The cash conversion cycle (CCC) is a measure of time indicated in days needed to convert inventory investments and other resources into sales-derived cash flow. Also known as a net operating cycle or simply cash cycle, CCC determines how long a net input dollar stays non-liquid from production to sale before it is received as cash.

Determining a company’s CCC1 involves three key factors: how long it takes for its inventory to be sold, its accounts receivables (AR) to be collected; and its accounts payables (AP) to be settled without penalties. While AR and inventory are considered short-term assets, AP is a liability.

You can express a company’s operational and management efficiency through different metrics, including CCC. A pattern of consistent or declining CCC values over significant periods is positive news, while the opposite should prompt investigation and analysis of other related elements. Note that CCC only applies to inventory-dependent businesses.

Note: there are some acronyms in this article. We’ve tried to simplify as much as possible and added all acronyms to the bottom of the article.

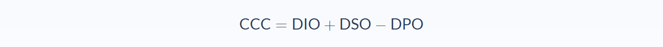

Cash Conversion Cycle Formula

- DIO = Days of inventory outstanding

- DSO = Days sales outstanding

- DPO = Days payables outstanding

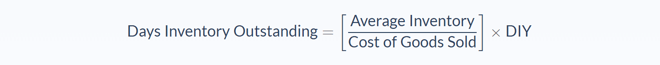

DIO is the number of days needed for the whole inventory to be sold, determined by dividing the average inventory by the cost of goods sold (COGS). The smaller the DIO2 value, the better.

The formula to calculate days of inventory outstanding is:

- Average Inventory = Beginning inventory – Ending inventory / 2

- DIY = number of days in the year

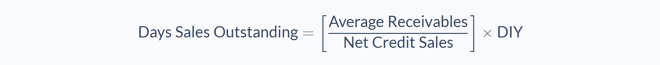

DSO3 refers to the number of days needed to collect payments on sales, obtained by dividing the accounts receivable (AR) by revenue per day.

Although cash-only sales have a zero DSO, people may use credit provided by the company, making this number positive. A smaller DSO value is again better.

The formula to calculate days sales outstanding is:

- Average Receivables = Beginning receivables – Ending receivables / 2

- DIY = number of days in the year

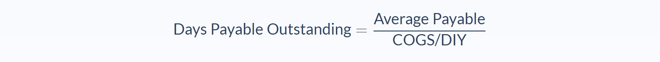

DPO4 is the company’s payment of its bills or AP, calculated by dividing the average AP by the daily COGS. Extending the DPO means allowing cash to stay longer with the company, thereby boosting its investment potential. A longer DPO is also better for business.

The formula to calculate days payable outstanding is:

- Average Payable = Beginning payable – Ending payable / 2

- COGS = Cost of goods sold

- DIY = number of days in the year

Take note that all three components of the CCC formula correspond to the right value in the income statement: Inventory and AP with COGS5, and AR6 with revenue. Also, Inventory, AR, and AP7 go into two separate balance sheets. If the period is equivalent to a quarter, balance sheets from the relevant quarter should be used; if the period covers the entire year, balance sheets for the relevant year apply. The reason is, that though the income statement reflects everything that occurred within a specific period, balance sheets merely capture the company’s state at a certain time.

For values such as AP, the average for the period should be used, which means AP from both the start and the end of the period are needed for the computation.

Cash Conversion Cycle Example

A software development company implemented a new marketing strategy in 2019 and wants to know how effective it has been, one year later. They decide to compute for their cash conversion cycle. They want it as a metric for determining whether their inventory moved faster, slower, or not at all in 2019, compared to 2018.

They begin with a review of their financial statements, where they learn that in the fiscal year 2018, they had net credit sales of $3000 and spent $3000 in COGS. They also find that for fiscal years 2018 and 2019, their inventory increased from 1000 to 2000 this year; their Accounts Receivable dropped from 100 to 90; and their Accounts Payable jumped from 800 to 900. In addition, they determined that their Average Inventory for both fiscal years is 1500; their Average AR is 95; and finally, their Average AP is 850.

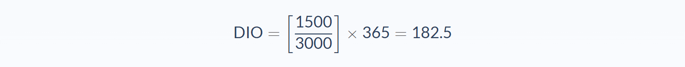

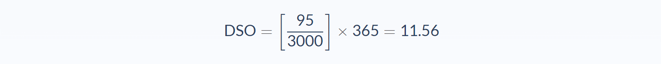

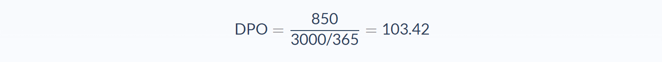

Let’s work out our numbers for days of inventory outstanding, days of sales outstanding, and days payable outstanding using the formulas from before:

After the necessary calculations using the above values, we have the following values to calculate the cash conversion cycle:

- Days of inventory outstanding (DIO): 182.5 days

- Days sales outstanding (DSO): 11.56 days

- Days payable outstanding (DPO): 103.42 days

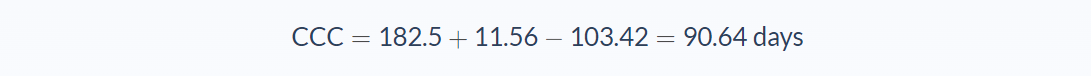

We can apply the values to our variables and calculate the cash conversion cycle.

In this case, the software development company would have a cash conversion cycle of 91 days.

If the software developer’s CCC for the previous fiscal year was significantly greater than 83 days, it means their new marketing strategy has been effective as shown by the improvement in their CCC between the ends of fiscal years 2018 and 2019. Still, despite the change being positive, any considerable difference in DIO, DSO, or DPO should be investigated deeper and further back in time. That way, the changes can be fully understood.

Cash Conversion Cycle Analysis

Determining a company’s cash conversion cycle involves many activity ratios. These ratios reflect AR, AP, and inventory turnover. All of these can be found in the balance sheet. But how exactly do these ratios impact business?

If a company sells products that people are looking for, cash cycles go faster. If the company cannot tell which products sell, cash cycles slow down. For example, when a huge excess of inventory builds up, money gets stuck in items that could not be sold. This is bad for business.

To move inventory faster, the company may have to offer discounts or even sell the inventory at a loss. Poor AR handling can indicate that the business is having a hard time getting customers to pay. That’s because AR is practically a loan to the customer, which means if the customers stall payment, the company ends up with a loss. The longer it takes for a business to receive the payment, the longer that money stays non-liquid and unavailable for reinvestment.

On the other hand, if the company holds off payments to its AP suppliers, it can benefit from being able to use the money for longer and making a bigger profit.

Cash Conversion Cycle Conclusion

- The cash conversion cycle is a metric that reveals how fast a company’s inventory moves until it is converted to cash.

- The cash conversion cycle formula requires three variables: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO).

- The results of the CCC are expressed as the number of days.

- The cash conversion cycle is of little value by itself but could be a game-changer when used to compare how fast inventory moved between two or more periods, and when making decisions to improve future inventory movements.

Cash Conversion Cycle Calculator

You can use the cash conversion cycle calculator below to quickly calculate how fast a company’s inventory is moving by entering the required numbers.

FAQs

1. What does the Cash Conversion Cycle (CCC) mean?

The cash conversion cycle is a metric that reveals how fast a company’s inventory moves until it is converted to cash.

2. What are the components of the Cash Conversion Cycle (CCC)?

The three components of the cash conversion cycle are Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO).

3. Why is the Cash Conversion Cycle (CCC) important to business?

The cash conversion cycle is important to businesses to determine the efficiency of a company's operations. This means that the cycle measures how fast a company sells its inventory and collects payments from customers, and how long it takes to pay suppliers.

4. Is a high Cash Conversion Cycle (CCC) good?

No, a high cash conversion cycle is not good because it indicates that the company's inventory is moving slowly. This means that the company may have to offer discounts or sell the inventory at a loss.

Instead, a good cash conversion cycle is low and indicates that the company's inventory is moving quickly.

5. What are the benefits of a positive Cash Conversion Cycle (CCC)?

The benefits of a positive cash conversion cycle are that the company can reinvest its cash back into the business, improve its liquidity position, and have more money to cover its expenses. Another benefit is that it may be able to negotiate better terms with its suppliers.