What Does the Expected Return of a Portfolio Mean?

The expected return of a portfolio is the average return an investor can expect to earn on a particular portfolio.

It is the total amount of money one can expect to gain or lose on an investment with a predictable rate of return.

An expected return is often expressed in percentages, with positive returns representing profits and negative returns representing losses.

Expected returns are used in capital budgeting to compare the profitability of investments with different cash flows. They are used by investors seeking to determine whether an investment is worthwhile based on their required rate of return.

It allows people to diversify their investment portfolios to choose investments that will work best for them.

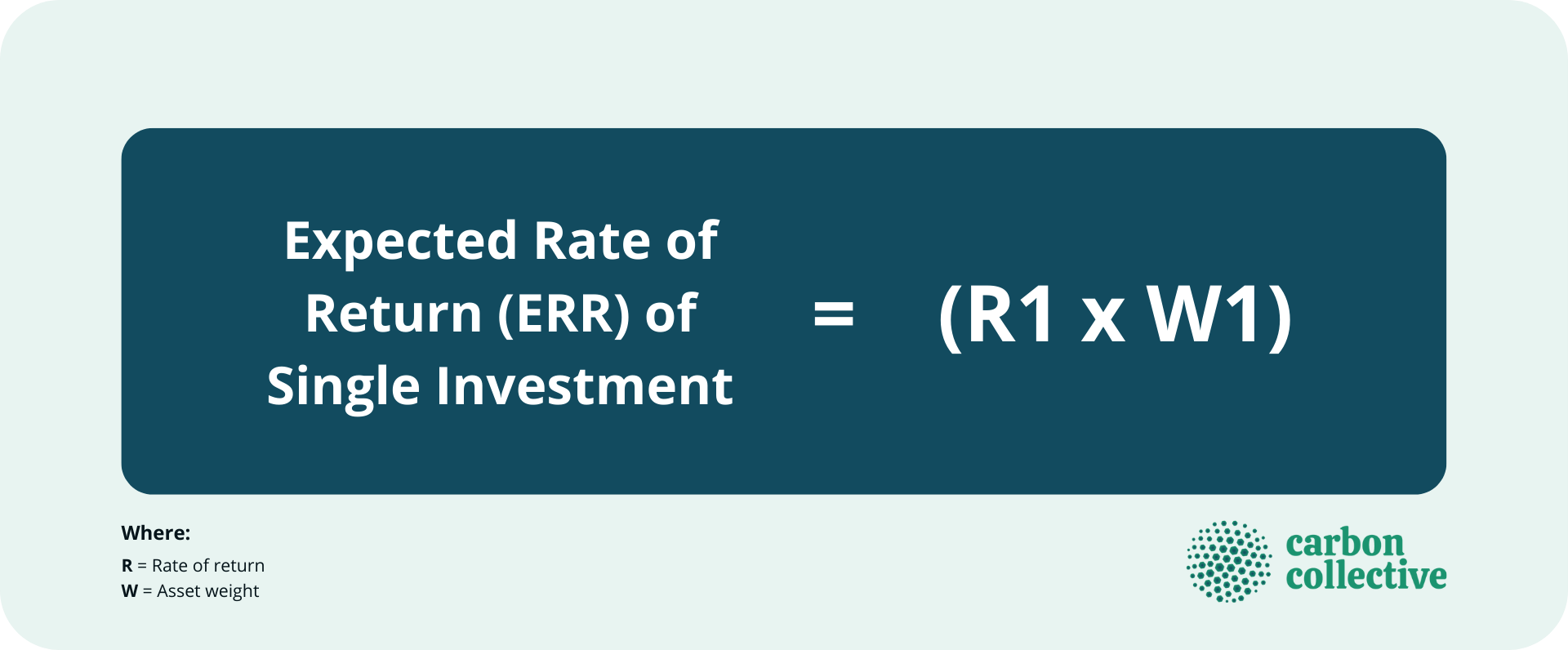

Formula for the Expected Return of a Portfolio

To calculate the expected rate of return of a single investment in a portfolio, multiply the rate of return by the asset's weight as part of a portfolio.

Where:

R = Rate of return

The rate of return is a calculation that estimates the annual return on an investment over a given period. Essentially, the calculations estimate how much you would have earned or lost had you invested in an asset. The rate of return can be either positive or negative.

To get the rate of return, divide the total earnings of an investment by the investment's value.

W = Asset weight

Asset weight is the percentage of an investment's value represented by a particular asset. It is used in calculations of expected return to determine the weighted average rate of return.

To get the asset weight, divide the value of each given asset by the total value of the portfolio.

Given that there are multiple investments in a portfolio, each of the results will have to be added together to come up with the entire portfolio’s expected rate of return.

It is expressed as this formula:

Sample Computation for Expected Return

Let us take an example of an investment with five stocks in the portfolio. The rate of return and weight for each stock are as follows:

Stock A

- Rate of return = 20%

- Weight =10%

Stock B

- Rate of return = 10%

- Weight = 20%

Stock C

- Rate of return = 8%

- Weight = 30

Stock D

- Rate of return = 6%

- Weight = 20%

Stock E

- Rate of return = -4%

- Weight = 20%

The rate of return for the entire portfolio would be calculated as follows:

Limitations of Expected Returns

Does Not Guarantee Real Returns

The computation of a portfolio's expected return is only based on estimates and analysis and is not a guarantee of actual returns.

It does not consider the possibility that returns might be higher or lower than expected. Thus, in some cases, an investor may earn more or less than expected with a certain percentage of accuracy.

No Guarantee of Diversification Either

The computation also assumes that there would be no risk involved in holding stocks with different rates of return in the same portfolio.

However, it does not factor in the possibility that one investment may negatively affect another investment's performance.

Based on Historical Data

An expected return is only a prediction based on historical data and trends, and future returns may or may not be similar to these. Thus, there is no guarantee of expected return patterns staying the same in the future.

Builds on Several Assumptions

Several assumptions are made about how to compute an investment's rate of return, including its estimated value at the beginning and end of each period under measurement.

Results might vary from those computed because of changes in market conditions or other external factors that may affect an investment's value between periods.

The estimated value must be estimated at a future date for which there is no fixed price and can change even before it reaches its time frame due to market changes.

Weighted Average Can Exclude Valuable Information

Additionally, even if different expected returns are computed for each investment in a portfolio, differences may be disregarded.

This assumes that the impact of an investment is equal regardless of its performance and weight. In some cases, however, lower-performing investments can positively impact a portfolio's total return because they reduce the risk level.

Importance of Portfolio Diversification

To make up for limitations associated with computing the expected rate of return, portfolio diversification must be ensured as much as possible. This means picking investments that yield different rates of returns and whose values would not be affected by the same factors.

Choosing several investments instead of only one or two makes it virtually impossible for an investor to lose money if the expected rate of return calculation is correct.

As investments are chosen with varying rates of return, their performance does not depend on a single factor or one source of investment risk.

This prevents diversification from being neutralized by correlations among certain investments over time and helps make profits even when some portions of investments perform poorly at any given time.

Final Thoughts

An expected return is a key tool in helping you make wise investment choices. As long as you understand the limitations of an expected return, it can help compare investments and see which ones provide the biggest returns over time.

However, because diversification helps reduce risk and prevent losses that one investment might cause, it remains crucial to remember that it should comprise one of the key factors you consider when making investment decisions.

Finally, it is crucial to remember that an expected return is a prediction, and it is nearly impossible to know the exact rate of return for any investment because factors influencing market performance change all the time.

FAQs

1. What is the expected return of a portfolio?

An expected return of a portfolio can be defined as the weighted average of expected rates of return for all individual investments over a specified measurement period. It only provides an estimate or prediction without guaranteeing that future results will follow this pattern, either because future conditions differ from those under which historical data were collected, or due to other factors, such as changes in market trends and conditions during the time between periods.

2. What other crucial factors require consideration when computing the return of an investment?

Market conditions during the time between periods, and whether or not correlation among certain investments exists over time.

3. What comprises an investment portfolio?

An investment portfolio comprises all investments owned by a person or entity, which can include stocks, bonds, mutual funds, real estate, and other financial instruments.

4. What are the limitations of expected returns?

The limitations of expected returns include market changes between periods during which historical data were collected and analyzed for computing an expected rate of return. This also includes other factors, such as the correlation among types of investments over time. When this exists, it negates any positive impact diversification might have on lowering risk levels for the portfolio.

5. How important is diversification when evaluating investment portfolios?

Diversification is crucial when evaluating investment portfolios because it helps reduce risk and prevents losses that one investment might cause. This allows you to make wise choices for investments without having to worry about one investment wiping out all your profits.

.png?width=1920&name=ERR(2).png)

.png?width=1920&name=ERR(3).png)