcap stocks are publicly traded companies with a market capitalization of between $50 million and $300 million. Microcap stocks generally trade on the OTCBB (Over-the-Counter Bulletin Board) or Pink Sheets.

Microcap corporations have more market capitalization than nano-cap businesses but less than small-, mid-, large-, and mega-cap firms. Firms with bigger market capitalizations do not always have higher stock prices than companies with smaller market capitalizations.

Microcaps are recognized for their volatility; they are considered riskier than corporations with bigger market capitalizations. Market capitalization calculates the market value of a company's outstanding shares by multiplying the stock price by the total number of outstanding shares.

Microcaps are also recognized for their high risk because many have unproven items and no established history, assets, revenue, or operations. They are particularly subject to large price shocks due to a lack of liquidity and a small shareholder base.

Microcap vs. Larger-Cap Stocks

Microcap stocks are also more likely to be involved in fraud and scams.

There are many more Microcap equities on the market than large- and giant-cap firms.

Investors may not find the same degree of information easily available as they do with major equities such as Apple (AAPL).

As a result of the limited information and a large number of Microcap companies on the market, research is critical to prevent fake stocks and other possible dangers.

Because many Microcap stocks are exempt from filing regular financial reports with the Securities and Exchange Commission (SEC), conducting research becomes even more challenging.

Benefits Microcap Stocks

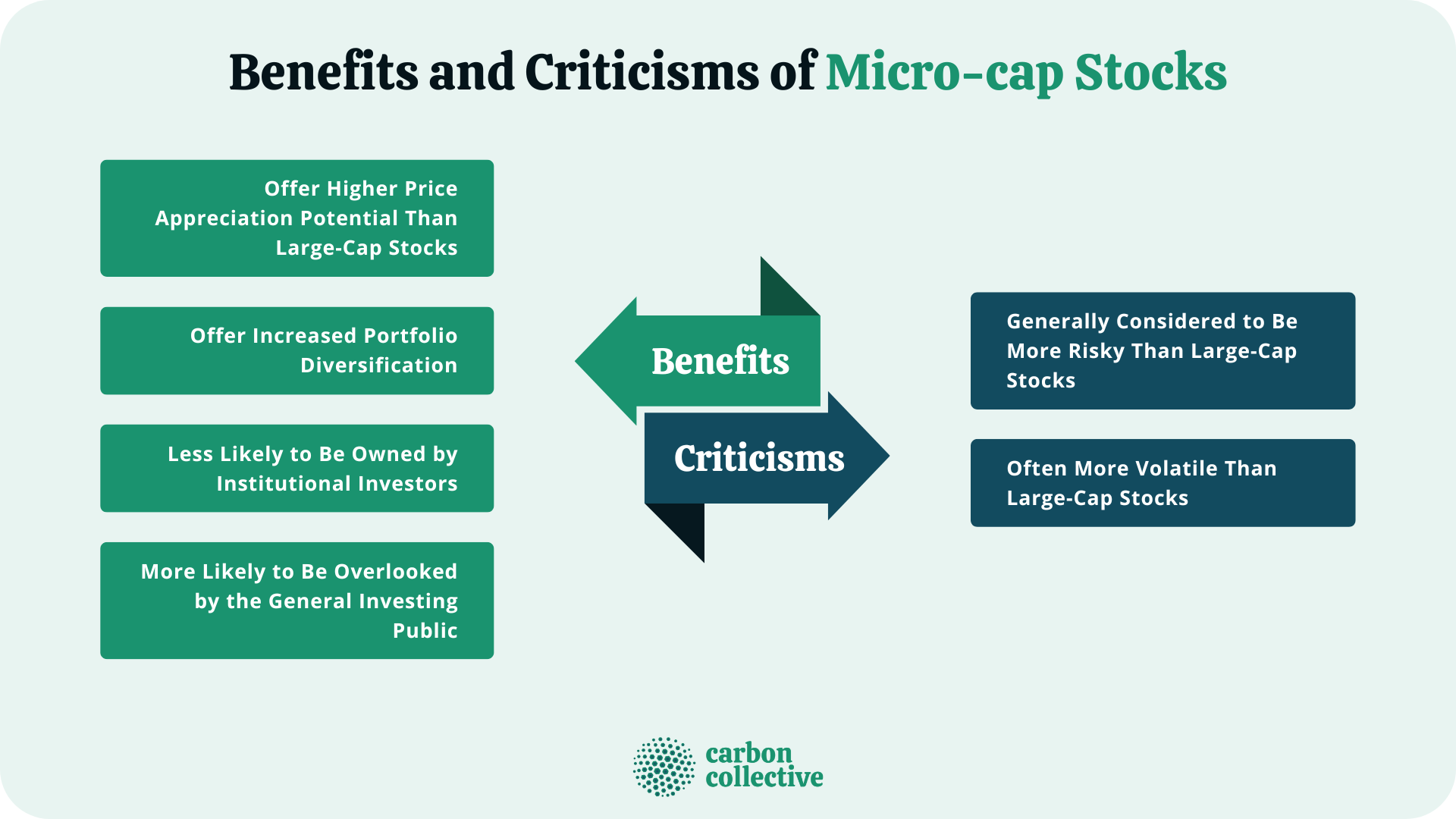

Microcap stocks may offer higher price appreciation potential than large-cap stocks.

They also offer increased diversification benefits since they tend to be less correlated with the overall market.

Investors may find achieving a higher return with a Microcap stock portfolio easier than with a large-cap portfolio.

Microcaps are not only less likely to be owned by institutional investors, but they are also more likely to be overlooked by the general investing public.

This provides a unique opportunity for the individual investor willing to do the required research.

Criticisms of Microcap Stocks

Microcap stocks are generally considered to be more risky investments than large-cap stocks.

This is due to several factors, including the limited operating history of many Microcap companies, the lack of analyst coverage, and the lack of liquidity in the market for their shares.

In addition, Microcap stocks are often more volatile than large-cap stocks.

Best Microcap Stocks to Invest In

A Microcap Stock is a publicly listed firm with a market capitalization between $50 million and $300 million.

Microcaps are considered to be more volatile and risky than larger-cap stocks, but they may offer a higher degree of price appreciation potential.

Some of the best Microcap stocks to invest in include:

- Zogenix, Inc. (ZGNX): ZGNX is a pharmaceutical company that develops and commercializes therapies for treating central nervous system disorders.

- Home Group, Inc. (HOME): HOME is a home furnishing retailer that offers a wide variety of products, including furniture, décor, and textiles.

- Revlon, Inc. (REV): Revlon is a cosmetic and beauty product company that provides a wide range of products, including makeup, skincare, and hair care.

- Clear Channel Outdoor Holdings, Inc. (CCO): CCO is an advertising company that owns and operates billboards, digital displays, and other out-of-home advertising media.

- GameStop Corporation (GME): GME is a video game retailer that offers various gaming products and accessories.

Where to Trade

Most Microcap stocks are traded on the "over-the-counter" (OTC) market rather than on a major securities exchange. They are quoted on over-the-counter (OTC) platforms like the OTC Bulletin Board (OTCBB) or OTC Link LLC (OTC Link).

OTCBB

The OTC Bulletin Board (OTCBB) is an electronic inter-dealer quotation system that shows quotations, last-sale prices, and volume statistics for a wide range of OTC equities securities that are not traded on a national securities exchange.

Companies who wish to have their securities quoted on the OTCBB must seek sponsorship from a market maker business that is a licensed broker-dealer and file current financial reports with the SEC or its banking or insurance regulator, according to the OTCBB's eligibility regulation.

The Financial Industry Regulatory Authority runs the OTCBB (FINRA). The Nasdaq Stock Market does not include the OTCBB. Fraudsters may falsely claim that an OTCBB firm is a Nasdaq company to deceive investors into believing that the company is larger than it is.

OTC Link LLC

OTC Link is an electronic inter-dealer quotation system that shows quotations, last-sale prices, and volume data for exchange-listed securities, OTC equity securities, overseas equity securities, and some corporate debt instruments.

In addition to posting quotations, OTC Link allows broker-dealer subscribers to send and receive trade messages, allowing them to negotiate transactions. OTC Link is a broker-dealer, an Alternative Trading System registered with the SEC, and a member of FINRA.

OTC Link divides securities into three markets depending on the quantity and quality of available information:

OTCQB

OTCQB contains securities issued by entities that have reported to the SEC or a U.S. bank, thrift, or insurance regulator;

OTCQX

OTCQX lists securities of companies that have met specific financial and disclosure requirements; and

OTC Pink

OTC Pink is an open market for a wide range of equity securities with no financial rules or reporting requirements.

Key Takeaways

Microcap stocks are publicly listed firms with a market value of $50,000 to $300,000,000.

These socks are considered more volatile and risky than larger-cap stocks but may offer a higher degree of price appreciation potential.

Most Microcap stocks are traded on the "over-the-counter" (OTC) market rather than on a major securities exchange.

OTCBB and OTC Link LLC are two popular platforms for trading Microcap stocks.

Further, Microcap stocks may be more susceptible to fraud and manipulation due to their lack of liquidity and weaker disclosure requirements.

FAQs

1) What is a Microcap stock?

It is a publicly listed company with a market capitalization between $50 million and $300 million. Microcap stocks are considered more volatile and risky than larger-cap stocks but may offer a higher degree of price appreciation potential.

2) Where are Microcap stocks traded?

Most Microcap stocks are traded on the "over-the-counter" (OTC) market rather than on a major securities exchange. OTCBB and OTC Link LLC are two popular platforms for trading Microcap stocks.

3) What are the dangers associated with investing in Microcap stocks?

Microcap stocks may be more susceptible to fraud and manipulation due to their lack of liquidity and weaker disclosure requirements. In addition, these stocks may be more volatile and risky than larger-cap stocks.

4) What are the benefits of investing in Microcap stocks?

Microcap stocks may offer higher price appreciation potential than larger-cap stocks. In addition, these stocks may allow investors to invest in early-stage companies with high growth potential.

5) What is the difference between Microcap vs. Larger-cap Stocks?

Microcap stocks are publicly traded companies with a market capitalization between $50 million and $300 million, while large-cap stocks are companies with a market capitalization greater than $300 million. Microcap stocks are considered more volatile and risky than larger-cap stocks but may offer a higher degree of price appreciation potential.