The times interest earned ratio is also known as the interest coverage ratio and it’s a metric that shows how much proportionate earnings a company can spend to pay its future interest costs.

In certain ways, the times interest ratio is understood to be a solvency ratio. This is because it determines a company’s capacity to pay for interest and debt services. Because such interest payments are often made long term, they are generally classified as a continuing, fixed cost.

Like most fixed expenses, non-payment of these costs can lead to bankruptcy; hence, the times interest earned ratio is treated as a solvency ratio.

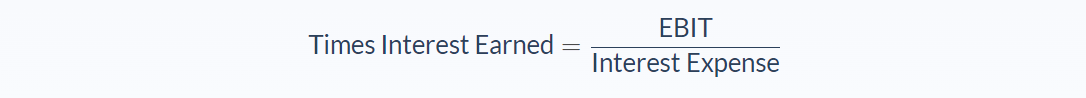

Times Interest Earned Ratio Formula

The EBIT (earnings before interest and taxes) and interest expense are both included in a company’s income statement. To help simplify solvency analysis, interest expense and income taxes are usually reported together. But they should remain separate from the normal operating expenses. This also means finding the EBIT will be easier.

The times interest earned ratio is expressed in numbers instead of percentages. The ratio shows how many times a business could pay its interest costs using its pre-tax earnings. This indicates that the bigger the ratio, the better the company’s financial position is. For example, a ratio of 3 means that a company has enough money to pay its total interest cost, even if this was multiplied by 3.

Obviously, creditors would be happy to lend money to a company with a higher times interest earned ratio. This is because it proves that it is capable of paying its interest payments when due. Therefore, the higher a company’s ratio, the less risky it is, and vice-versa.

A financial analyst can create a time series of the times interest earned ratio to have a clearer grasp of the business’ financial status. A single ratio may not mean anything because it could only speak for one set of revenues and earnings. By calculating the ratio on a regular basis, this value will become more meaningful in terms of representing a company’s true fiscal status.

Times Interest Earned Ratio Example

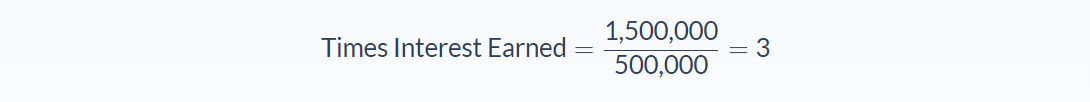

Let’s say ABC Company has $5 million in 2% debt outstanding and $5 million in common stock. The firm has to generate more money before it can afford to buy equipment. The cost of capital for incurring more debt has an annual interest rate of 3%. Investors are looking forward to annual dividend payments of 4% plus an increase in the company’s stock price. The company issues further debt of $5 million. Therefore, its total annual interest expense will be $500,000 and its EBIT will be $1.5 million.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- EBIT: 1,500,000

- Interest Expense: 500,000

We can apply the values to our variables and calculate the times interest earned ratio:

In this case, ABC Company would have a times interest earned ratio of 3.

This means the company is generating enough income to cover its total interest costs 3 times over. Simply put, its income is 3 times greater than its interest expense for the year.

Times Interest Earned Ratio Analysis

Many factors influence the times interest earned ratio. One of them is the company’s decision to either incur debt or issue the stock for capitalization purposes. Businesses make choices by looking at the cost of capital for debt or stock.

Generally speaking, a company that makes a consistent annual income can maintain more debt as part of its total capitalization. When a creditor finds that a business has consistently made enough money over a period of time, the company will be viewed as a better credit risk.

Utility firms, for instance, are regularly making an income since their product is a necessary expense for consumers. In some cases, up to 60% or even more of these companies’ capital is funded by debt.

On the other hand, startups and other businesses that don’t have regular incomes usually issue stocks for capitalization. As soon as a company can show a track record of making stable earnings, it can start funding its capital via debt offerings too.

Despite its uses, the times interest earned ratio also has its limitations, such as the EBIT not providing an accurate picture as this value does not always reflect the cash generated by the company. For instance, sometimes, sales are made on credit, and it’s possible for a company’s ratio to come out low in the calculation despite excellent cash flows.

Also, Interest Expense is an accounting calculation that is not always exactly correct, as when it includes premiums or discounts on bond sales, for example, instead of the given rate on the face of the bonds.

Neither does the metric consider any forthcoming principal payments, and the calculation can yield a favorable number despite the company’s principal payment being so large that it can gobble up the entire EBIT. Lastly, since the ratio is based on current earnings and expenses, it can only reflect the company’s ability to pay interest in the short term.

As a solution, EBITDA (earnings before interest, taxes, depreciation, and amortization) should be used instead. Being non-cash expenses, depreciation and amortization will not affect the company’s cash position in any way.

Times Interest Earned Ratio Conclusion

- The times interest earned ratio measures a company’s ability to pay its interest expenses.

- This formula requires two variables: earnings before interest and taxes (EBIT) and interest expense.

- The times interest earned ratio is usually expressed as a number.

- The higher a company’s times interest earned ratio, the more cash it has to cover its debts and invest in the business.

- The times interest earned ratio has limitations, but these can be addressed by using EBITDA instead.

Times Interest Earned Ratio Calculator

You can use the times interest earned ratio calculator below to quickly calculate your company’s ability to pay interest by entering the required numbers.

FAQs

1. What is the times interest earned ratio?

The times interest earned ratio is a calculation that measures a company's ability to pay its interest expenses.

2. How do you calculate the times interest earned ratio?

The times interest earned ratio is calculated by dividing the company's earnings before interest and taxes (EBIT) by its interest expense.

3. What is a good time interest earned ratio?

There is no definitive answer to this question as the times interest earned ratio can vary depending on the company. However, a higher ratio is generally considered better as it indicates that the company has more cash available to cover its debts and invest in the business.

4. Why is the times interest earned an important ratio?

The times interest earned ratio is important as it gives investors and creditors an idea of how easily a company can repay its debts.

5. What information does the times interest earned ratio provide to investors or creditors?

The times interest earned ratio provides investors and creditors with an idea of how easily a company can repay its debts. It is important to note, however, that the ratio does have some limitations.