Discounts are often provided as an attractive offer to lure in interested investors and consumers. Depending on the context, there are two definitions of the discount rate

- The discount rate is the expected rate of return for an investment. It is also known as the cost of capital, hurdle rate, or required rate of return, and it helps to estimate the present value of an investment or business based on its expected future cash flow.

- The discount rate is the interest rate commercial banks are charged for the loans they borrow from the Federal Reserve Bank.

What does it mean?

- A discount rate, as per the first definition is the interest percentage that an investment is expected to generate over its lifetime.

- It allows investors and businesses to assess the risk associated with an investment and determine if a present investment will yield the profits that they are aspiring for.

- The discount rate is an estimate or helpful metric to make assumptions about future developments but without taking into consideration all the variables.

Example 1: Lisa expects an 8,000 investment to generate a 10% return in a year, that is she is expecting a return of $8800 on her investment. Then the discount rate will be 10% for assessing any investment opportunity around her.

Let us take another example to explain the discount rate in-depth

Example 2: James decides to invest his inheritance amount of $25,000 and expects to receive $50,000 in return. To find receive the best investment, he decides to hire a personal finance advisor and review the different options.

- To lend the money to someone or put it into someone’s investment project, James should expect to receive some economic compensation due to the risk of non-collection and the cost of opportunity he faces.

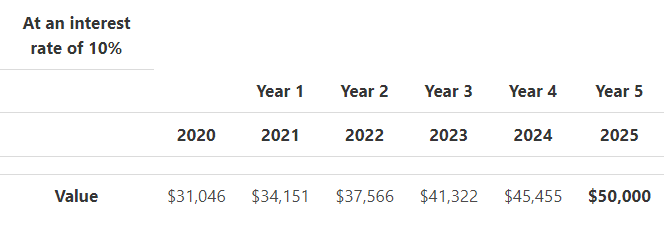

- In the above table, to calculate what the $50,000 (Year 5) means in Year 4, we work backward and use the below formula for real estate to calculate the investment worth.

.png?width=410&name=Screenshot%20(33).png)

- We can deduce the investment will be worth $45,455 in year 4, $41,322 in year 3, $37,566 in year 2, $34,151 in year 1 and is $31,046 today.

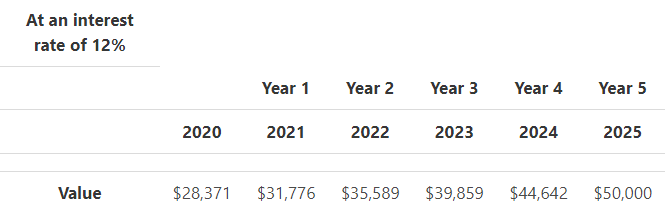

- Real Estate #2: The next option is somewhat of high risk and thus the interest rate is higher. With a discount rate of 12%, the worth of the real estate in five years will be as follows

- We can deduce the investment will be worth $44,642 in year 4, $39,859 in year 3, $35,589 in year 2, $31,776 in year 1 and is $28,371 today.

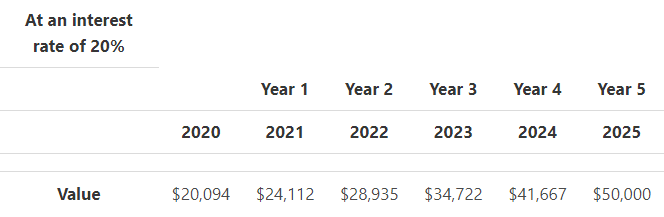

- Real Estate #3: With a discount rate of 20% to yield an amount of $50,000 in five years, he will have to put up an amount of $20,094 as the investment amount. This project is high risk and thus the interest rate is the highest in the country.

- The worth of the real estate in five years will be as follows:

- We can deduce the investment will be worth $41,667 in year 4, $34,772 in year 3, $28,935 in year 2, $24,112 in year 1 and is $20,094 today.

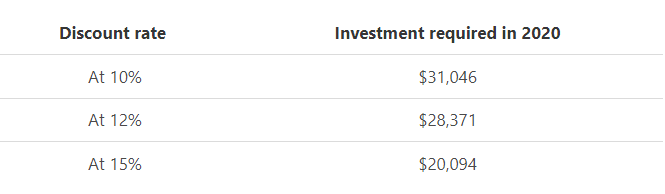

- Thus, James will have to choose from the below investments in 2020 at different rates, if he wants a return of $50,000 yield in five years

- The higher the discount interest rate the higher the risk. You are not sure if you invest a large amount today, you will get $50,000 in year 5. You would like to invest in something safe and secure.

- But in this case, the secure option Real Estate #1 would require James to invest $31,046 today for a yield of $50,000 or he can decide to go with the riskier Real Estate #3 which only requires him to invest $20,094 today.

It is important to note over here that investment is dependent on various other factors like the economy, and government policies which we cannot be sure of completely.

Types of Discount Rate

In this section, we will look at the basics of the types of discount rate

1. Weighted Average Cost of Capital (WACC)

- WACC is used to calculate the enterprise value of a business and is a combination of the cost of equity and the cost of debt.

- Instead of using the cost of capital as a measure, companies prefer to use WACC as it is the minimum return the company wants.

- Companies prefer to invest in projects with expected returns more than the WACC

2. Cost of Equity

- It is the rate of return a company pays out to equity investors.

- It can also be said to be used by the equity investors to assess if an investment meets their capital return requirements or the compensation the market investors require in exchange for owing the assets and risk of ownership.

3. Risk-Free Rate

- The risk-free rate replaces the discount rate when investing in standard financial assets such as treasury bonds.

- It is the rate of return investors can expect to earn on investments that carry zero risks. It is generally considered the safest investment option.

- A risk-free rate is a theoretical number as all investments carry a risk or the other, due to uncertainty of other factors affecting it.

4. Cost of Debt

- The cost of debt is used for measuring the value of a bond or fixed-income security.

- It is the interest rate a company uses to pay its debts. To calculate the cost of debt, a company establishes the total amount of interest it is paying on each of its debts for the year and then divide it by the total of all its debts.

- For bonds, it is known as the yield to maturity or the return on the bond which is bought now and held till maturity.

Importance of Discount Rate

1. Potential Value of an Investment

A discount rate can help to figure out the potential value of a business or an investment at the present time. As we have already seen, a slight difference in the discount rate can make a big difference in investment worth.

2. Time Value of Money

We can also use the discount rate to calculate the time value of money. The time value of money means that the money you have now is worth more than what it will be in the future, due to its potential purchasing power.

For example, your company gives you a salary of $20,000 now and tells you in 5 years, your salary is going to be $100,000. It is important to note that the purchasing power of $100 might not be the same in 5 years.

3. Comparison of Different Investments

It can help us to compare different investments. There are many options available in the market, but it is important to do some analysis into its real value, rather than taking the benefits promised at face value.

For example, A high-interest rate with a debt fund might look tempting but can be risky, while a lower interest rate with a government or reputed bank’s project might feel better due to its security.

4. Opportunity Cost

It can help to calculate the opportunity cost for a firm, which represents the benefits a business fails to realize when selecting one alternative over another.

For example, if a firm spends $500 on the internet consumed, then its opportunity cost is $500. It means the firm cash expenditure of $500 represents a lost opportunity to purchase another alternative with the amount.

5. Assess Risk

One of the crucial advantages of a discount rate is its ability to determine the riskiness of an investment. The business or individual can then discount the cash flow to compensate for the uncertainty and the conceivable losses that can occur to an investment.

6. Investment Yield

We can use the discount rate to compute the amount an individual or business should invest now to receive the future investment goal. As well, as to calculate the worth of the investment over the years.

Problems With the Discount Rate

- Several assumptions are made to estimate or calculate the discount rate.

- A company or an individual might only use one discount rate for all future cash flows. And does not take into consideration that interest rates and risk profiles are constantly changing.

- It is not suited for short-term investing and focuses on long-term value creation.

The Discount Rate Used by Central Banks

In this section, we will just touch on the basics of the discount rate used by central banks without going too much into details

- In the United States, commercial banks can borrow money for short-term requirements from the central bank or the Federal Reserve Bank.

- The Bank uses these loans to fund shortfalls or address liquidity issues.

- Such a facility is called a discount window because the funds are usually given for 24 hours or less and the interest rate that the central bank charges on such loans are called discount rates.

- It is important to note that it is not the available market rate but a rate that is set by central banks and serves as a standard for other interest rates in the economy.

- However commercial banks hardly use this interest rate as it is higher than the interbank borrowing rates and, borrowing from the central bank may be seen as a sign of weakness by its shareholders or investors.

- The discount window is largely used during times of financial stress and uncertainty.

- For example, during the 2008 financial crisis, the Federal Reserve bank took on a crucial role to maintain financial stability by extending the lending period to 30 days and later to 90 days. And they reduced the discount rate to let banks borrow billions in the discount window.

- It is an important indicator of economic stability as if a bank is short on cash to facilitate customer withdrawals or give loans, they can borrow money from the central bank for the short term.

- This helps to lower the fear among the people and save the economy from a complete meltdown.

Summary

- Depending on the context, the discount rate also called the discounted rate of return is the expected rate of return for an investment.

- Or the Discount rate is the interest rate commercial banks are charged for the loans they borrow from the Federal Reserve Bank.

- It allows investors and businesses to assess the risk associated with an investment.

- The different types of discount rates are Weighted Cost of Capital (WACC), Cost of Equity, Risk-Free Rate, and Cost of Debt.

- Advantages of discount rate include measuring the potential value of an investment, assessing the time value of money, comparison of different investments, investment yield, opportunity cost, and determining risks.

- The problems with discount rate include several assumptions being made to estimate the discount rate, the use of only one discount rate, and its inability to comprehend short-term investing.

- Discount rates used by central banks are the facility provided for commercial banks to borrow funds over 24 hours or less to meet shortfalls in funds or address liquidity issues.

- The interest rate that the central bank charges on such loans is called discount rates.

FAQs

1. What is a discount rate?

Discount rate is the expected rate of return for an investment. It allows investors and businesses to assess the risk associated with an investment. The different types of discount rates are Weighted Cost of Capital (WACC), Cost of Equity, Risk-Free Rate, and Cost of Debt.

2. How do you choose the appropriate discount rate?

There is no one-size-fits-all answer to this question. You need to consider the type of investment, the risks associated with it, and the time horizon you are looking at. You can use a discount rate calculator to make the process easier.

3. Why is a discount rate important?

A discount rate is important because it allows investors and businesses to assess the potential value of an investment, assess the time value of money, compare different investments, determine the yield on an investment, and understand the risks associated with an investment.

4. What affects the discount rate?

Several factors can affect the discount rate, including the risk associated with the investment, the time horizon you are looking at, and the prevailing interest rates.

5. Is a high discount rate good?

It depends on the context. In general, a high discount rate indicates that an investment is risky and may not be suitable for everyone. However, a high discount rate could also mean higher potential returns for investors who are willing to take on the risk.