Revenue, also known as sales or turnover, is an increase in the company’s equity due to the sale of a product or service. The income of the company is due to operating. Any income that comes in through the operation of a business will be considered revenue.

Revenue Definition

Revenue is the top line or gross income which costs will be subtracted to get the value of your net profit. Your net income is known as your bottom line. Revenue is also referred to as the company’s sales.

If the revenue exceeds the company’s expenses for that financial year, there will be a profit on the income statement. To increase the profit of the company, the company needs to increase its revenue of the company or reduce its expenses of the company. Investors look at the company’s revenue to determine if it would be a good investment.

You can grow your net income even if your revenue stays the same, you will have to cut your cost to achieve this. This doesn’t, however, help the company in the long run. The two essential figures that investors want to see on business reports are the revenue of the company and the earnings per share.

Accounting for Revenue

Revenue is an account that will increase the total equity of a company for a short duration. The revenue account with a credit balance will be closed at the end of the financial year, and it will permanently be moved to the balance sheet account. A revenue account will only account for one fiscal year, there is no running balance in that account.

Big corporations will close their revenue accounts to their retained earnings. Still, a partnership will close its revenue to the different partners’ capital accounts. In both situations, the revenue account will be closed to an equity account featured on the balance sheet.

Revenues are recorded when the income is earned, not when the cash is received for sale; this is consistent with an accrual accounting basis.

Calculate Revenue

Revenue can be calculated in a variety of ways, depending on the accounting method that the company uses. If the company makes use of accrual accounting, then the revenue will include the sales that were made on credit. The cash flow statement will give you an indication of how efficiently a company collects the money that is owed to them by customers.

If a cash accounting system is used the business will only consider sales as revenue once payment has been received for that sale. When cash is paid to a company, it is called a receipt, a company can have receipts without a revenue linked to the receipt. In those cases, it is usually a client that already paid, but the product or service has not been delivered yet.

Revenue Formulas

Sale of Goods

The company will first need to determine what number of units were sold during the period. Then they will have to work out the average price per unit. These two amounts are then multiplied to determine the revenue earned from the sale of goods.

Services Rendered

This is essentially the same formula, it’s just reworded to be more applicable to a service-based business instead of a product-based business.

The company will first need to calculate the number of customers that availed of the service during the period in question. Then the average price of the service will need to be calculated. These two values are then multiplied by each other to get the revenue earned from providing a service.

Types of Revenues

Two types of revenues can be earned:

- Operating revenue: Operating revenue is collected through the company’s primary operations. This will be the products that the company sells or the service that the company provides.

- Non-Operating revenue: Non-operating revenue is revenue that comes from activities that are not core to the business operations, there usually are side activities. Side activities could include rent, interest, dividends, and royalties.

Revenue vs. Income

Revenue is the gross amount that is earned by a company, and the income is the final net amount that a company receives. Revenue is calculated by adding up all the profits without any expenses or deductions. Income is calculated after all fees and deductions have been made.

Example

Example 1: Jim has a panel beating company that repairs cars. Jim is currently restoring a vehicle for Sandra. After he finished the job, Jim sends Sandra an invoice of $2,000 for the labor, and he accounts for the sale in his finance system. The income is recorded because Jim already completed the work and earned the revenue even though he hasn’t been paid yet.

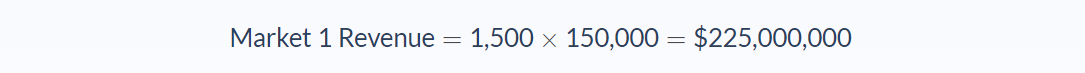

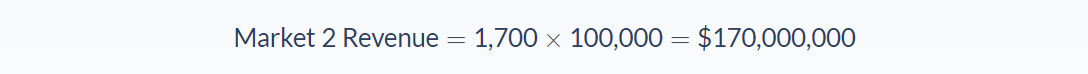

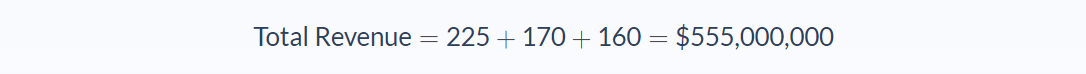

Example 2: A computer company manufactures and sells computers in three different markets. In 2019 they sold 150,000 computers in market 1 at an average price of $1,500 each. In market 2, they sold 100,000 computers at an average price of $1,700. In market 3, they sold 80,000 computers at an average rate of $2,000.

Calculate the total revenue of the company for the year 2019.

Solution

Step 1: Determining the Number of Units Sold During the Period

- Market 1: 150,000 units

- Market 2: 100,000 units

- Market 3: 80,000 units

Step 2: Determining Average Price Per Unit

- Market 1: $1,500

- Market 2: $1,700

- Market 3: $2,000

Step 3: Calculating Earnings from Sale of Goods

Revenue Conclusion

- Revenue could also be known as sales, it is an increase in the company’s equity due to the sale of a product or service.

- Revenue is the top line or gross income where costs will be subtracted to get the value of your net profit.

- Revenue is an account that will increase the total equity of a company for a short duration.

- Revenue can be calculated in a variety of ways, depending on the accounting method that the company uses.

- The two types of income are revenue from operations or revenue from non-operations

FAQs

1. What is revenue?

Revenue is the amount of money a company brings in through the sale of products or services. It's also sometimes referred to as sales and is an important part of a company's income statement.

2. Is revenue the same as profit?

No, revenue is the gross amount of money a company brings in, while profit is the net amount of money a company brings in after expenses are deducted. For example, if a company has $10,000 in revenue and $2,000 in expenses, its profit would be $8,000.

3. What are the types of revenue?

There are two types of revenue: revenue from operations and revenue from non-operations. Revenue from operations is income that comes from a company's primary business activities, while revenue from non-operation is income that comes from activities that are not core to the business. This could include rent, interest, dividends, and royalties.

4. What is the difference between sales and revenue?

The terms "sales" and "revenue" are often used interchangeably, but they are not the same thing. Sales are the total amount of money a company brings in from the sale of products or services, while revenue is the amount of money a company brings in after expenses are deducted.

5. How do you calculate revenue?

There is no one definitive way to calculate revenue, as it can be done in a variety of ways depending on the accounting method used. Generally, revenue is calculated by multiplying the number of units sold by the average price per unit. However, other factors such as discounts and returns may also need to be considered.