The quick ratio, also referred to as the acid test ratio, is a liquidity ratio that measures the ability of a company to pay off its short-term liabilities with quick assets that can be converted into cash within 90 days. Put simply, the quick ratio measures how much money a business could raise from selling its near cash assets in order to pay current liabilities.

Any business will have short term, as well as long term, assets that it can turn into cash on a short term or long-term basis. Long-term assets are things like buildings, stock inventory, and vehicles. They are used to run the business and can’t be converted to cash easily (or quickly).

On the other hand, short-term assets are known as quick assets and can easily be converted into cash in the short-term (generally within 90 days). Quick assets include cash in hand, cash in the bank, account receivable and short-term investments.

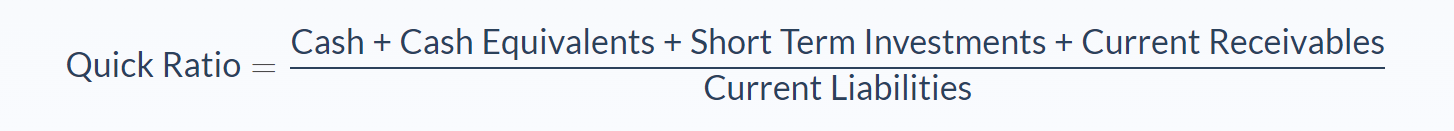

Quick Ratio Formula

To calculate the quick ratio value for a particular company you add its cash, cash equivalents, short terms investments, and current receivables, then divide the answer by the value of a company’s current liabilities.

The calculation of the quick ratio is a straightforward process, and you will find the values of cash, cash equivalents as well as current receivables on a company’s financial statement. Cash, in this case, refers to the amount of cash held by a company in hand as well as the cash in the bank.

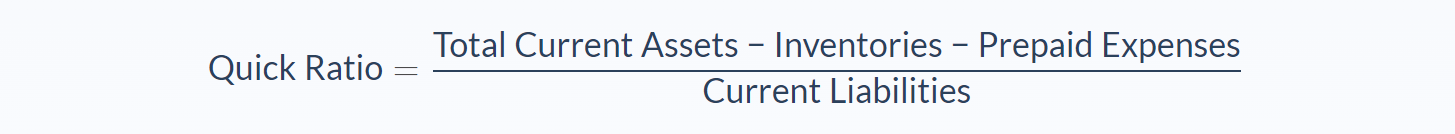

In some circumstances, the financial statements do not provide a breakdown of the quick assets, and you can calculate the value of a company quick ratio using a different formula.

The second formula for calculating a company’s quick ratio workings by deducting inventory as well as other prepaid assets from the value of the company’s total assets, dividing the answer by the value of a company’s total current liabilities.

Quick Ratio Analysis

Any business should be able to meet its short-term debts, expenses, and other bills when due, and it is something that will enable them to maintain a good rapport with investors.

In addition, using the quick ratio, investors and lenders will be able to determine if a business would be in a good financial position to pay off its short term debts. Businesses that record a higher quick ratio will be more likely to secure investment because the ratio will show that they are able to meet current liabilities if they need to by selling liquid assets.

For a company that has a low or a decreasing quick ratio, this would indicate financial problems and a company will a low ratio may not be able to fully pay off current liabilities in the short term, which is an additional risk for any potential investor.

Like with many financial ratios, the acid test ratio is best used to compare companies of similar size in the same industry. This will give you the most meaningful results because their capital needs will likely be very similar.

Sometimes, the quick ratio will not provide a true measure of the liquidity of a company. It assumes that a company can turn current assets into cash to pay off current liabilities, but you also need working capital to operate the business, and this is not factored into the formula.

Another limitation of the acid test ratio is that it doesn’t provide information about the level or timing of cash flow, and these are also very important when determining whether a company is able to meet its current liabilities when they become due.

Quick Ratio Example

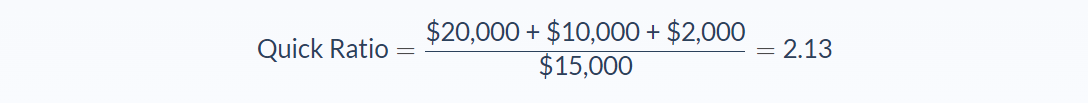

Roxanne runs a successful eCommerce business selling her own line of clothing online. She wants to scale up production and stock a larger inventory and needs a loan to do it. The bank asks her for a detailed balance sheet so they can calculate the quick ratio of the company.

- Cash: $20,000

- Accounts Receivable: $10,000

- Inventory: $10,000

- Stock Investments: $2,000

- Current Liabilities: $15,000

Let’s calculate the quick ratio:

A quick ratio of 2.13 indicates that Roxanne’s company could pay off their debts or current liabilities using their near assets and still have some quick assets remaining.

Quick Ratio Conclusion

When calculating the quick ratio or acid test ratio for a company the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- Quick assets are current assets that a company can convert into cash within the short term (usually within 90 days)

- To calculate the quick ratio you sum up cash, cash equivalents, short-term investments, and current receivables, then divide the answer by current liabilities

- You can also determine the ratio by subtracting the value of inventory and prepaid expenses from the total current assets of a company

- The ratio could be used to measure and compare the ability of companies in the same industry to pay off their short-term debts using their near assets

Quick Ratio Calculator

You can use this calculator to calculate the quick ratio of a company by entering the values for cash and equivalents, accounts receivable, short-term investments, and current liabilities.

FAQs

1. What is the quick ratio?

The quick ratio is a liquidity measure that shows how well a company can meet its short-term liabilities with its near assets.2. What is quick ratio vs. current ratio?

The quick ratio is a more stringent liquidity measure than the current ratio because it excludes inventory and prepaid expenses from current assets.3. What is the formula to calculate the quick ratio?

The formula for the quick ratio is: Quick Ratio = (Cash + Cash Equivalents + Short-term Investments) / (Current Liabilities)4. Why is knowing the quick ratio important?

The quick ratio can give you a snapshot of how a company is performing liquidity wise and whether it will be able to meet their short-term liabilities.