Working capital management involves the relationship between a firm’s short-term assets and its short-term liabilities. The goal of working capital management is to ensure that a firm is able to continue its operations and that it has sufficient ability to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts receivable and payable, and cash.

Working Capital Excel Template

This working capital Excel template lets you quickly calculate both the working capital and the working capital ratio.

Why Firms Hold Cash

The finance profession recognizes the three primary reasons offered by economist John Maynard Keynes to explain why firms hold cash. The three reasons are for the purpose of speculation, for the purpose of precaution, and for the purpose of making transactions. All three of these reasons stem from the need for companies to possess liquidity.

Speculation

Economist Keynes described this reason for holding cash as creating the ability for a firm to take advantage of special opportunities that if acted upon quickly will favor the firm. An example of this would be purchasing extra inventory at a discount that is greater than the carrying costs of holding the inventory.

Precaution

Holding cash as a precaution serves as an emergency fund for a firm. If expected cash inflows are not received as expected cash held on a precautionary basis could be used to satisfy short-term obligations that the cash inflow may have been bench marked for.

Transaction

Firms are in existence to create products or provide services. The providing of services and creating of products results in the need for cash inflows and outflows. Firms hold cash in order to satisfy the cash inflow and cash outflow needs that they have.

Float

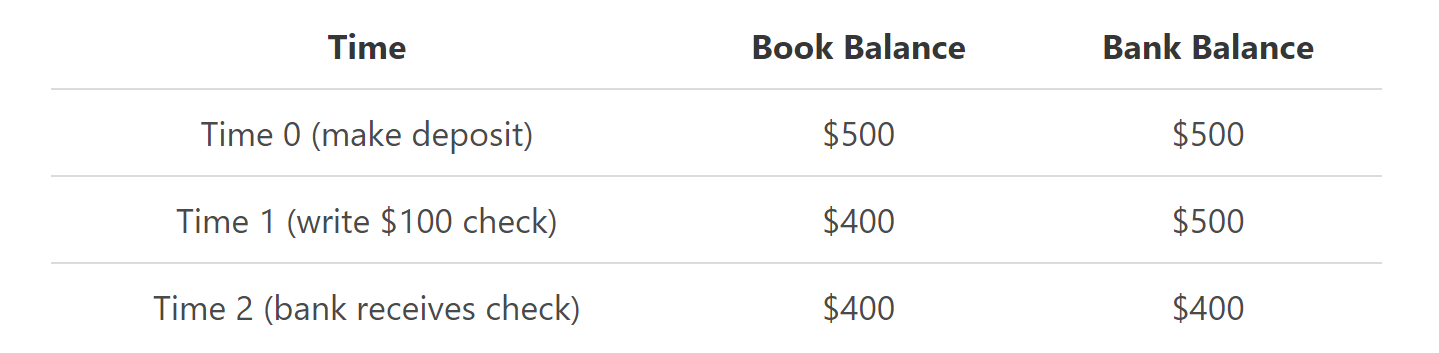

Float is defined as the difference between the book balance and the bank balance of an account. For example, assume that you go to the bank and open a checking account with $500. You receive no interest on the $500 and pay no fee to have the account.

Now assume that you receive your water bill in the mail and that it is for $100. You write a check for $100 and mail it to the water company. At the time you write the $100 check you also record the payment in your bank register. Your bank register reflects the book value of the checking account. The check will literally be “in the mail” for a few days before it is received by the water company and may go several more days before the water company cashes it.

The time between the moment you write the check and the time the bank cashes the check there is a difference in your book balance and the balance the bank lists for your checking account. That difference is float. This float can be managed. If you know that the bank will not learn about your check for five days, you could take the $100 and invest it in a savings account at the bank for the five days and then place it back into your checking account “just in time” to cover the $100 check.

Float is calculated by subtracting the book balance from the bank balance.

- Float at Time 0: $500 − $500 = $0

- Float at Time 1: $500 − $400 = $100

- Float at Time 2: $400 − $400 = $0

Ways to Manage Cash

Firms can manage cash in virtually all areas of operations that involve the use of cash. The goal is to receive cash as soon as possible while at the same time waiting to pay out cash as long as possible. Below are several examples of how firms are able to do this.

Policy For Cash Being Held

Here a firm already is holding the cash so the goal is to maximize the benefits from holding it and wait to pay out the cash being held until the last possible moment. Previously there was a discussion on Float which includes an example based on a checking account. That example is expanded here.

Assume that rather than investing $500 in a checking account that does not pay any interest, you invest that $500 in liquid investments. Further assume that the bank believes you to be a low credit risk and allows you to maintain a balance of $0 in your checking account.

This allows you to write a $100 check to the water company and then transfer funds from your investment to the checking account in a “just in time” (JIT) fashion. By employing this JIT system you are able to draw interest on the entire $500 up until you need the $100 to pay the water company. Firms often have policies similar to this one to allow them to maximize idle cash.

Sales

The goal for cash management here is to shorten the amount of time before the cash is received. Firms that make sales on credit are able to decrease the amount of time that their customers wait until they pay the firm by offering discounts.

For example, credit sales are often made with terms such as 3/10 net 60. The first part of the sales term “3/10” means that if the customer pays for the sale within 10 days they will receive a 3% discount on the sale. The remainder of the sales term, “net 60,” means that the bill is due within 60 days. By offering an inducement, the 3% discount in this case, firms are able to cause their customers to pay off their bills early. This results in the firm receiving the cash earlier.

Inventory

The goal here is to put off the payment of cash for as long as possible and to manage the cash being held. By using a JIT inventory system, a firm is able to avoid paying for the inventory until it is needed while also avoiding carrying costs on the inventory. JIT is a system where raw materials are purchased and received just in time, as they are needed in the production lines of a firm.

This overview was developed by Eric Maneval.

No adaptation of its content is permitted without permission.

FAQs

1. What is working capital management?

Working capital management is the process of monitoring and regulating a company's short-term liquidity. This includes ensuring that the company has enough cash on hand to meet its day-to-day needs, as well as making sure it doesn't have too much or too little debt.

2. What is an example of working capital management?

An example of working capital management would be a company ensuring it has enough cash on hand to meet its day-to-day needs, as well as making sure it doesn't have too much or too little debt. Additionally, the company might try to optimize its cash flow by delaying payments to suppliers or collecting payments from customers sooner than normal.

3. Why is working capital management important?

Working capital management is important because it helps a company ensure its short-term liquidity. This is necessary to maintain operations on a day-to-day basis, as well as fund new investments or expansions. A company that can't meet its short-term liquidity needs may have to go into debt or sell assets, which could impact its long-term prospects.

4. What are the objectives of working capital management?

The objectives of working capital management are to ensure that a company has enough cash on hand to meet its day-to-day needs, make sure it doesn't have too much or too little debt, and optimize its cash flow. All these objectives are necessary for a company to maintain a healthy liquidity position and minimize the risk of financial distress.

5. What are some tips for effective working capital management?

Some tips for effective working capital management include making sure a company has enough cash on hand to meet its day-to-day needs, making sure it doesn't have too much or too little debt, and optimizing its cash flow. Additionally, a company should regularly monitor its liquidity position and make changes to its policies as needed.