What Is a CAIA?

The Chartered Alternative Investment Analyst credential (CAIA) is intended for financial professionals primarily working in the alternative investment industry.

This mainly refers to those who work for hedge funds and private equity firms. Still, it may also refer to persons who work for traditional financial institutions in non-traditional jobs, such as those who manage the derivatives book or the trading desk.

Moreover, CAIA professionals manage, analyze, distribute, or regulate alternative assets, including venture capital and real estate.

CAIA vs CFA

The CAIA credential, like the Chartered Financial Analyst (CFA) designation, offers individuals access to jobs, member chapters, and educational opportunities.

Because alternative investments differ significantly from traditional investments, such as stocks, bonds, mutual funds, and exchange-traded funds, the CAIA accreditation was created to identify individuals most qualified to deal with these assets.

The CFA covers alternative investments, but the CAIA goes considerably further into the subject and the valuation methodologies that are unique to each.

The CFA is considered the more challenging of the two, as the tests cover more information and have traditionally had lower success rates than the CAIA exams.

Overall, the CFA is regarded as a good overall credential for the financial business; on the other hand, the CAIA may significantly impact specialist finance fields such as private equity or hedge funds.

Requirements for CAIA

To qualify for the designation, one of the following conditions must be met by the candidate:

- A bachelor's degree or equivalent and at least one year of financial industry experience,

- Four years of finance industry experience

Furthermore, the applicant must complete a two-level curriculum covering qualitative analysis, alternative investment trading theories, and indexation and benchmark.

A comprehensive self-evaluation instrument should be completed every three years to retain the designation.

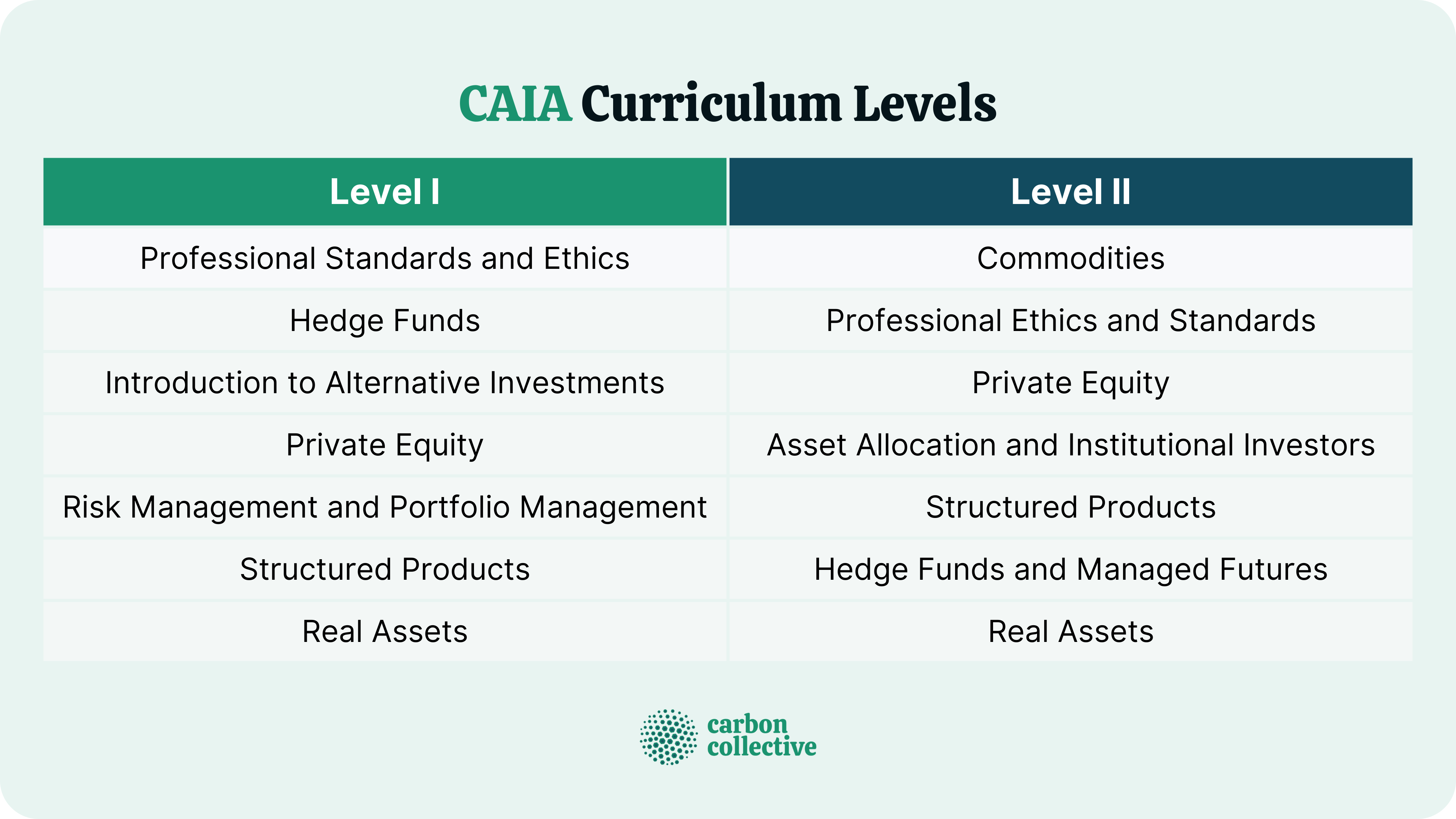

CAIA Curriculum Levels

There are two levels in the CAIA program, which must be completed sequentially. The first level focuses on core topics related to alternative investments, while the second level covers more advanced concepts.

Level I

Candidates for CAIA Level I are expected to have a minimum undergraduate grasp of conventional finance and quantitative analysis. The Level I exam is a 200-question multiple-choice exam that covers the following topics:

- Professional Standards and Ethics

- Hedge Funds

- Introduction to Alternative Investments

- Private Equity

- Risk Management and Portfolio Management

- Structured Products

- Real Assets

Level II

The Level II test has 100 multiple-choice questions and three sets of essay questions. Each year, the questions are modified to reflect changes in the industry. The questions are about:

- Commodities

- Professional Ethics and Standards

- Private Equity

- Asset Allocation and Institutional Investors

- Structured Products

- Hedge Funds and Managed Futures

- Real Assets

The Chartered Alternative Investment Analyst Association recommends 200 hours of studying per level to prepare for the examinations. The tests are given every March and September.

Enrollment costs $400, while Level I and Level II test registration costs around $1,395 each. Once qualified, yearly membership dues of $350 for one year or $650 for two years are required.

Scholarships may be available to early registrants and members of select partner organizations to assist cover the costs of registration and taking the Level I and Level II tests.

What Can You Do With A CAIA Designation?

The CAIA credential is often seen in the hedge fund and private equity industries, as these are the areas of alternative investments where professional expertise is in the highest demand.

Some of the most popular employment roles for CAIA charter holders include:

- Investment Analyst: An investment analyst is responsible for conducting research and due diligence on potential investments and providing recommendations to portfolio managers.

- Portfolio Manager: A portfolio manager oversees a group of assets and makes decisions about which securities to buy and sell.

- Hedge Fund Analyst: A hedge fund analyst is responsible for researching and analyzing hedge funds and making recommendations to investors about which funds to invest in.

- Investment Manager: An investment manager is responsible for deciding how to invest a client's money.

- Credit Structurer: A credit structurer is responsible for creating financial products that meet the needs of investors.

- Chief-Level Executive: A chief-level executive is responsible for the overall management of a company.

Final Thoughts

The CAIA designation is one way to stand out in the competitive world of alternative investments. The credential denotes a high level of expertise and commitment to the industry and can open up doors to exciting and lucrative career opportunities.

To earn the CAIA, candidates must pass two exams and have either a bachelor's degree or four years of experience working in the financial industry. The exams cover hedge funds, private equity, and real assets.

Once qualified, CAIA charter holders can work in various roles, including investment analyst, portfolio manager, and hedge fund analyst.

FAQs

1. What is a CAIA?

A CAIA is a Chartered Alternative Investment Analyst. The CAIA designation is the highest credential in the alternative investments industry and denotes a high level of expertise and commitment to the field.

2. What is the difference between a CAIA and a CFA?

The CFA (Chartered Financial Analyst) designation is for professionals working in traditional financial markets, such as stocks and bonds. The CAIA designation is for alternative investment professionals, including asset classes such as private equity, hedge funds, and real estate.

3. What are the requirements to become a CAIA?

To become a CAIA, candidates must pass two exams and have either a bachelor's degree or four years of experience working in the financial industry. The exams cover hedge funds, private equity, and real assets.

4. How much does it cost to take the CAIA exams?

Enrollment costs $400, while Level I and Level II test registration costs around $1,395 each. Once qualified, yearly membership dues of $350 for one year or $650 for two years are required.

5. How many hours of study are recommended for the CAIA exams?

The Chartered Alternative Investment Analyst Association recommends 200 hours of studying per level to prepare for the examinations.