Preferred stock is an equity procedure that can be used by any company that wants to fund project expansion. Firms often raise funds through sales of preferred and ordinary stock. Preferred stock is at times referred to as preferred shares. Owners of preferred stock have equal rights to ownership in a company just like counterparts holding shares of common stock shares.

Preferred stockholders, however, are not guaranteed a right to voting as is the case with common stock. Nonetheless, they have priority when it comes to receiving dividends and bankruptcy. Since preferred stock bears both the characteristics of equity and debt instruments, it is mostly considered as a hybrid instrument of the two with both equity and fixed income characteristics.

Apart from that, the preferred stock also has a par value characteristic that is similar to that of bonds. Their hybrid nature makes them less volatile compared to common stock as it provides a stream of dividends. This means the stock can be considered as an alternative investment by risk-averse investors who want to buy equities.

The callable feature of preferred stock is very outstanding as it enables the issuer to be able to redeem them at any time for cash value hence a source of security for investors. Holders of preferred stocks are normally given priority to any common stockholders when dividends are paid. Additionally, dividends tend to be paid at a fixed rate.

Preferred Stock Valuation Formula

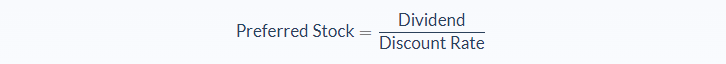

The value of the preferred stock can be simply calculated as a fraction of dividends and the discount rate. However, other characteristics, such as being callable, may be taken into account, varying the result. For a simple straight case, preferred stock can be computed as shown below.

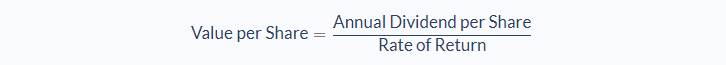

As it was initially stated, preferred stocks shareholders normally receive fixed dividends and are always given priority ahead of common stock shareholders when dividends are being paid at the end of the year. The formula for computing the present value of a preferred stock takes into account perpetuity. In determining the value of a share of standard preferred stock, the formula is given as:

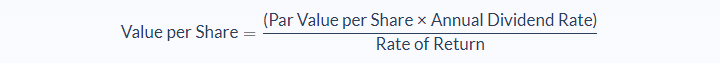

To compute the annual dividend per share of preferred stock one needs to multiply the face value of the stock by the stated dividend rate (market assessment of the risk inherent in the preferred stock) hence simplifies the formula above to the one shown below:

Perpetuity is formed by the fixed dividend payments which follow the nature of the preferred stock. In a situation whereby the preferred stock has a constant rate of dividend growth, then we assume that the value is equal to the present value of a perpetuity.

Unlike the formula in a case of simple and straight preferred stock, the other formula elaborates on how to go about a case involving risk inherent in the preferred stock with a stated dividend rate.

This formula enables you to arrive at a weighted annual dividend per share of preferred stock by multiplying the face value of the stock and the stated dividend rate hence giving a more realistic picture of the current situation of the stock market. This flexibility in the formula enables one to arrive at the most accurate value of a share of preferred stock in the market.

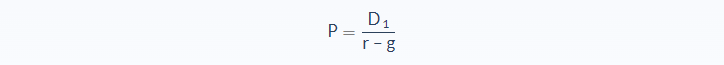

If the dividend has a history of predictable growth, or you know that constant growth will occur, you can use the Gordon Growth Model formula:

- P = Fair Value of the stock

- D1 = Expected dividend amount for next year

- r = Cost of Equity or the required rate of return

- g = Expected growth rate of dividends (assumed to be constant)

Preferred Stock Valuation Example

Example 1

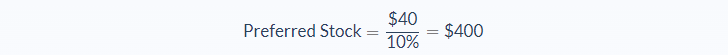

For instance, person A is an investor who wants to invest in a straight preferred stock that pays annual dividends of $40. Considering the risk, the market will consider a discount rate of 10%. Compute the preferred stock value of person A.

Person A will pay a price of $400 as the preferred stock value for the security.

Example 2

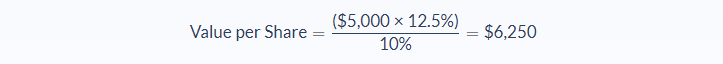

Person B, an investor with a share of $5,000 par value preferred stock in a company which pays 12.5% dividends annually. The required rate of return on the preferred stock of 10%. Determine the value of the share.

Person B’s preferred stock at 12.5% required return equals $6250.

Preferred Stock Valuation Analysis

The hybrid nature of preferred stock makes it less volatile than common stock. As a result of this, most investors who are risk-averse normally consider it as an alternative when they want to buy equities.

The callable and convertible features of preferred stock have enabled it to be preferred as the name suggests. It’s normally seen as a source of security for investors because when they run out of cash they can redeem the shares for cash value. Similarly, the holders of preferred shares are normally given priority ahead of their common stockholders’ counterparts.

An investor should use preferred stock value to ensure that he/she is investing in a company with positive returns. For instance, an investor should consider investing in a preferred stock shares business with a company that pays a higher preferred dividend rate than the required rate of return. In Example 2 above, the preferred dividend rate is 12.5% while the required rate of returns is 10% leading to a $6250 for a $5000 par value share.

Preferred Stock Valuation Conclusion

- Preferred stock is a company’s form of equity that can be used to fund project expansions.

- This formula requires two variables: annual dividend per share of preferred stock and the rate of return required

- Annual dividend per share of preferred stock is computed by multiplying the face value of the stock and the stated dividend rate

- There is an inverse relationship between the stated preferred dividend rate and the required rate of return

- If the required rate of return is lower than the preferred dividend rate then the preferred stock will have a value above its par and vice versa.

- When the required rate of return is equal to the preferred dividend rate, then the value of the preferred stock will match its par value.

Preferred Stock Valuation Calculator

You can use the preferred stock calculator below to quickly calculate a company’s price or value of preferred stock in relation to its annual dividend per share of preferred stock and the rate of return required by entering the required numbers.

FAQs

1. What does preferred stock mean?

Preferred stock is a type of security that a corporation issues to raise capital. When a company has profits, it can either pay dividends or invest them back into the business. If the company pays dividends on common stocks, then the shareholders earn money periodically.

2. What is the difference between preferred stock and common stock?

The primary difference between preferred stock and common stock is the dividend pattern. Shareholders with a stake in preferred stocks usually have priority in receiving dividends when there are not enough funds to pay all shareholders. In contrast, holders of common stocks have no preference for when they will receive their dividends.

3. What are the benefits of preferred stock?

Preferred stock is a type of security that can be used to fund expansion or dividend payments. It also benefits investors since the dividends usually yield higher returns than common stocks, which makes them more appealing.

4. Is the preferred stock a good investment?

Many preferred stocks offer a higher return than other types of stocks. Some companies prefer to use dividends instead of reinvesting them into their business, which is why investors may benefit from buying preferred shares.

5. Is preferred stock debt or equity?

Preferred shares are equity.