Net asset value (NAV) refers to the net worth of a firm and is calculated as the difference between the total assets and total liabilities of the firm. NAV is usually referenced in the context of mutual funds and Exchange Traded Funds (ETF) and is expressed on a per-share basis. It is the price at which the units of the fund, registered with the Securities and Exchange Commission (SEC), are traded.

In other words, investment or redemption of shares or units of SEC-registered mutual funds and ETFs happens at their net asset value. Therefore, NAV is usually expressed on a per-share basis and is calculated at the close of the trading window of every business day.

Unlike stocks, mutual funds are not traded on a real-time basis. Therefore, their prices do not keep changing every second (unlike stock prices) and are calculated only once during the trading day (at the cut-off time).

All trade orders placed before the cut-off time for NAV calculation are executed the very same day on the NAV calculated for that day, while the orders that are placed after the cut-off time are processed the next business day, and the NAV for such orders would be the NAV calculated for the following business day.

For example, if the cut-off time for NAV calculation is 2 PM, the orders placed before 2 PM would be executed based on Day 1’s NAV, while orders placed after 2 PM would be executed based on Day 2’s NAV.

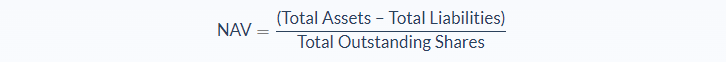

Net Asset Value Formula

Total Assets would include all the assets of the firm such as securities and other investments, cash and cash equivalents, accrued income, and receivables. Note that these assets have to be expressed at their market value and not cost price.

Since a mutual fund would have invested in multiple stocks, the value of such securities is based on and is the sum total of the closing prices of individual securities at the end of the trading day.

- Cash and cash equivalents refer to the amount of cash or other liquid assets held by the fund as on that day

- Receivables will include dividends or interest income that is due to be received that day

- Accrued income would include any income that has been earned by the fund but not yet received

Total liabilities include all short-term and long-term liabilities and accrued expenses.

Short-term and long-term liabilities are the sum total of the following payments and expenses and can be classified as long term and short-term based on the payment horizon.

- Short-term and long-term loans owed to banks and other financial institutions

- All types of charges and fees owed to various financial entities

- Shares issued to non-residents

- Outstanding income or dividend payments to non-residents

- Sale proceeds of shares of non-residents pending repatriation

Accrued expenses could include salaries, utility payments, other operating expenses, management, marketing, sales and distribution expenses, transfer agent fees, custodian and audit fees, and various other operational expenses.

The number of outstanding shares may vary each day depending upon the frequency with which investors invest in or redeem the mutual fund units.

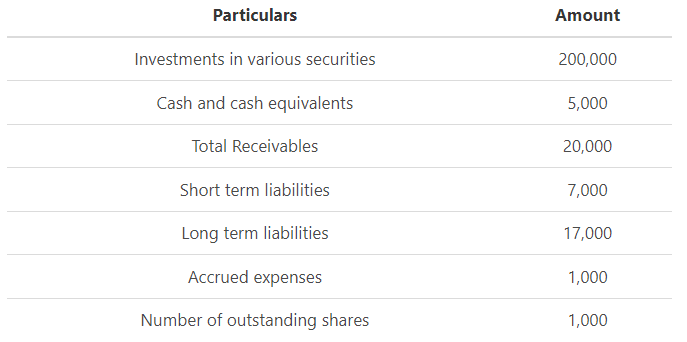

Net Asset Value Example

You have been provided with the following assets and liabilities details of Mutual Fund X as of February 10, 2020. Calculate its net asset value as of that date.

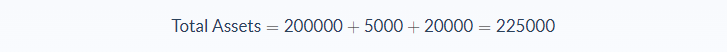

To calculate the net asset value, we have to calculate the sum total of all the assets, which would be equal to the sum total of investments, cash, and receivables:

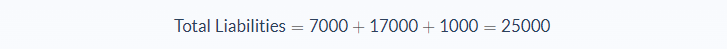

Next, we calculate the sum total of all the liabilities, including short-term liabilities, long term liabilities, and accrued expenses:

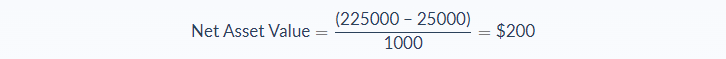

Once we have total assets and liabilities we can calculate the net asset value:

This means that the mutual fund’s value per share is $200.

Net Asset Value Analysis

All mutual funds and exchange-traded funds must calculate their net asset value daily. But ETFs, unlike open-ended mutual funds, are traded on the stock exchange like shares, and therefore might be trading at a premium or discount to the fund’s NAV at any particular point in time. This difference in NAV prices provides various opportunities for active ETF traders to spot and encash profits.

Investors primarily use net asset value to compare performances of different funds as well as to compare a fund’s performance against the benchmark index. But the fact is, net asset value is not a true reflection of a fund’s performance. This is because mutual funds distribute almost all their incomes and gains to the unitholders. When this happens, the net asset value of the fund might fall, thus projecting a distorted picture of the fund’s performance.

Therefore, investors should use other measures such as compounded annual growth rate (CAGR) or the total annual return to compare different funds and get a better picture of fund performance rather than NAV.

Net Asset Value Conclusion

To sum up:

- Net Asset Value is the net value of assets and liabilities of a mutual fund or ETF expressed on a per-share basis

- NAV is the price at which investors buy or sell units of the fund

- NAV is usually calculated daily during business days and trade orders placed before the cut-off time are executed on a same-day NAV basis while orders placed after the cut-off time are executed on the following day’s NAV

- Number of outstanding shares of the fund change constantly depending upon the supply and demand of the fund’s units as on any particular day

- Slight difference in NAV pricing for ETFs during trading hours provide arbitrage opportunities for ETF traders

- Other measures such as CAGR or total annual return provide a better measure of fund performance rather than net asset value

Net Asset Value Calculator

You can use the net asset value (NAV) calculator below to work out your mutual fund value per share by entering the assets, liabilities, and outstanding shares.

FAQs

1. What is a net asset value?

Net asset value (NAV) is the net value of assets and liabilities of a mutual fund or ETF expressed on a per-share basis. It is the price of a fund's underlying holdings minus its liabilities.

2. What is the formula for net asset value?

The formula for net asset value is:

Net Asset Value = (Assets − Liabilities) / Number of Outstanding Shares

3. What is the difference between a share price and a net asset value?

The difference between a share price and a net asset value is that the share price reflects the current market value of a company's stock, while the net asset value reflects the underlying assets of the company.

Another difference is that the net asset value is always calculated taking into account a company's liabilities, while the share price does not.

4. Is net asset value the same as equity?

No, net asset value is not the same as equity. Equity is the portion of a company's assets that are paid for by shareholders. It represents their ownership of the company.

4. Which net asset value is good, high, or low?

NAV reflects the underlying assets and liabilities of a company, so it can be seen as a good or bad measure depending on the particular situation. A high NAV would indicate that the company has a lot of assets and is well-funded, while a low NAV would suggest the opposite.